August Month-End Portfolio Update

The Time Has Come To Cut Rates

In his keynote address at the Federal Reserve’s Jackson Hole Economic Symposium, Federal Reserve Chair Powell said the Fed now feels it is time to adjust monetary policy. His comment followed the release of the minutes from the Fed’s July FOMC meeting, which showed “several” members were in favor of a 25 basis point cut in July while “the vast majority” said if economic data continues to come in as expected, it would be appropriate to cut in September. Here are some of the key takeaways from Powell’s Jackson Hole speech:

- “The time has come for policy to adjust.”

- “The timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

- “We do not seek or welcome further cooling in labor market conditions.”

- “My confidence has grown that inflation is on a sustainable path back to 2 percent.”

- “The upside risks to inflation have diminished. And the downside risks to employment have increased.”

When the FOMC next meets on September 18th, market participants will be focusing on updates to the Summary of Economic Projections, specifically changes to the FOMC’s “dot plot” forecast for the Federal Funds Rate. In June, the Fed forecasted 25 basis points of rate cuts in 2024 and 100 basis points of rate cuts in 2025. If data continues to point to a soft-landing, it is likely the Fed will favor quarterly cuts of 25 basis points next year, as some Fed officials have said the pace of cutting should be “gradual” and “methodical.” A harder economic landing would likely lead to faster cuts.

5% Yields Coming to an End

Now that the Fed has telegraphed a rate cut at the September FOMC meeting, yields have declined across the curve. Notably, 1- to 3-month yields have fallen by 10 and 17 basis points, respectively, in August (see chart below), and these typically don’t see declines until the Fed is very close to cutting rates. Money Market Fund rates will also begin to see their yields decline over the coming months as front-end rates, including overnight repo, adjust lower in yield.

U.S. Treasury Yield curve – August Yield Changes

Source: Bloomberg

Summer Ends with Improving Inflation and Solid Consumer Data

The last week of August not only marked the end of summer, but it brought data that supports the soft-landing narrative:

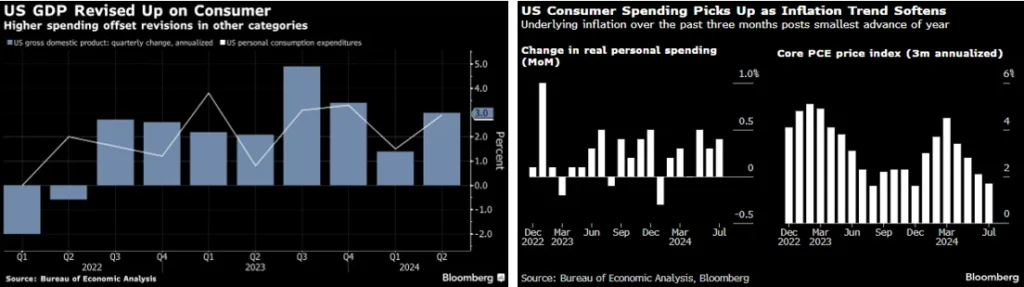

- Q2 GDP was revised up from an initial reading of +2.8% to +3.0%. Personal consumption led the way with an increase from +2.3% to +2.9%, reflecting stronger purchases of goods and services from health care, housing to utilities and recreation. Business spending was revised lower but the increase in consumer spending helped offset that decline.

- The Fed’s preferred inflation gauge, Personal Consumption Expenditures (PCE), rose at a mild +0.2% in July for both headline and Core-PCE. The three-month annualized Core-PCE reading came in at +1.7%, the slowest pace this year. The three-month annualized core services ex-housing measure, which Powell often cites, declined to just +2.0%, the lowest since November 2020.

- Personal Spending rose +0.5% led by services (primarily housing and utilities) while goods spending was led by motor vehicles as well as food and beverages. Inflation-adjusted spending rose higher than expectations to +0.4%, the second highest reading of the year.

- Weekly initial jobless claims came in slightly lower than expectations at 231,000, which is much improved from the 2024 high of 250,000 back in July. Last week’s reading brough the 4-week moving average down to an 11-week low of 231,500.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.