August Mid-Month Portfolio Update

Two Down, Two To Go

Following July’s FOMC meeting, Fed Chair Powell repeatedly referenced the theme of data dependency and confirmed that the Fed will be focused on the two job reports and two CPI reports still to be released ahead of their September meeting. To date, we’ve seen two of the four reports. First up was the July jobs report which had something for everyone. For the second month in a row, nonfarm payrolls came in lower than expectations. Job gains came in at 187,000 versus expectations of 200,000 and the prior month’s gains were revised down from 209,000 to 185,000, marking the weakest two months of gains in more than two years. However, the headline unemployment rate ticked down to 3.5% (versus June at 3.6% and May at 3.7%) amid no change in the labor force participation rate for the 5th consecutive month. Wages grew more than expected at 0.4%, keeping the year-over-year reading at +4.4%. So, a below headline reading along with higher wages gives material for both hawks and doves.

CPI also had something for everyone. For the 2nd consecutive month, both the monthly reading for headline and core CPI came in at +0.2%. The year-over-year headline CPI rose from 3.0% to 3.2%, slightly lower than expectations while core CPI declined from 4.8% to 4.7%. Over the past three months, CPI is up at only a 1.9% annual rate, the smallest three-month reading since the onset of COVID. July prices were led almost exclusively by housing with shelter costs making up 90% of the increase. However, the closely watched “supercore” measure (service costs minus energy and housing) saw prices accelerate for the first time this year.

These ‘goldilocks’ readings (not too hot or too cold) are likely to keep the Fed on hold at its next meeting in September. The fed funds futures market is pricing in no further rate hikes for 2023 and for rate cuts to begin in the second quarter of 2024.

Contrasting Fed Commentary

So far this month, we’ve heard contrasting comments from FOMC officials:

Hawks

- Bowman: “additional increases will likely be needed to lower inflation to the FOMC’s goal”.

- Daly: “There’s still more work to do. And the Fed is fully committed to resolutely bringing inflation back down to its 2% target.”

- Kashkari: “Are we done raising rates? I’m not ready to say that we’re done,”

Doves

- Williams: “monetary policy is in a good place” and “whether we need to adjust it in terms of that peak rate — but also how long we need to keep a restrictive stance — is going to depend on the data”.

- Harker: “Absent any alarming new data between now and mid-September, I believe we may be at the point where we can be patient and hold rates steady and let the monetary policy actions we have taken do their work,”

- Bostic: “We are today in a restrictive stance, and as inflation continues to fall, the degree to which it’s restrictive actually grows as that gap between the inflation rate and our interest rate widens.”

