Antitrust Anxiety Part 2

Revisiting Big Tech’s Legal and Regulatory Challenges

Through an era of unprecedented volatility, driven by a pandemic, war, and bank failures, Big Tech legislation has remained a constant. Almost two years ago, we published our blog Antitrust Anxiety: The Long Road to Big Tech Reform that explored lawsuits against Big Tech, pending legislation, and some of the key players in US antitrust enforcement. Ultimately, our prior discussion concluded that major changes to antitrust law or Big Tech operating models were years away, leaving cash investors with breathing room in the near term. While this largely remains true, some time has passed since this last antitrust publication, and there have been several notable developments that may provide more visibility as to what reforms will look like—and perhaps more importantly, when they may be implemented. As such, we believe it is prudent to revisit this topic and provide some updates on the Who, The What, and possibly the When of Big Tech reform.

New US Antitrust Cases

As with previous antitrust lawsuits, the timeframe of these cases may exceed the horizon of cash investors. However, lawsuits from global regulatory authorities have continued to flow in, with two cases currently residing in the US standing out.

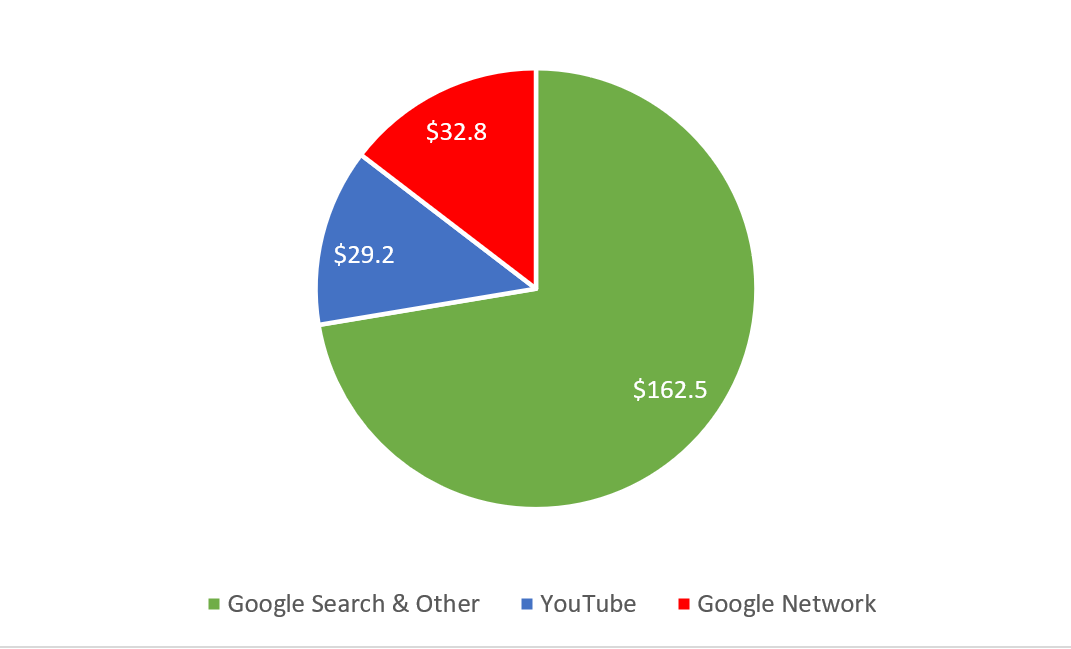

Led by long-time Alphabet Inc. opponent Jonathan Kanter, the Department of Justice (DOJ) filed a second antitrust complaint against Google in January of 2023. Their suit alleges that Google’s scope in digital advertising tools, including their control of the largest digital ad auction network, led to self-preferential treatment and inflated prices. To remedy this, the plaintiff proposed that Google undergo a forced divestiture of its Google Ad Manager Suite. In effect, the DOJ is calling for a separation of Google Network (~12% of revenues) from their advertising business (~80% of revenues), presenting a risk to the company’s operating model by removing auction fees and limiting revenues outside of Google. The case will likely take years to adjudicate, and Google will likely seek remedies to avoid a breakup.

