Comprehensive Cash Investment Strategies

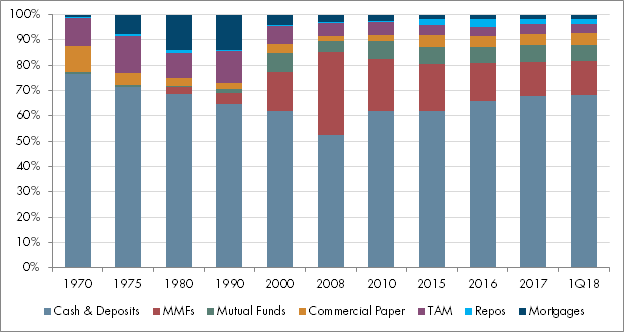

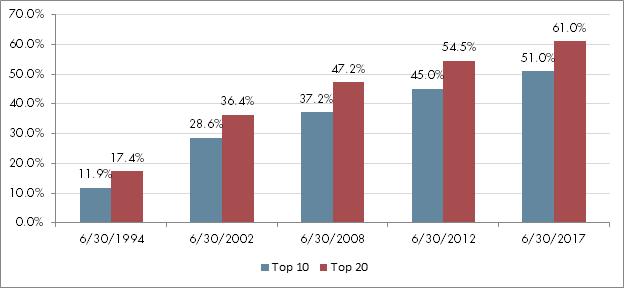

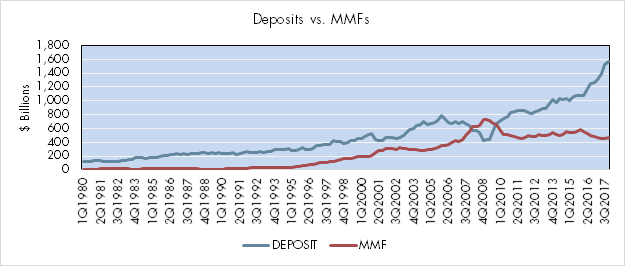

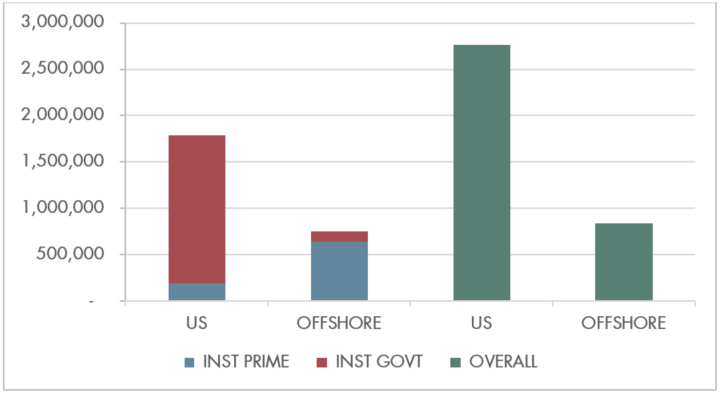

10 min readAbstract The evolving treasury cash investment landscape and yield disadvantage of bank deposits have prompted many practitioners to look for alternative options for managing their excess cash. We address this topic in a generalized manner, summarizing three major categories of available cash investment vehicles: deposits, pooled assets and direct purchases. The pros and cons of…