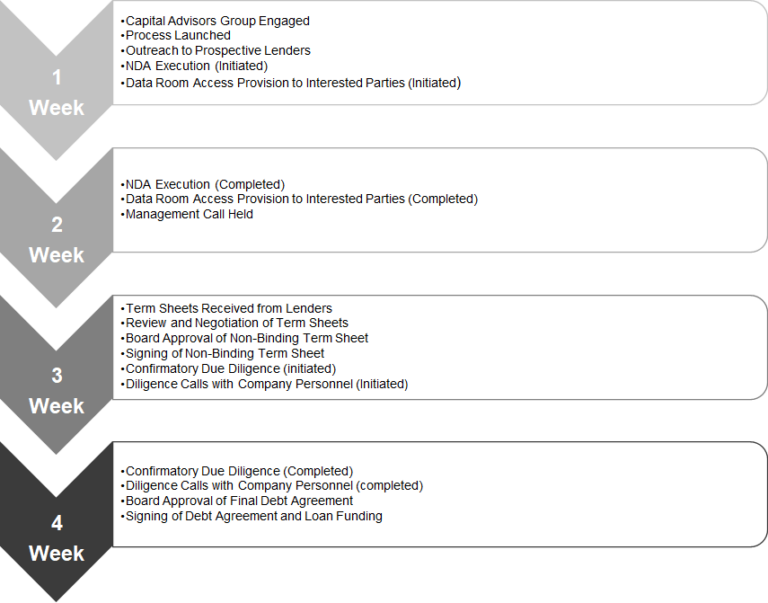

Debt Finance Definitions

4 min readVenture Debt Non-dilutive capital for venture backed startups in early and growth stages Revenue-Based Financing Funding based on a fixed percentage of gross revenues Equipment Leasing Equipment rental agreement with a lender based on a fee schedule Asset Based Lending Revolving line of credit or term loan secured by collateral Recurring Revenue Lines Line of…