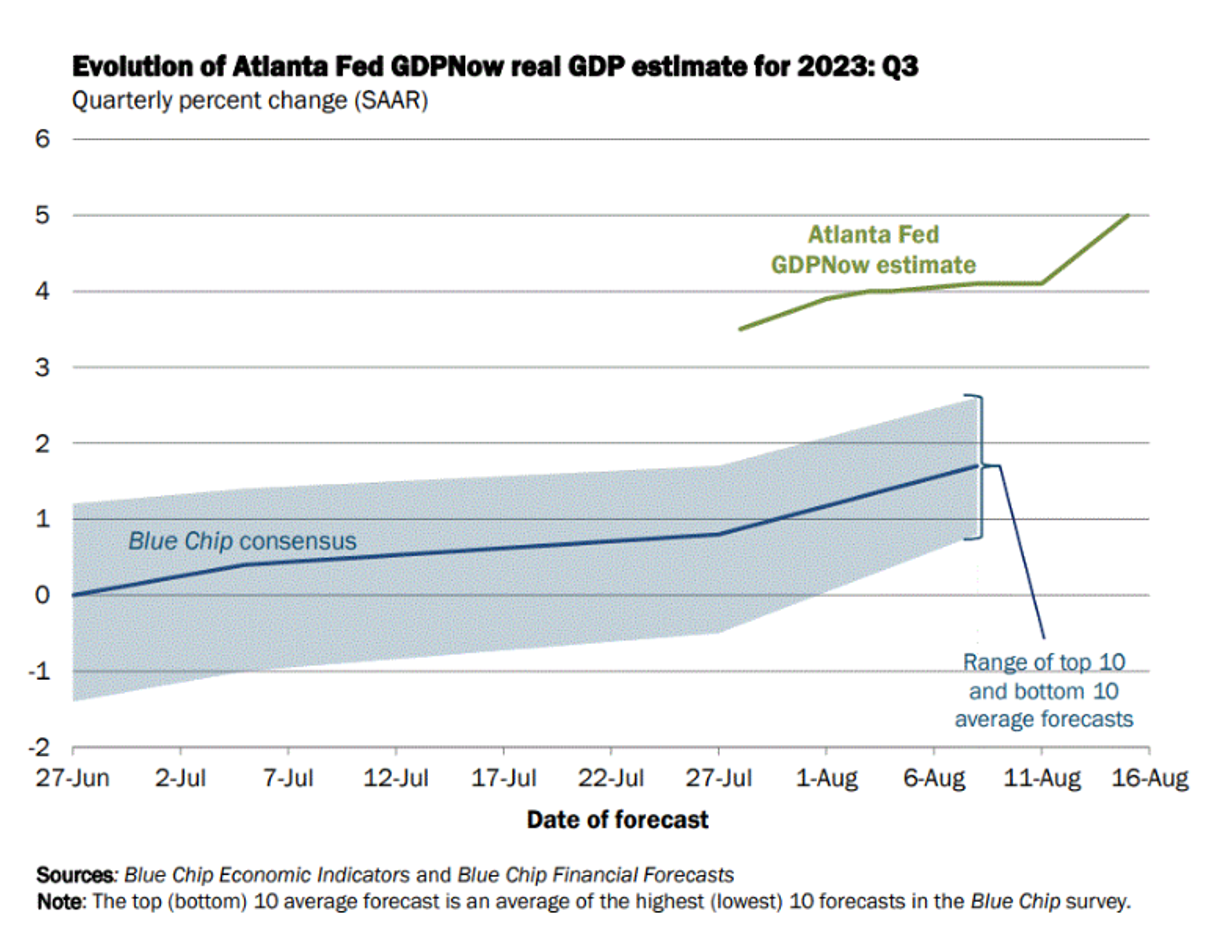

Q3 GDP Estimates

The Atlanta Fed calculates a GDP estimate called GDPNow. For the second quarter, they estimated a +2.4% reading which is exactly where the official reading of GDP came in. Looking ahead to the third quarter, their GDPNow model is estimating an impressive +5.0% reading while the market consensus is around +0.7%. Although this estimate will fluctuate based on available economic data through the months ahead of the official GDP release, this solid estimate for Q3 continues to support the soft-landing narrative for 2023.

