April Employment Report – Labor Market Cools but Doesn’t Freeze

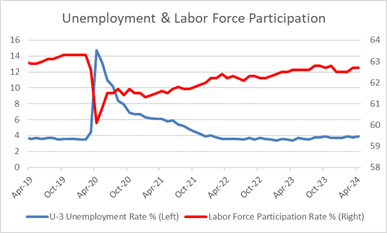

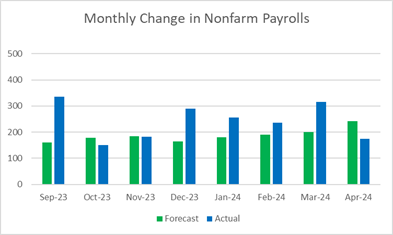

Total nonfarm payroll employment rose by 175K in April, missing expectations by 68K, while the unemployment rate increased 0.10% to 3.9%. Over half of the total gain in payrolls were in the Health and Private Education industry, perhaps a signal of weaker hiring across the broader economy than the headline number would suggest. The report serves as the first major sign of labor market cooling this year, which may help reduce inflation if this proves to be the start of a sustained trend.

Average hourly earnings increased by 3.9% year-over-year in April, cooling from a 4.1% increase in the twelve-months ending in March. This follows a hotter than expected first-quarter employment cost index, the Fed’s preferred wage inflation gauge. If sustained, smaller average hourly earnings gains could signal reduced wage inflation in the second quarter. The report supports the Fed’s thesis that employment and inflation concerns have moved into ‘better balance’ over the prior year and could encourage them to pursue cuts sooner than otherwise expected to support the labor market. However, one report does not signal a sustained trend, and consistent labor market slack may still be necessary to move inflation towards the Fed’s 2.0% goal.

Takeaways for Cash Investors

Fed– The Fed Funds Futures Market moved to price in an additional cut in 2024. The market now expects the Fed to pursue two 0.25% cuts this year at their September and December meetings, respectively. While still more hawkish than the Fed’s most recent projections, FOMC participants have recently been downplaying the likelihood of multiple cuts in the second half of the year as the broader economy remains healthier than expected.

Rates– Short-term rates remained largely stable following the employment report, however, the yield on the 2-year Treasury note fell 0.09% and the yield on the 10-year Treasury bond declined by 0.07%. The market reaction is consistent with the Fed potentially pursuing more cuts than were anticipated prior to the report’s release to support a cooling labor market.

Credit– A cooling labor market usually acts as the primary driver behind worsening consumer balance sheets. A sustained decrease in hiring would have negative knock-on effects for spending and corporate cashflows. However, the labor market remains historically strong, and less labor competition would continue to place downward pressure on wage gains, supporting business margins.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.