After Three Rate Cuts Since July, What’s the Fed’s Next Move?

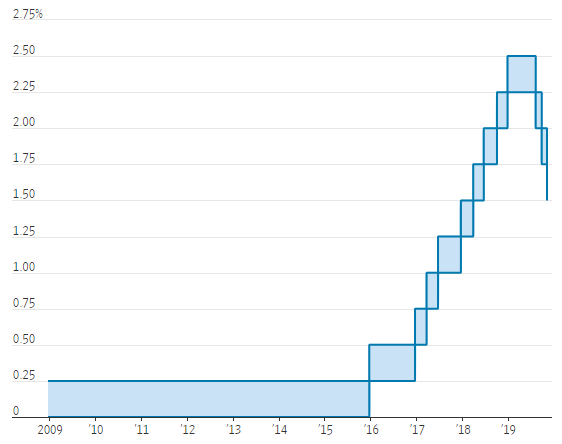

In a move that surprised no one, the Federal Open Market Committee (FOMC) cut rates by 25 basis points at its October meeting, the third cut in as many months. The current Federal Funds rate range now lies at 1.50%-1.75%, still relatively high compared to short-term rates in other G8 economies and still well off the lows seen from 2008-2016 (Figure 1).

Figure 1: Federal Reserve Rate Target

Source: WSJ, Fed Cuts Rate for Third Time This Year, Signals Pause

Where Will the Fed Go from Here?

Markets had fully priced in the reduction for over a week, and a variety of news sources had reported that the Fed was almost certain to cut. The question now is where the Fed goes from here.

Shortly after its June meeting, the Fed established that it would engage in its first rate-cutting cycle since the end of the recession. Chair Powell framed the moves as “insurance” against a variety of risk factors, namely: trade policy uncertainty, weakening global growth, and worsening financial conditions (evidenced by an inverted yield curve).

The Fed’s plan seems to have worked reasonably well; the fall in short term rates has reversed the inverted yield curve for the time being. A reported “Phase 1” agreement between the U.S. and China has eased tensions somewhat on the trade front. And indicators of consumer confidence and financial market conditions have rebounded, signaling that the probability of a recession over the next twelve months has likely fallen.

Standing Pat…for Now

Now the Fed finds itself at another inflection point. While still maintaining an easing bias, the Fed signaled that it views the current level of interest rates as appropriate for the current environment. This may indicate that, at least for the next meeting, the Fed will stand pat.

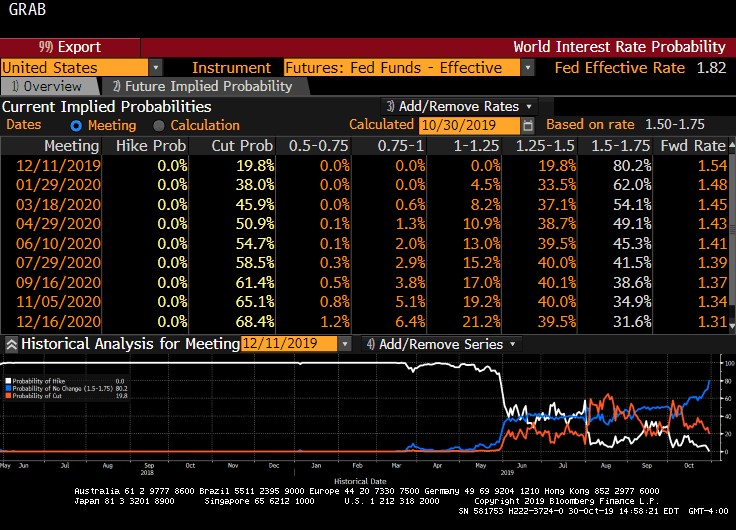

The market is largely in sync with this assessment, as the probability of another cut before the end of the year has diminished.

Figure 2: Fed Funds Futures Projections

Source: Bloomberg

One thing to keep in mind is that the Fed faced a parallel situation at the end of last year. After raising rates for the better part of three years, the Fed decided to hit the pause button and see how things progressed heading into the new year.

As it turns out, this passive stance ended up being the wrong move, as it anchored them to the current rate level rather than letting them be more dynamic in responding to a changing environment. The result was that the Fed was forced to cut more than it would’ve liked, in order to head off burgeoning risks. Now that it has signaled another “pause” in the rate cutting cycle, it remains to be seen whether the Fed will act more quickly this time if downside risks reemerge.

Increasing Liquidity to Calm Repo Markets

The other noteworthy aspect of the Fed meeting concerns its liquidity operations. As has been reported, the Fed is now in the process of both expanding its balance sheet and offering a temporary repo facility to ensure that there is adequate liquidity in short-term funding markets. This comes in response to the Repo Ruckus that occurred in mid-September, when liquidity all but dried-up.

Of note, in his remarks to the press, Jerome Powell explicitly stated that the Fed is aiming to bring banks’ excess reserve balances back up to early September levels of roughly $1.4 trillion (as of October 23rd they sat at $1.32 trillion). He also stated that the Fed is considering allowing intra-day overdraft accounts for member banks in hopes of freeing up more idle cash.

The problem (which Powell implicitly acknowledged) is that there remains a great deal of uncertainty regarding what level of reserves is “enough.” Despite the Fed’s best intentions, volatility in the repo market around month-end is now a common occurrence, with SOFR undergoing a 50-basis point spike on September 30th. It remains to be seen how the market will respond around year-end, and more broadly whether or not the Fed will need to re-access its ability to control short-term rates.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.