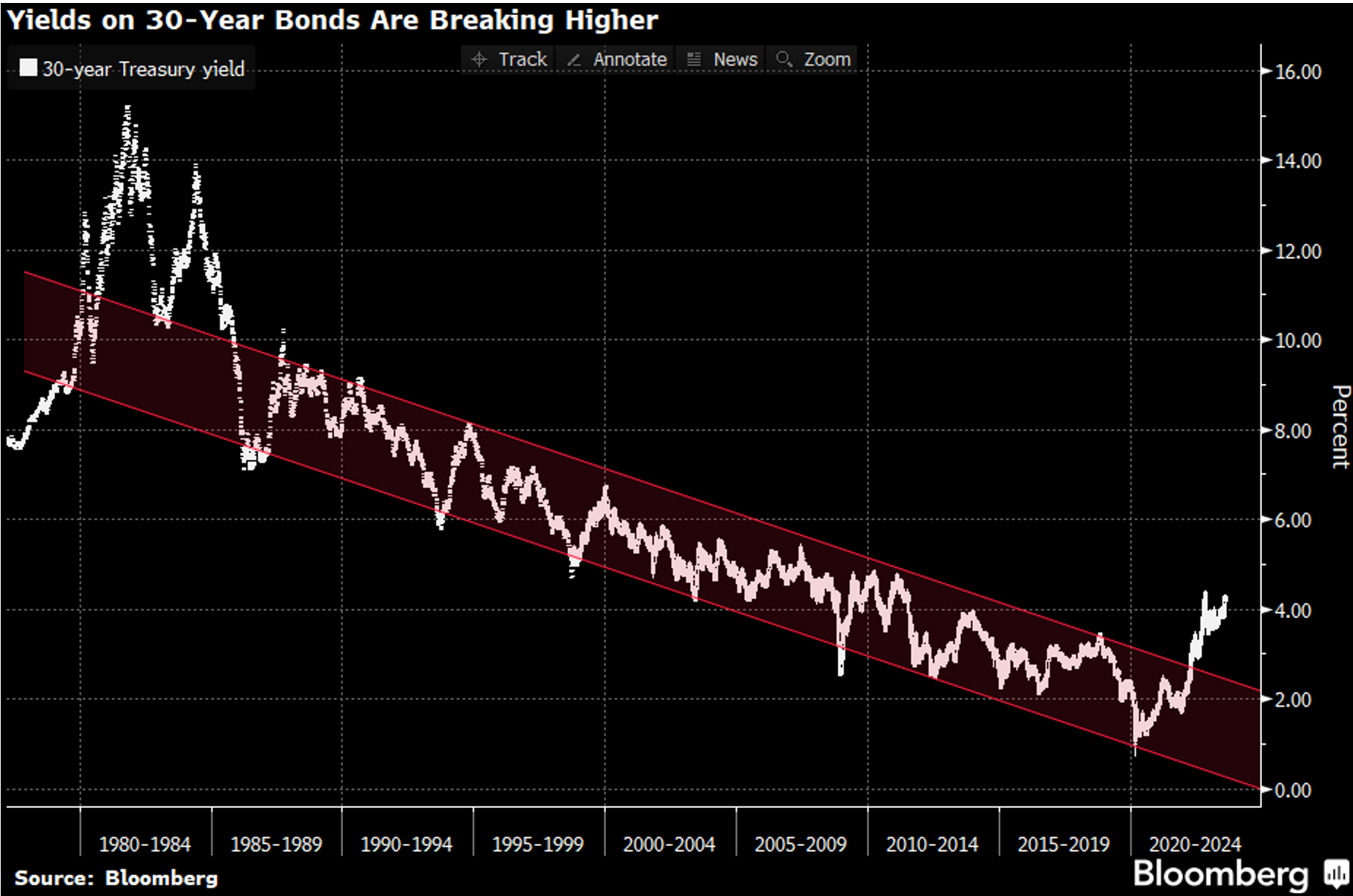

Yield Curve Steepening (as of 8/17/23)

Equity and Credit indexes delivered great performances in July. The Dow Jones Industrial Average climbed for 13 straight sessions, the longest winning streak since 1987. The S&P is now up over 28% from its 52-week low (reached on October 12th) and it secured its 5th consecutive month of gains, the longest streak since August 2021. Corporate bond spreads tightened in July for both investment grade (IG) and high yield securities, with the Bloomberg main IG Corporate and High Yield Indexes improving to the tightest spread levels of the year at +119 and +392, respectively.

Long-term bond yields have climbed relative to the front-end this month with 20- and 30- year yields rising approximately 30 basis points. At the same time, the 2-year Treasury yield has risen 7 basis points while the 1-year T-bill has seen yields decline.

- The US Treasury boosted the size of its quarterly bond sales for the first time in over 2 years to help finance the government’s budget deficits (which prompted Fitch to cut the government’s AAA rating), leading to an increase in longer-term Treasuries for the first time since 2021.

- The Bank of Japan announced more flexibility in their yield curve control policy, lifting its hard cap on 10-year JGB yields which had fueled concerns that Japanese investors could shift some cash away from their US Treasury holdings.

- Oil prices rose to the highest levels of 2023, primarily impacted by supply cuts announced by Saudi Arabia which followed OPEC’s announcement earlier in the year that it was extending their production cuts through next year. This has fueled inflationary concerns which impacts the 10- to 30- year portion of the curve.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.