The Inflation Wave: Defensive Capital Strategies for Early-Stage Companies

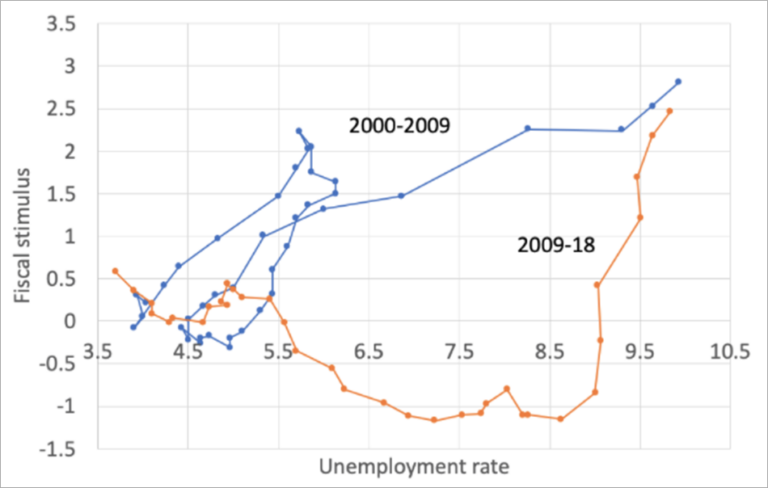

6 min readAs the US economy emerges from the severe economic dislocation of the pandemic, early indications point to a strong recovery in 2021, with GDP growth poised to exceed 6% based on annualized first quarter data. Expansionary fiscal and monetary policy, healthier household balance sheets, and pent-up consumer demand are likely to significantly boost economic activity….