A 360° Overview of a Proactive Cash Management Strategy

Co-authored by: Spyros Qendro, CFA®, and Carter Bourassa

DOWNLOAD FULL REPORT

Abstract

In an environment characterized by limited forward visibility, it’s more crucial than ever for cash investors to understand the landscape and the risks and opportunities it creates. In this paper, we will evaluate what makes a successful cash management strategy while underscoring the steps of the process for getting there. We will focus on:

- Identifying one’s needs and requirements

- Evaluating available money market instruments

- Basics of insightful due diligence

- Requirements for successful investment monitoring

Introduction

Over the last two years, a combination of factors exogenous to financial markets have resulted in significant levels of global uncertainty. The resurgence of volatility in the context of major geopolitical events has pressured private investment and caused recession concerns to resurface. Already, a number of major central banks have demonstrated an easing bias. Their intent is to act proactively to insulate their economies from the current uncertainty and any potential future headwinds. But with the severity of the upcoming slowdown hinging on events that are impossible to predict, portfolio resiliency, careful monitoring, and quality credit analysis are paramount to the cash investor’s good night’s sleep.

Know Thyself

The first and arguably most impactful step in building an investment portfolio is taking stock of one’s own goals and limitations. It is important for investors to clearly delineate their risk tolerance, ongoing liquidity requirements, available research resources, and preferences regarding geography, industry, issuer concentration, financial instrument selection and manager concentration prior to embarking on portfolio construction. This requires that one take an inward look at their organization, plan their near-to-medium-term operational needs, and fit their investment policy within the broader context of their business strategy. A well-tailored investment policy statement helps the investor get the most out of their portfolio by minimizing the likelihood of unpleasant surprises, setting an appropriate yardstick for measuring performance, and ensuring funds are available to the business when needed.

While specific considerations may vary depending on the nature and growth stage of a business, a good template of questions one should answer prior to making investment decisions is:

- What are my primary goals/requirements for investing?

- Where do I stand on the risk/return spectrum?

- What is my available pool of cash to invest? How does this relate to my expected cash needs over time?

- How certain am I regarding future liquidity needs? Thinking probabilistically can inform decisions on risk tolerance.

- How do I evaluate performance? Am I focused on effective capital preservation or competitive returns?

