Moving from LIBOR to SOFR

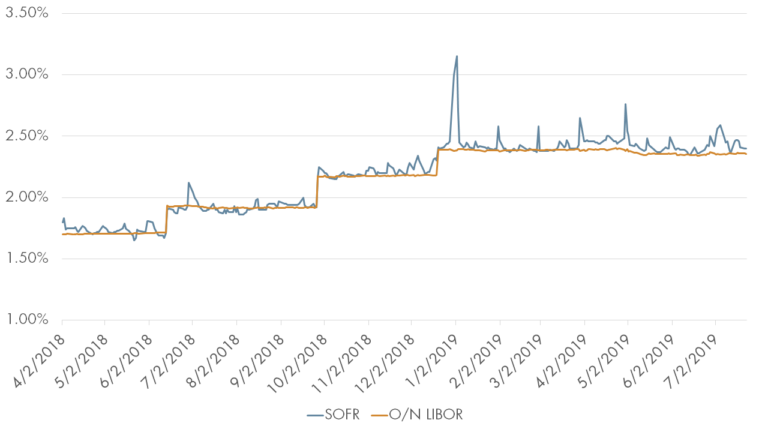

8 min readDOWNLOAD FULL REPORT Abstract The era of LIBOR (the London Inter-Bank Offered Rate) is coming to an end. The rate, which underpins some $200 trillion in floating-rate bonds, loans, securitizations, and derivatives contracts, is broken—at least according to the international regulatory community. In the U.S., this has led to the introduction of SOFR (the Secured…