Revisiting Bank Deposits as a Liquidity Solution

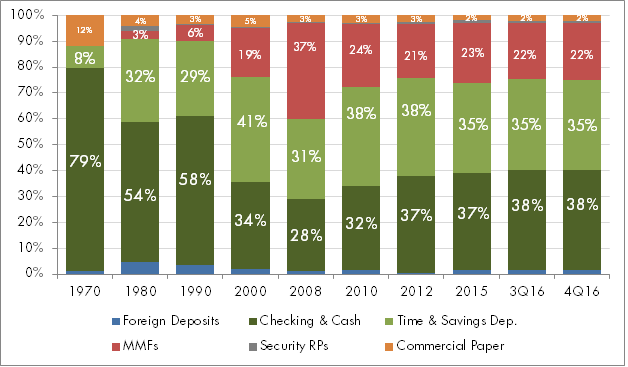

3 min readAbstract Treasury organizations maintain deposit relationships despite uninsured credit risk and lost yield opportunity. Earnings credit rates may become less competitive than market-based rates. Including separate accounts in the mix helps address both credit and yield objectives in institutional liquidity management. Introduction The search for liquidity management solutions reached a new level of significance when…