Know the Market

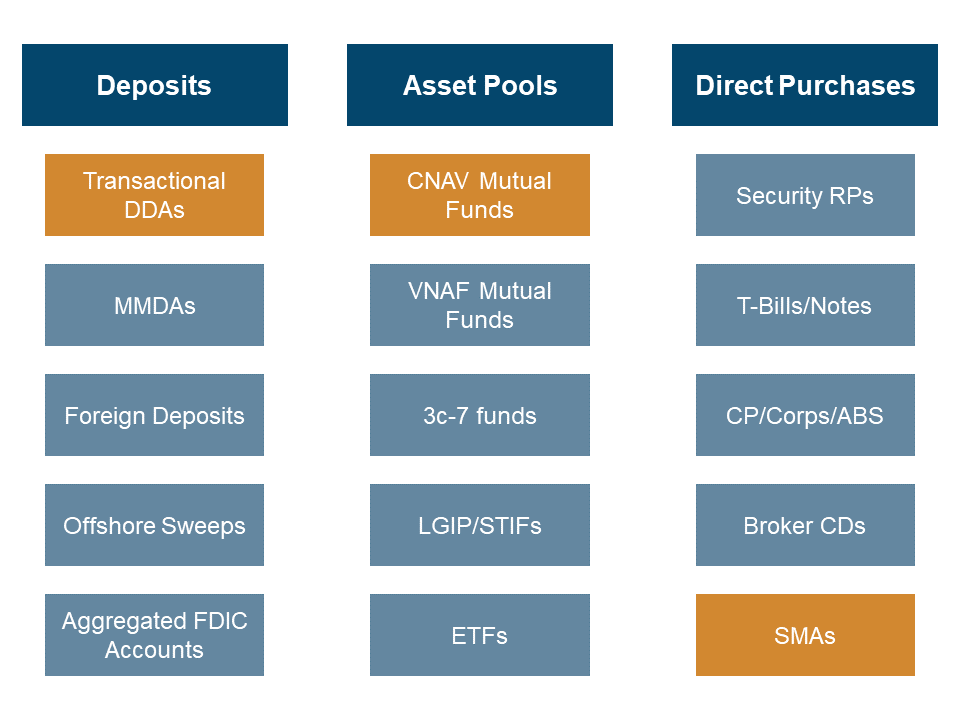

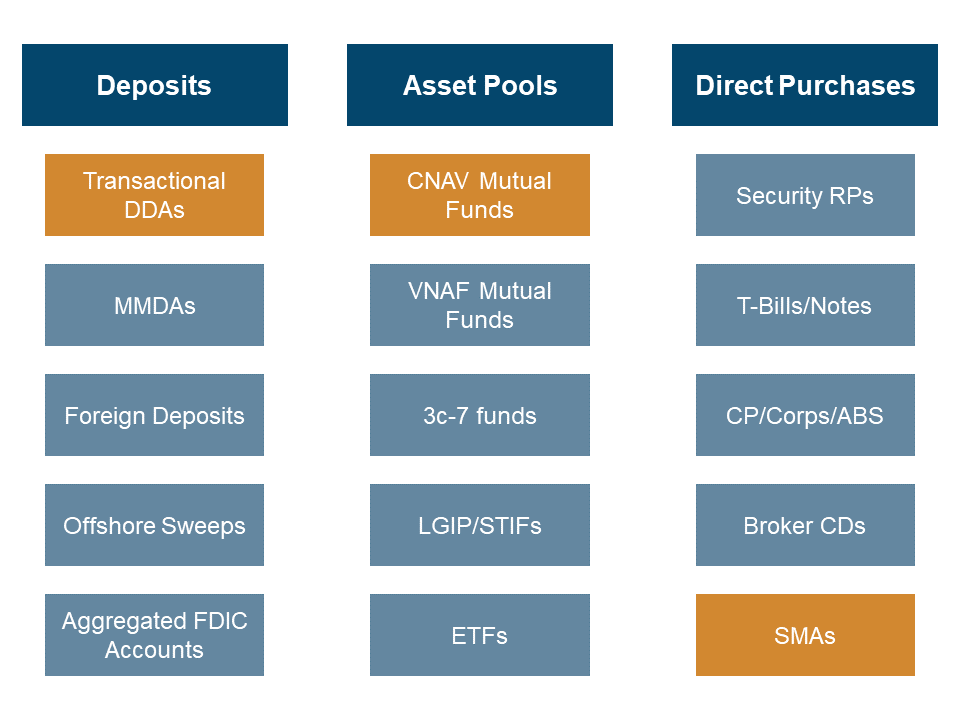

Cash management vehicles vary in their specifications and utility to the cash investor. Broadly speaking they can be classified as falling under one of three categories: Deposits, Asset Pools, or Direct Purchases (Figure 1).

Figure 1: Cash Vehicles At-A-Glance

Source: Capital Advisors Group, Inc.

1. Deposits refer to a broad range of transactions which involve the transfer of funds to a third party for safekeeping. Liquidity and maturity characteristics can vary somewhat widely on these instruments, ranging from overnight liquidity in accounts such as money market demand accounts (MMDAs) to fixed maturity time deposits. Sweep accounts can allow for high levels of liquidity while typically earning returns more akin to a savings account by “sweeping” the funds into pooled asset accounts overnight. Deposits up to $250,000 are guaranteed by the FDIC, while accounts that hold balances in excess of that limit see the residual amounts directly exposed to the counterparty institution. Aggregated FDIC accounts help to overcome this problem by distributing larger cash balances into $250,000 deposit segments across various member banks. However, counterparty risk is still present in this case in the form of operational risk for the institution facilitating the cash distribution. Furthermore, as pointed out in a recent blog, Early-Stage Companies and the Risk of Bank Deposits, yields on deposit accounts have largely failed to keep up with other short-term rates, making them relatively uncompetitive from a performance perspective.

