Our Process

Our credit process, focused specifically on short-term liquidity investments, is designed to help identify default risks and continuously assess the suitability of eligible investments, with the primary objectives of preserving principal and ensuring liquidity.

A Focus on Risk Management

“We view our role as a manager of risk, first. We place emphasis on credit risk management and understanding the dynamics and interdependence of the short-term markets.”

Lance Pan

Director of Investment Research and Strategy

Preserve Principal, Maximize Liquidity

Our investment universe is comprised of high-grade credits evaluated by our Research team and approved by our Credit Committee. Analysts monitor credits for changes to risk profile and suggest modifications to the Approved Credit List as part of the process to help mitigate credit risk throughout the business cycle. Our proprietary credit model is an integral part of our investment management process.

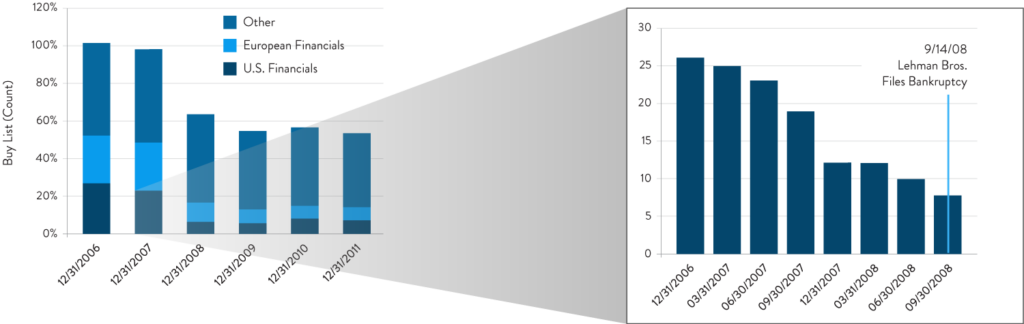

Capital Advisors Group’s Preemptive Approved List Management Reduced Client Exposure to Financials Pre-2008 Crisis

30+ Years of Thought Leadership

We provide timely, in-depth research on cash investing that highlights our thought leadership on a range of topics facing short-term, fixed income investors, including portfolio construction, credit considerations, counterparty risk, investment policy development, and market issues.

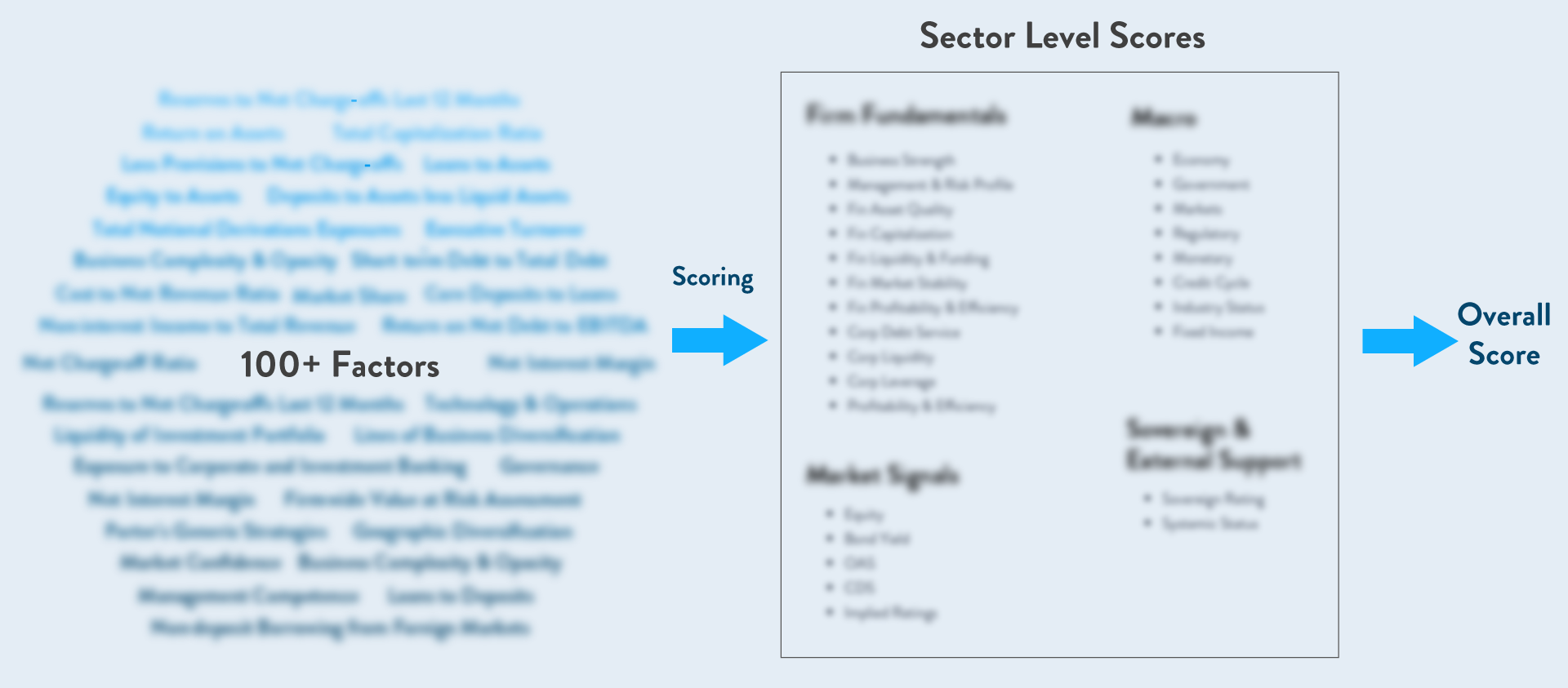

CounterpartyIQ® – Credit Analysis

The CounterpartyIQ® platform is a web application based on our credit research methodology that captures, analyzes, and scores credit exposures, evaluating more than 100 characteristics of each credit that we cover. Driven by both quantitative and qualitative factors, it informs the credit decisions for your portfolio.

Each Category is Scored and Factored into the Overall Score

CounterpartyIQ®

We offer our clients access to the CounterpartyIQ® platform to provide them with a dashboard for real-time counterparty credit risk monitoring.