AFP Conference Attendees Rethink Cash Management Strategies In Wake of Money Market Fund Reforms

Our panel session at this year’s AFP Conference on “Managing Liquidity in a Post-Reform World” came at an opportune time—just after new SEC regulations on institutional prime money market funds went into affect that have already started to dramatically transform the cash management landscape. So it was no surprise when much of the formal discussion at the conference (not to mention plenty of informal cocktail party talk as well) focused on one simple question: “Now what?”

A standing-room-only crowd of more than 250 conference attendees heard our three panelists—Kim Kelley-Lippert, CTP, Manager of Treasury Operations at American Honda Motor Co., Inc.; Klas Holmlund, CFA, Assistant Treasurer at Vertex Pharmaceuticals; and David Miller, Treasurer and Senior Vice President at Hunt Companies—share their insights and experiences positioning their organizations for the new era.

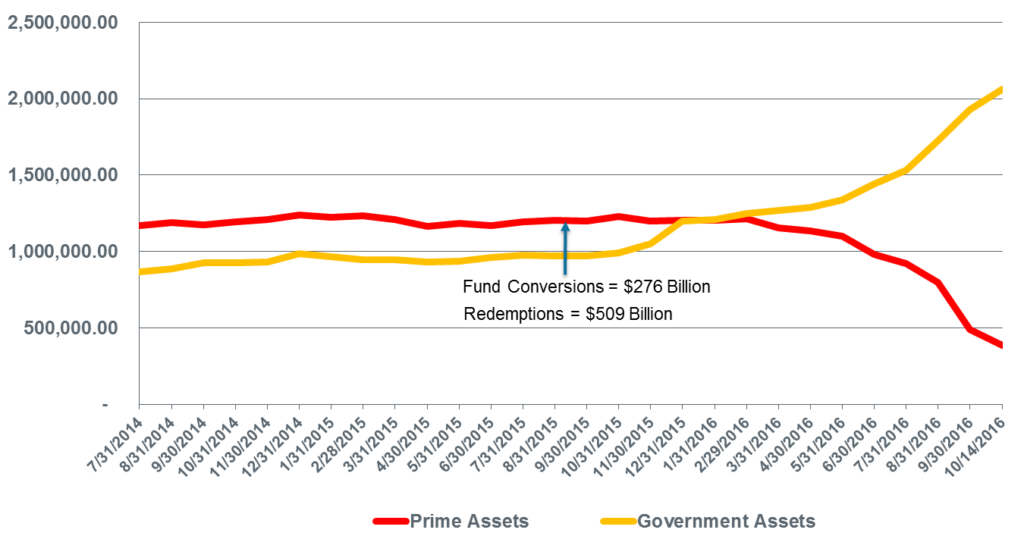

The session provided an overview of the macro changes in cash management markets. Even before the institutional prime funds on October 14 imposed SEC-mandated floating net asset values, optional redemption fees and possible liquidity gates, asset managers had made major moves into alternative cash investments. More than $785 billion had been pulled out of prime funds, a 67% reduction from $1.24 trillion in the funds at the start of 2016. Much of that cash flowed into government money funds not subject to the new rules, with assets increasing by more than $1 trillion to $2.1 trillion, a 138% increase (Figure 1).

Figure 1: Over $785 Billion in Outflows from Prime Money Market Funds

Source: iMoneyNet: Money Fund Analyzer – Prime and gov’t fund assets (7/31/2014 – 10/14/2016)

But with yields stuck at historically low rates as all that cash chased a limited supply of government debt, many investors said they were also considering other scenarios that might offer slightly higher returns along with an acceptable balance of liquidity and safety of principal.

Some said they planned to trade off a bit of liquidity by allocating a portion of their portfolios to investments with longer maturity dates and slightly higher returns. Others said they would change their investment policies to accommodate a broader range of investments, including separately managed accounts and/or direct purchases of commercial paper and other alternatives.