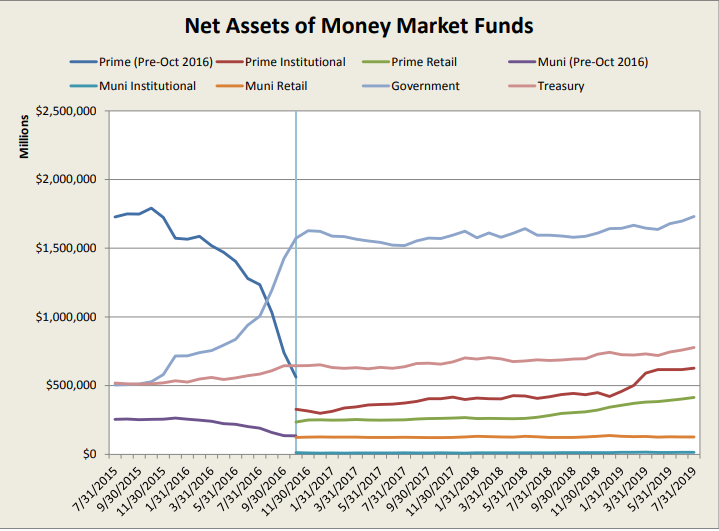

2. Pooled products are money market funds, short bond mutual funds, and other products with shared underlying investments. Money funds are required to comply with SEC regulatory guidelines under Rule 2a-7. Among other things, funds must invest at least 97% of assets in first-tier securities, and 30% of assets must mature within one business week. Additionally, Rule 2a-7 specifies that non-government (prime) money funds must report a variable floating NAV rather than a constant NAV. This new development has posed a risk for cash investors who view money funds as a pure dollar-in, dollar-out instrument and has resulted in a large shift in cash from prime funds to lower yielding government funds (Figure 2). Money market-light instruments (such as Ultra Short Bond Funds and ETFs) often offer some features similar to money funds but are not subject to the regulatory requirements to maintain certain liquidity buffers or credit quality levels. In that way, they are inherently riskier investments.

Figure 2: Net Assets of Money Market Funds

Source: https://www.sec.gov/files/mmf-statistics-2019-07.pdf

3. Direct investments, either in-house or via a separately managed account (SMA), provide another alternative for cash investors. Unlike pooled products, SMAs allow investors to build a customized portfolio to fit their risk tolerance and cash flow requirements. The portfolio is designed in accordance with an investment policy, which lays out minimum credit requirements, issuer concentration limits, and maturity constraints. Investors can augment this to limit or allow exposure to asset classes and industries that may not be available through deposits or pooled products. Additionally, they can structure the portfolio to produce organic liquidity via regular maturities that coincide with cash flow requirements. This allows investors to potentially improve performance by investing further out on the curve, while also maintaining adequate levels of liquidity.

Do Your Due Diligence

The next step beyond the broad structuring of the portfolio is a more granular examination of potential investments. Options for investment can vary in their characteristics but should be evaluated on three separate factors: duration, liquidity characteristics, and credit quality.

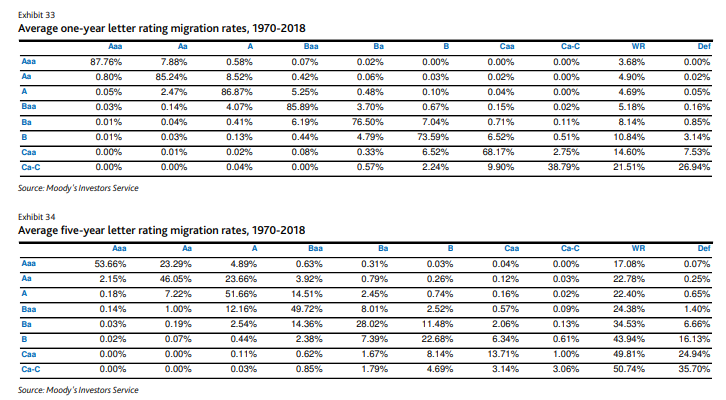

The duration component is straightforward, in that greater duration corresponds to increased risk. For cash investors, time horizons are often short enough that default risk is minimal. However, there is risk of negative credit events, and thereby ratings migrations with associated price impacts. A comparison of average ratings migration rates over a one- vs. five-year time horizon illustrates this point.

