Media – Whitepapers

January 18, 2018

Abstract At the start of each year, we typically name three broad market trends or events that could potentially have the greatest impact on the short-term debt market. For 2018, we think central bank tightening, tax reform and event risk will have the most impact on short-term debt markets. We

Read more

December 14, 2017

Executive Summary ABCP can still be a good investment choice in large corporate treasury accounts due to the liquidity, flexibility, and yield potential of the asset class. Most traditional multi-seller conduits persevered through the recent financial crisis. Despite low issuance and investor skepticism, the mechanism of ABCP structures improved due

Read more

December 13, 2017

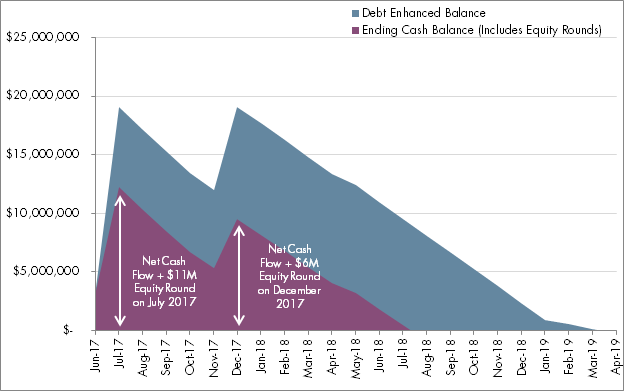

Challenge Capital Advisors Group (“CAG”), was engaged by a late clinical stage biotech firm (the “company”) with a strong investor syndicate that was seeking debt financing to supplement a recent equity raise and bridge through a projected potential acquisition date. The option to acquire the biotech firm was part of

Read more

November 16, 2017

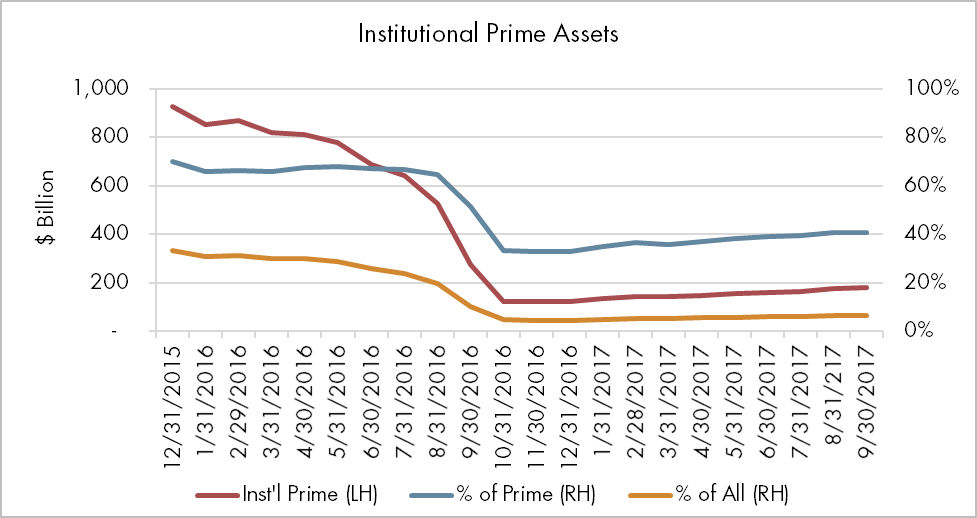

It’s been a year since new SEC rules restructured institutional prime money market funds by requiring that they float net asset values (NAVs) and impose redemption restrictions in times of fiscal stress. When the changes hit, a generation of cash managers who had always turned to prime funds as a

Read more

November 16, 2017

Abstract In the year since the SEC instituted new rules governing money market mutual funds, institutional prime funds have recaptured some lost ground, although balances still lag government funds. Fund characteristics returned to pre-reform levels with wide dispersions and concentrated exposures to non-US financial issuers. Asset-backed instruments also increased. While

Read more

October 13, 2017

Abstract The Republican bill represents a starting point for tax and budget negotiations. While details are lacking, the current plan offers some interesting angles for market participants to think about their liquidity investment strategies. We highlighted parts of the bill relevant to corporate cash investors and their potential impact on

Read more

September 18, 2017

Abstract Debt limit negotiations often go down to the wire, generating headline risk and investor uneasiness. The yield on T-bills maturing around default date may be substantially higher than those maturing in neighboring months. The exponential growth in government money market funds since the 2016 regulatory reform increases contagion risk

Read more

August 11, 2017

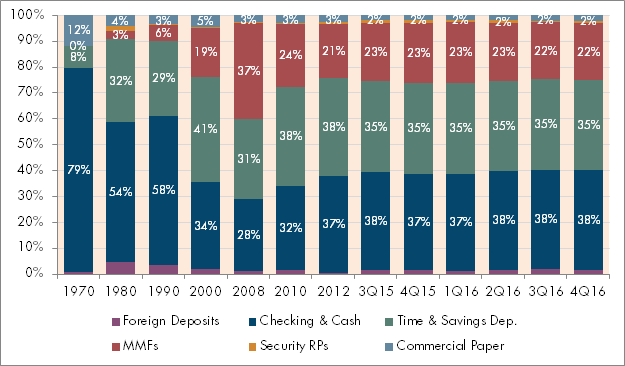

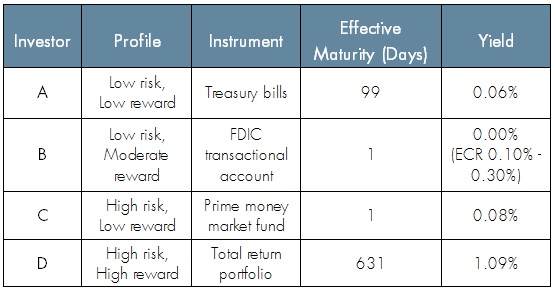

Abstract The return of yield opportunities presents institutional cash investors with fresh challenges. Higher rates have driven up the cost of staying with ultra conservative instruments. Money market fund reforms have left corporate cash managers with few clear choices to add yield. And historically popular cash vehicles that have undergone

Read more

July 13, 2017

Abstract The return of yield opportunities presents institutional cash investors with fresh challenges. Higher rates have driven up the cost of staying with ultra conservative instruments. Money market fund reforms have left corporate cash managers with few clear choices to add yield. And historically popular cash vehicles that have undergone

Read more

June 9, 2017

Abstract Key takeaways: While details are lacking, one can generally expect balance sheet normalization to start at the end of 2017, with reinvestment gradually phased out over one year, taking 2.5 years to complete for a total reduction of $1.8 trillion in Treasury and MBS bonds. Impacts to Expect: Higher

Read more