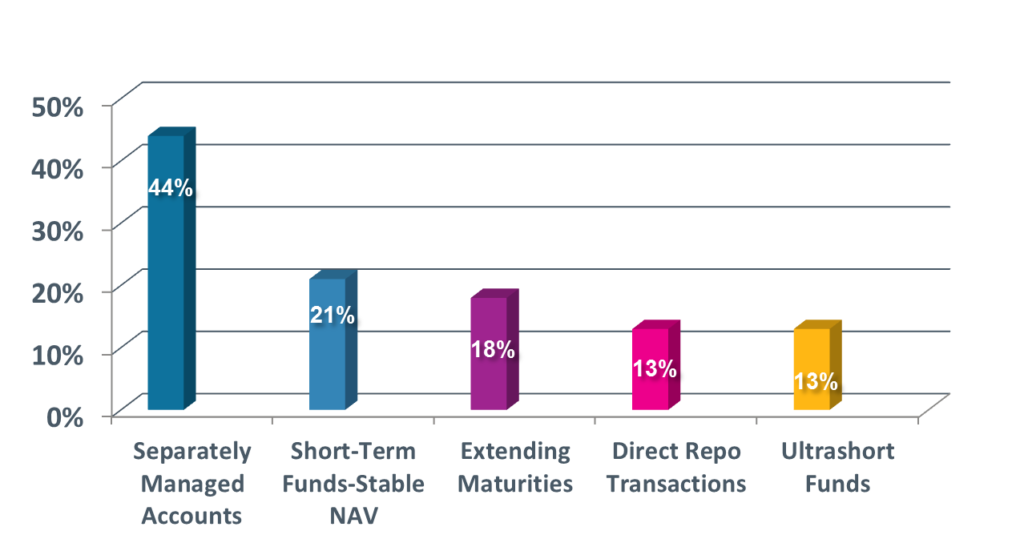

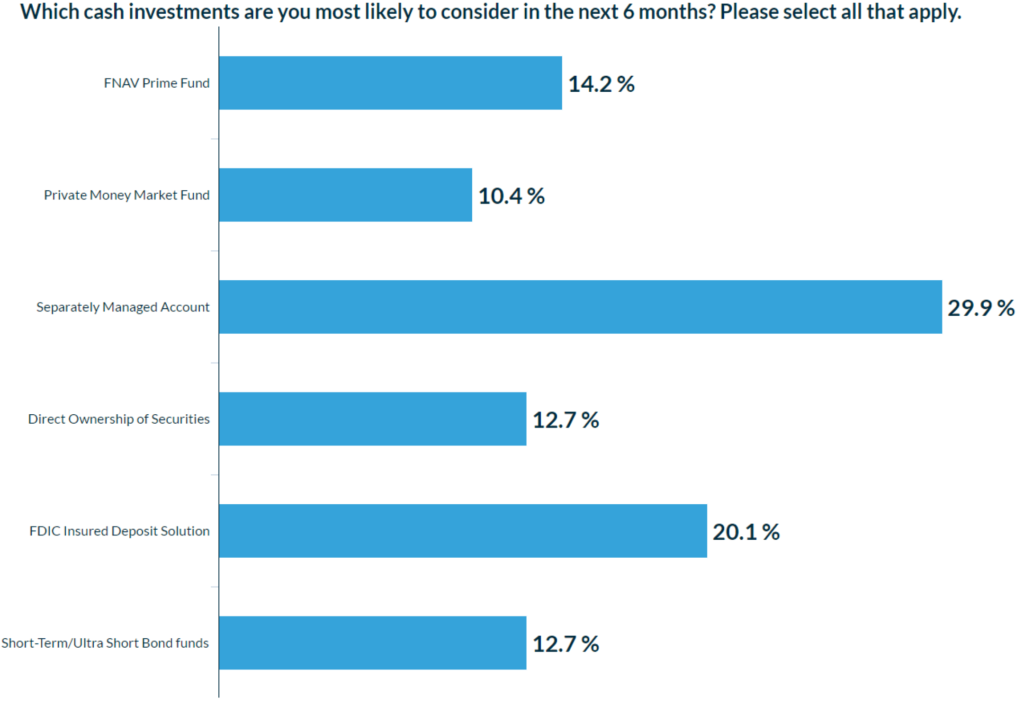

In fact, in the annual AFP Liquidity Survey fielded last summer, 44% of respondents said they were considering separately managed accounts, the most-preferred investment alternative that organizations would consider in response to the money market fund reforms (Figure 2). We got similar results from an electronic poll of the attendees at our conference session. When asked to choose one of six options, 29.9% of the respondents to our instant poll said they were considering separately managed accounts, followed by FDIC-insured deposit solutions (20.1%), floating-NAV prime funds (14.2%), direct ownership of securities (12.7%), short-term/ultra-short bond funds (12.7%) and private money market funds (10.7%) (Figure 3).

