Liquidity Isn’t Guaranteed

The History of the Fed’s Quantitative Tightening (QT) and its current standing

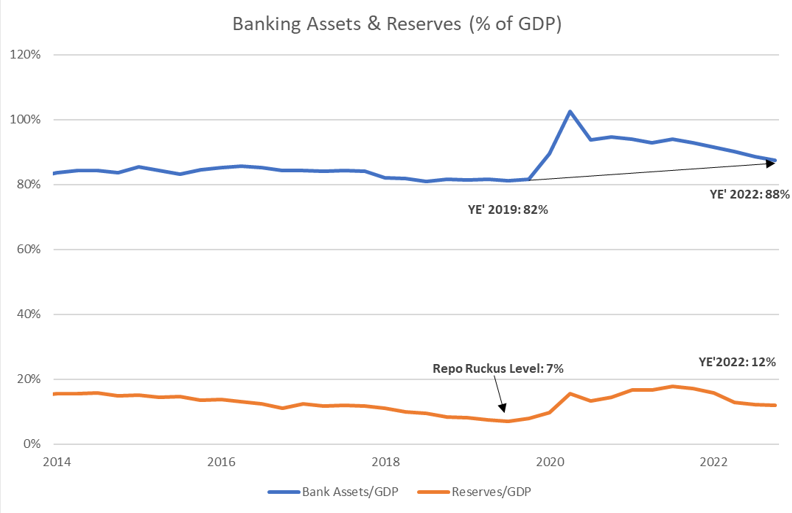

The Fed’s history with Quantitative Tightening (QT) is both limited and perilous. Its only prior experience with Quantitative Tightening in 2018-2019 ended in disaster, when funding markets locked up in September 2019 due to a lack of available liquidity. This episode is infamously known around this corner as the “Repo Ruckus.”

At the heart of the issue was that the Fed unwittingly drove bank reserve levels too low. Doing so caused banks to pull back from their usual intermediation in financial markets. This sent short-term interest rates skyrocketing well above their typical range at the time. Investors and businesses alike were sent scrambling for alternative sources of liquidity.

The situation today is different, but the risks are still very much the same. As the Fed engages in its current iteration of QT, it runs the risk of once again misjudging the level of reserves the banking system needs to function smoothly. A redux of 2019 isn’t necessarily likely, but it cannot be completely ruled out.

Quantitative Tightening and the Fed’s Liabilities

From an accounting perspective, Quantitative Tightening is a simple operation which results in an equal reduction in the Fed’s assets and its liabilities. On the asset side, it reduces the size of the central bank’s securities portfolio, while on the liability side, it reduces either bank reserves or Overnight Reserve Repurchase Agreements (ONRRP). Reserves are the cash that commercial banks hold at the Fed, while reverse repos are overnight loans to the Fed (primarily made by money market funds), secured by Treasuries.

Crucially, the Fed cannot control the composition of the liability reduction directly. It can influence cash to flow out from one source or another (a topic we’ll get to later), but the actual decision is made by private sector actors. The problem this poses becomes apparent when looking at how this iteration of QT has impacted the Fed’s liabilities.

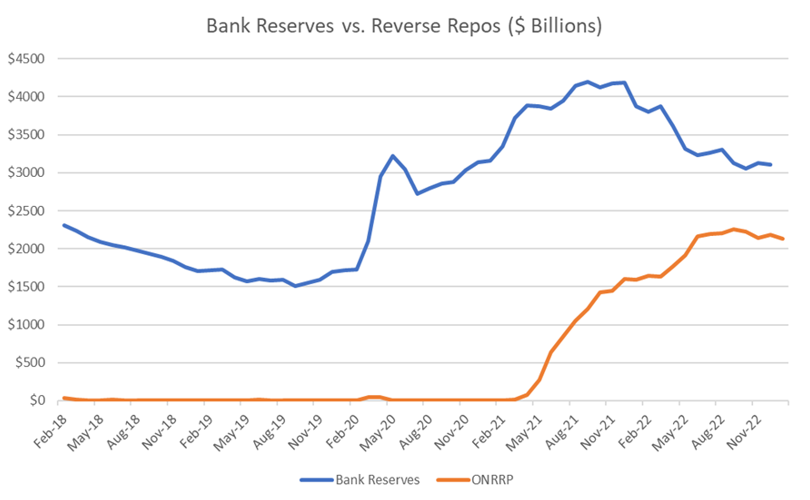

As Figure 1 illustrates, essentially all of the Fed’s balance sheet reduction so far has stemmed from bank reserves. Reserves have declined by ~25% from their $4.1T high in December 2021, while ONRRP balances have hardly budged.