Figure 3: Moody’s Ratings Migration

Source: Moody’s Investors Service

As Figure 3 highlights, the percentage of investment-grade credits that fell into junk status rises by more than threefold over a five-year horizon vs. a one-year horizon. This illustrates a real risk for cash investors, who may be forced into selling if an investment gets downgraded below an allowable level, which in turn may lead to accounting losses.

An additional risk from increased duration is interest-rate risk. Should rates rise, securities with longer durations will tend to see commensurately greater declines in their market values. This also plays into the liquidity components of security analysis, as more liquid, higher quality securities will also tend to hold their value better in market swings. Ideally, a cash investor will achieve continual organic liquidity to meet operational needs. However, in the case that an investor needs to raise cash via sales, securities with better liquidity will typically see tighter bid-ask spreads and a more favorable selling environment.

The final factor that comes into play is credit quality. There is some overlap between credit quality and liquidity, as securities with higher credit quality also tend to be more liquid. Moreover, many cash investors think of liquidity and credit quality solely in terms of ratings level. But while this may be effective at filtering investments (e.g., having a minimum rating requirement for purchase), it is not as effective at determining relative credit quality. The ratings agencies may have their own biases linked to their issuer-pay model. Before the crisis, this bias manifested itself in the overly high ratings of non-agency mortgage-backed securities (MBS), and more recently it can be seen with indications of leniency for highly levered corporates at the bottom end of the investment grade scale.

It makes sense for cash investors to take a more granular approach to determining credit quality. Analysis should be both bottom up and top down, with the goal of limiting the amount of downside risk to the portfolio while still earning an adequate return. A review of a firm’s fundamentals, competitive position, and market acceptance, augmented by an analysis of pertinent qualitative factors such as governance quality and headline risk, may reveal relative value opportunities that fit better within an investor’s strategies. For instance, it is possible that an A-rated consumer goods name fits better into a portfolio than an AA-financial name because it is less cyclically sensitive. On the other hand, analysis might lead to an introduction of alternative vehicles such as credit-card asset-backed securities (ABS) to increase portfolio diversification.

Altogether, it is imperative the investor devote necessary resources in support of adequate and detailed due diligence prior to taking any action. By ensuring appropriate quality of investments at an individual and portfolio level, one can be better prepared to react to market-moving events and to help ensure that credit quality buffers can support liquidity throughout the business cycle.

Effective Monitoring is Key

Outside of purchasing decisions, credit quality monitoring is key to determining whether a particular high-quality investment remains so. Analysis of market sentiment on the credit can give advance warning on whether credit quality is deteriorating before it flows through to the bottom line. Additionally, analysis of news and current events can bring to light current and potential issues that might impact portfolio credit quality. This is especially true now, with the trade war, Brexit, and an inverted yield curve posing acute challenges to a variety of sectors.

Overall, effective monitoring requires detailed analysis of a myriad of components regarding each credit, its broader operating environment, and potential second or higher order dependencies that could impact company performance. The potential complexity of this undertaking, in terms of time commitment, information, and skilled, dedicated staff requirements, may make this level of engagement unrealistic for investors with limited credit research resources. Nevertheless, alternatives exist in the form of credit research products that can support a small investment team, or outsourcing investment management to a third party entirely. Some important considerations in the latter case should include track record, fee structure, manager licensing, and quality of investor services.

Conclusion

Given heightened uncertainty over the outlook for the next few years, it is important for investors to remind themselves of the fundamentals. A successful cash management strategy ensures that a portfolio performs optimally throughout the business cycle, helping the investor resist knee jerk reactions to market events. Participating in the financial markets involves risk, implying that there are no guarantees of capital preservation. Therefore, it pays for investors to have a deep understanding of the risks pertinent to their positions, as well as confidence that their investment choices align with their risk tolerance and investment goals. While in-depth credit research and continuous monitoring could be costly in terms of both time and available company resources, options are available to outsource these costs to a professional manager, or to utilize a research product to reduce the burden of sourcing and analyzing financial data. Prudent investors should have appropriate tools available to maximize transparency and improve oversight of their portfolios.

DOWNLOAD FULL REPORT

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.