Figure 2: 2016 AFP Liquidity Survey

Source: 2016 AFP Liquidity Survey Report of Survey Results (pages 23-24)

Figure 3: AFP Session Audience Poll

Source: https://api.cvent.com/polling/v1/api/polls/spau8jox

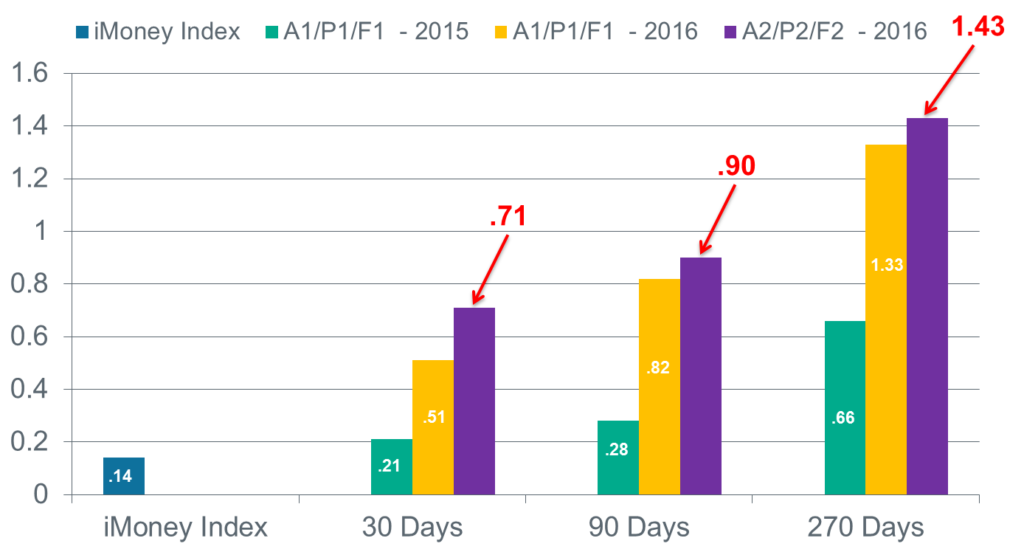

Many corporate cash managers who invested in safe but relatively low-yield government funds are starting to quantify the possible opportunity costs they may incur if they fail to move to one or more of those alternative investments. At our panel session, we looked at the costs of keeping cash in government funds versus options for investments in A1/P1 and A2/P2 corporate paper at different maturities. The yield differentials were substantial—for instance, A2/P2 CP yield for the Bloomberg Index rate was five times greater than the iMoney Index rate (Figure 4). And the spread for longer portfolios was even greater.

Figure 4: Wider Yield Spreads = Opportunity Costs

Sources:

iMoneyNet: Money Fund Analyzer (as of 10/14/2016)

Bloomberg USD Dealer CP Curve Index (A1/P1/F1) (as of 10/14/2015)

Bloomberg USD Dealer CP Curve Index (A1/P1/F1) + (A2/P2/F2) (as of 10/14/2016)

Don’t be surprised if we see a lot more movement of cash into alternatives once the dust starts to settle from the impact of the money market fund reforms—especially if and when the Fed decides to raise interest rates again by the end of this year or early in 2017.

During our panel session and through several days of conversations at the AFP Conference with corporate cash managers wrestling with the fallout from the reforms, one thing became clear to me. We’re only at the starting line of a long-term process of reallocating cash investments in response to this once-in-a-generation disruption of the cash management landscape. Watch this space for more thoughts, observations and commentary on the cash investment outlook as we move into 2017.

Note: the graphics in this blog post were from our AFP Conference panel session.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.