The reasons for this are two-fold. First, banks (particularly small ones) have experienced large deposit outflows as a result of their unwillingness to raise deposit rates. Secondly, government money funds have decided to run portfolios with incredibly short WAMs to take advantage of Fed rate hikes. As a result, they have used the ONRRP facility disproportionately when compared to buying Treasury bills or engaging in private market repos.

How Low Can Reserves Go?

The minimum level of reserves banks desire to hold is a question the Fed has been grappling with for a while. In Fed lingo, this is referred to as the “Lowest Comfortable Level of Reserves” (LCLoR for short). The Fed initially used a survey of banks to estimate the LCLoR at $617 billion in 2018. This was soon rendered unreliable when the Repo Ruckus occurred only a year later. At that time, bank reserves were hovering around $1.5 trillion. Since then, the Fed has used the pre-pandemic level of reserves as the dynamic equilibrium for the LCLoR. It estimates that the LCLoR is 8% of nominal GDP, equivalent to the actual level of banking system reserves in December 2019. In dollar terms this equates to ~$2 trillion currently.

There is reason to believe that the actual number might be even higher than this. The banking system has grown in proportion to economic output since December 2019, implying that LCLoR should be a higher percentage of GDP.

Additionally, given that deposit outflows have varied across the banking system, it’s likely that reserve levels are also unequally distributed. This would imply that the LCLoR would need to be higher than is otherwise the case, as banks with lower reserve levels could run into constraints even as others retain excess reserves. It’s in part why Barclays Money Market Strategist Joe Abate recently put his estimate of the LCLoR at $2.7 trillion.

What Can the Fed Do to Prevent Bank Reserves from Falling too Far?

The most obvious way to prevent bank reserves from falling too low is to just end Quantitative Tightening. As of now, this is not out of the realm of possibility. Traditionally, the Fed does not like to both ease and tighten policy at the same time, meaning that if the Fed were to start cutting interest rates it could end QT out of principle. It remains to be seen whether the Fed will continue to adhere to this position (recent comments by Governor Waller suggest that this is at least up for debate). Assuming it does, there is a possibility that a recession in 2023 forces the Fed to cut rates and in turn end QT.

Conversely, according to Chair Powell, the Fed’s default assumption is that it will run QT for “a couple of years.” For this to occur, runoff from ONRRP will need to pick up, either due to changes in market dynamics or nudges from the Fed.

On the market side, a rise in Treasury bill yields or tri-party repo rates could get money funds to term out their portfolios. Additionally, banks that start to run low on reserves could begin offering higher rates on deposits, acting to both retain existing depositors and attract inflows out of other savings products.

If this is insufficient, the Fed could change the terms of the ONRRP program, by either reducing the interest rate on the program or reintroducing counterparty limits. Along the same lines, the Fed could also increase the interest rate paid on reserves or allow banks to omit reserves from certain regulatory capital requirements. Both moves would likely incentivize banks to hold more reserves at the margin.

What’s the Fallback?

Even with these options at their disposal, it’s not hard to conceive of a scenario in which reserves fall to the LCLoR. The actual LCLoR could be well above where the Fed estimates, and it might not want to adjust the terms of the ONRRP program or interest on reserves to compensate for this.

In the case where this does occur, the Fed has a tool of last resort in the Standing Repo Facility, introduced in July 2021. The facility allows banks to access reserves on a daily basis, at an interest rate equivalent to the top end of the Fed funds target range. Thus, if banks find themselves short of reserves, they always have the option of picking up more at the Fed (so long as they are solvent and have the necessary collateral). There was a temporary version of this facility that helped calm repo markets in 2019.

This sounds great, but the reality is that banks don’t typically use Fed facilities except as a last resort. Borrowing from the Fed has historically been stigmatized, with market participants only opting for it as a measure of last resort. The Fed is on a campaign to de-stigmatize its lending operations, which seems to have had some success with its Discount Window. However, this all-important new facility remains inactive, with a large number of eligible banks having yet to even sign up for the program. Until it is tested, we won’t know if this program will work as intended when reserves are scarce.

Conclusion

The reality is that while the Fed has the tools to ensure adequate liquidity in financial markets, there’s too many unknowns to take successful management of the situation for granted. The Fed cannot directly control the pace of reserve reduction, and it doesn’t really know what the Lowest Comfortable Level of Reserves is. Until the Standing Repo Facility proves its muster, there’s going to be the threat of a 2019 redux which could roil funding markets.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.