Exhibit 1: Breakdown of Google’s Advertising Revenues in 2022 ($ billions)

Source: U.S. Securities and Exchange Commission Form 10-K Filing. Alphabet Inc. (2022)

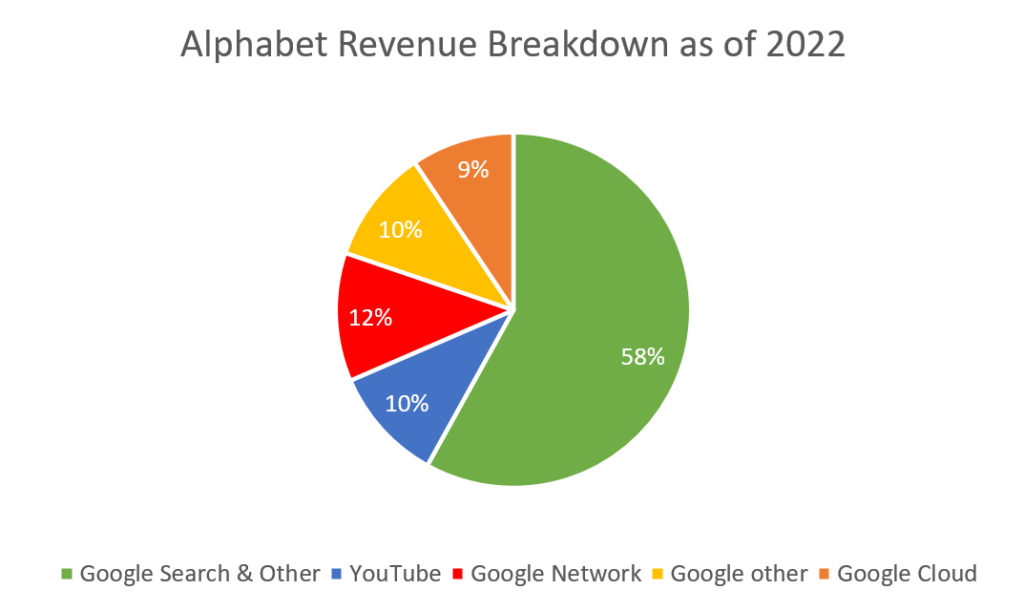

Exhibit 2: Alphabet Inc. 2022 Revenues by Segment

Source: U.S. Securities and Exchange Commission Form 10-K Filing. Alphabet Inc. (2022)

Note: Excludes Other Bets of $1.1B, which rounded to 0% of revenues.

Another noteworthy antitrust development is Microsoft’s return to the conversation. Having largely escaped antitrust scrutiny since their previous challenges in the 2000s, Microsoft was sued by the FTC in December of 2022 in an effort to block the $75 billion acquisition of video game publisher Activision-Blizzard. The FTC argued that the deal, initially announced in January of 2022, would allow Microsoft to lock users within its Xbox and Xbox’s cloud-gaming ecosystem by withholding their properties, particularly the lucrative Call of Duty franchise, from other consoles. This, to date, is the strongest reaction to the deal by regulators, but with several global regulatory agencies also reviewing the case, other challenges could be introduced.

To appease regulators, Microsoft has offered concessions, most notably contracts to Call of Duty on multiple consoles for the next ten years. If confirmed, Microsoft expects the transaction to go through in the middle of 2023. The deal would boost gaming revenues by roughly 50% but would simultaneously reduce Microsoft’s significant cash moat (which last totaled $104.8 billion).

