August End-Month Portfolio Update

August Bond Yields – Up, then Down

To recap, US Treasury yields rose during the first half of the month led by a variety of factors: increased Treasury supply, solid economic data, higher inflation expectations, reduced overseas demand for US government securities and Fitch’s ratings downgrade. The 10-year note reached a 16-year high of 4.36% and the 2-year rose above 5%. However, softer economic data surfaced in late August and Treasury yields have since declined:

- JOLTs job openings fell to a two-year low of 8.8M while the ADP employment report came in lower than expectations.

- Consumer Confidence had the largest one-month drop in two years.

- Second quarter GDP was revised down from 2.4% to 2.1%.

- The Fed’s preferred inflation gauge (Core PCE) posted the smallest back-to-back increase since late 2020.

Source: Bloomberg

Source: Bloomberg

A Healthy Spike in the August Unemployment Rate

August’s nonfarm payrolls increased by 187,000 – higher than expectations of 170,000 – however, the prior two months’ reports had downward revisions of 110,000. In an interesting twist, the unemployment rate rose to a 19-month high from 3.5% to 3.8%. However, the spike was healthy as the labor force participation rate jumped to its highest level since February 2020 at 62.8%, with the civilian labor force surging by 736,000. There were 597,000 new entrants into the labor market (people looking for work for the first time), marking the highest level since October 2019. On the inflation front, average hourly earnings came in lower than expected at +0.2%, an 18-month low. Although we still have another CPI release ahead of the next FOMC meeting on September 19 and 20, this employment report is likely to have encouraged the Fed to keep rates unchanged this month.

Source: BLS

Source: BLS

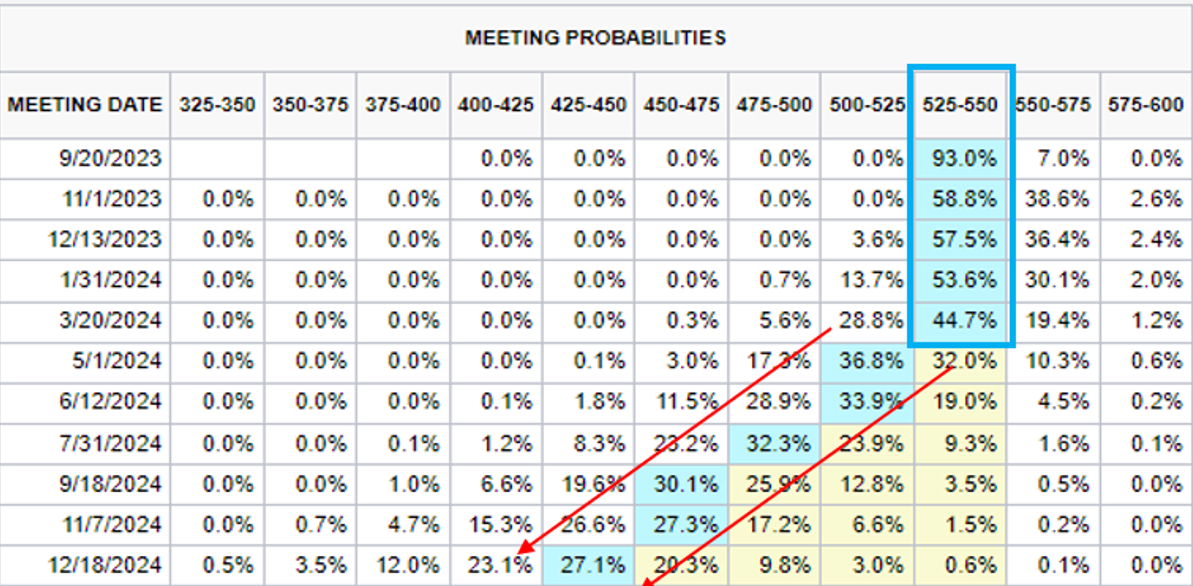

Rate Hike/Cut Probabilities

In his recent speech at the Jackson Hole Symposium, Fed Chair Powell left the door open to another rate hike this year saying, “we are prepared to raise rates further if appropriate”. His comments are also in line with the Fed’s latest economic projections which show another 25-basis point rate hike in 2023, which would bring the Federal Funds Rate target range to 5.50% to 5.75%. However, the Fed Funds futures market is not fully pricing in further rate hikes (highlighted in blue) and suggests that rate cuts may begin at the May 2024 FOMC meeting (highlighted in red).

Source: CME Group

Source: CME Group

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.