April Month-End Portfolio Update

Powell At May FOMC Meeting: Not As Hawkish As Expected

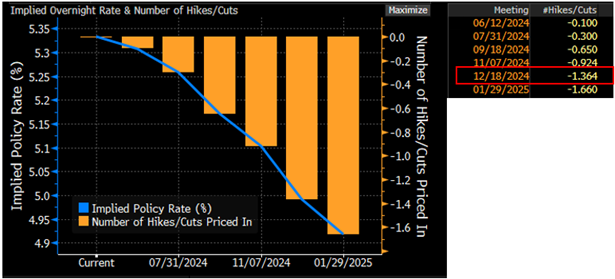

The FOMC met yesterday and kept the overnight lending rate unchanged for the 6th consecutive meeting at the 5.25%-to-5.50% range. Their statement acknowledged the recent increase in inflation data by adding “In recent months, there has been a lack of further progress toward the Committee’s 2 percent inflation objective.” In his press conference, Fed Chair Powell reiterated that it will not be appropriate to reduce the federal funds rate until they have gained greater confidence that inflation is moving sustainably toward 2% and that it will likely take longer than previously expected to reach that goal. Some market participants had forecast that Powell might hint at openness to additional tightening but when asked about the possibility of higher rates, he said “It’s unlikely that the next policy rate move will be a hike.” Treasury yields rallied lower after that comment with the 2-year yield down 6.5 basis points to 4.96%. The Fed Funds Futures market is now pricing in one 25 basis point rate cut by the December 2024 FOMC meeting.

Source: Bloomberg

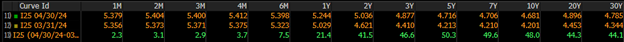

Source: Bloomberg

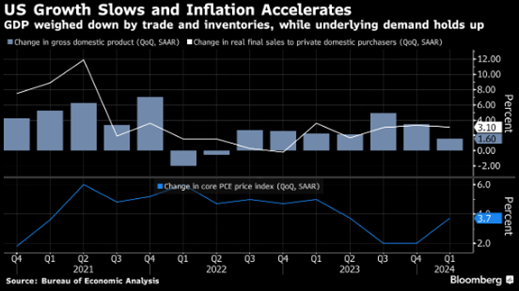

Soft Q1 GDP Data May Not Tell The Full Story

The preliminary reading on first quarter 2024 GDP came in at +1.6%, lower than expectations of +2.5%. However, two of GDP’s most volatile categories, inventories and trade, may conceal underlying strength in economic growth. Combined, inventories and net exports pulled headline GDP -1.2% lower, but a decrease in inventories in one quarter can often lead to an increase in subsequent quarters as companies restock. When the negative impact of inventories and trade are excluded from the reading, known as Final Sales to Domestic Purchasers, the US economy grew at a robust +2.8% pace. Personal Consumption slowed to +2.5%, but the still-solid reading points to the continued strength of consumer spending. However, inflation data was disappointing; the quarterly Core-PCE Price Index rose +3.7% in Q1 after having slowed to a +2.0% pace in the two previous quarters. The Core PCE year-over-year reading was unchanged at +2.8%, which helped to ease market concerns. Powell’s press conference yesterday suggested that the Fed looked through the weaker headline GDP reading and focused instead on the sturdy labor market, solid consumer spending, and sticky inflation in making the decision to keep monetary policy changes on hold for the time being.

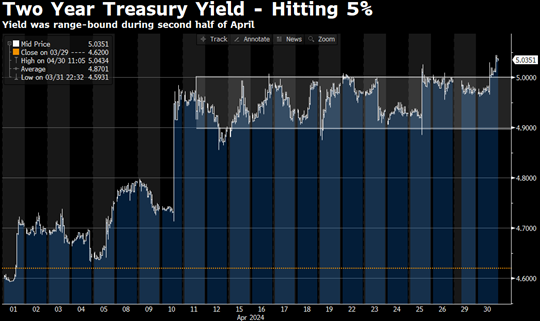

Two Year Treasury Yield Ended April at 5% after Inflation Report

In one of the last data releases in April, the Employment Cost Index (which is a closely watched inflation gauge by Fed Officials) rose +1.2% in the first quarter, higher than expectations and marking the biggest increase in a year. The 2-year treasury yield rose back above 5% on the last day of April despite being mostly range-bound during the second half of the month, and then fell back to 4.96% after the May 1st FOMC meeting made it clear that rate hikes are off the table.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.