Exhibit 3: 2022 Revenues from Microsoft Gaming and Activision-Blizzard

Source: U.S. Securities and Exchange Commission Form 10-K Filings. Microsoft Corp (2022). Activision-Blizzard, Inc. (2022)

The Key US Antitrust Players

The cases above are being pursued by Lina Khan, Chairwoman of the FTC, and Jonathan Kanter, Assistant Attorney General of the Department of Justice, both of whom are outspoken critics of Big Tech. Appointed by President Biden, they have made good on their word to further police these companies, as evidenced by the lawsuits mentioned above. While Big Tech has been the main target of antitrust, Khan and Kanter have also taken action against other industries, with lawsuits against book publishers, airlines, and gene sequencing companies making headlines.

Since they took the reins, anticompetition cases have been pursued more frequently but also in a less traditional manner. Khan’s FTC sued to block the acquisition of the VR company, Within by Meta, arguing it would lessen competition and hamper innovation. While antitrust rhetoric typically applies to mature industries, this case was based on the FTC’s expectations of how the nascent industry could develop. Ultimately, this aggressive strategy has translated into multiple losses for the watchdogs, including the Within case. While Khan and Kanter have yet to deal any major blows to Big Tech, more lawsuits aimed at curbing Big Tech’s power—likely targeting changes to business practices and/or operating models—are likely to continue during their tenure.

New Regulation

Multiple pieces of tech-targeted antitrust legislation have been introduced by Congress, but they have stalled out since the end of 2022. Meanwhile, the European Parliament passed two broad pieces of legislation, The Digital Markets Act (DMA) and Digital Services Act (DSA) in July of last year. The Acts identify and seek to regulate “gatekeepers”, defined as companies who:

- Have an annual turnover of at least €6.5 billion or a market cap of at least €65 billion.

- Serve more than 10,000 active business consumers and 45 million active end users in the European Union.1

- Have an “entrenched and durable position” in the last three years.2

The Digital Services Act requires swifter action on misinformation and illegal content, as well as providing transparency to users surrounding how their algorithms work. Aside from possible fines, the DSA does not likely present a threat to the operating models of Big Tech.

The Digital Markets Act, however, takes aim at the “walled garden” approach to digital product stores and could significantly affect the operating models of Apple, Google, and Amazon. The main message of these broad rules is essentially “if we can’t break them up, break them open.” Namely, the DMA breaks open app stores by allowing sideloading—downloading apps from third-party app stores—as well as allowing third-party app payment systems, which could cut into commissions received by Apple and Google. Additionally, the DMA prohibits self-preferential treatment of products and services, meaning companies cannot rank their products above that of their competitors, something Amazon has been accused of.

Overall, these changes are not significantly different from current lawsuits and proposed legislative changes, but a key difference is the timeframe. The European Union will designate “gatekeepers” by September of this year and will begin enforcement by March of 2024. While both acts will only apply to operations within the European Union, tech companies have historically applied European standards globally, which tend to be stricter. Whether or not this trend continues is uncertain, but the 2024 timeframe may expedite action on matters with uncertain timeframes, such as the Apple v. Epic appeal and the stalled US legislation. For example, Google allowed some developers such as Spotify to start using their own in-app payment systems just a day before the EU ratified the main rules of the DMA. As such, this legislation provides a clearer idea of when we can expect changes to Big Tech.

Bottom Line

The big picture of Big Tech legislation is unchanged, but developments in the last two years have added some clarity as to what investors may expect in the future. While the possibility of breakups remains a longer-term concern, companies can expect greater competition in some of their businesses as their “walled gardens” are broken open.

Despite all of this, many Big Tech companies remain strong credits for cash investors. These companies typically share attributes of low leverage as well as sizable cash holdings that can help mitigate the risk of regulatory fines. Moreover, Big Tech can dip into these holdings to ensure debt payments in the event of an economic downturn and may negate the need to issue new debt. These attributes may be particularly beneficial in the current environment, with volatility in the financial sector and higher debt costs given the rise in interest rates. Near-term pressure remains low, but investors should continue to monitor regulatory developments and other operating changes that could affect Big Tech companies.

2https://ec.europa.eu/commission/presscorner/detail/en/IP_22_6423

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.