Media – Whitepapers

September 17, 2018

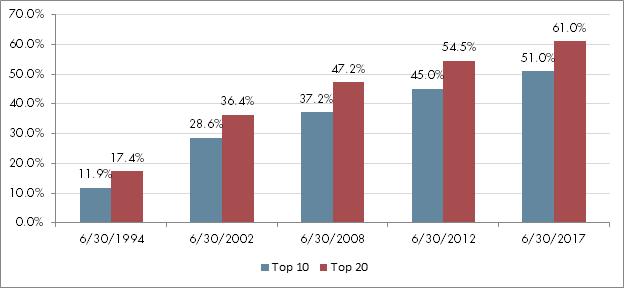

Following the collapse of Lehman Brothers in 2008, the rapidly deteriorating economic environment in the U.S. and abroad caused most treasurers to reevaluate their cash investment strategies, with a specific focus on restricting investment in certain asset types. Some companies implemented these restrictions by changing their investment policies, while others

Read more

August 14, 2018

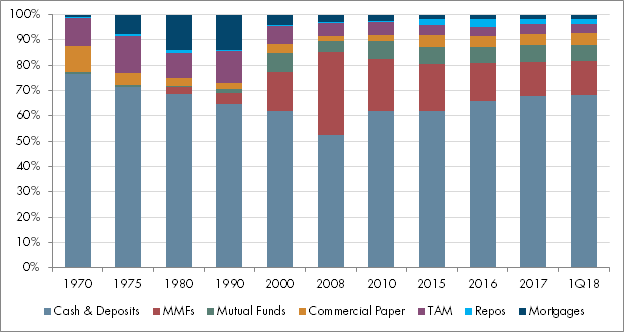

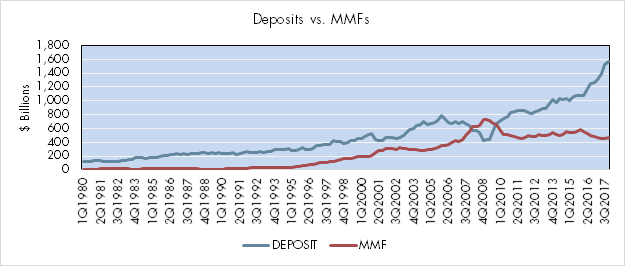

Abstract The evolving treasury cash investment landscape and yield disadvantage of bank deposits have prompted many practitioners to look for alternative options for managing their excess cash. We address this topic in a generalized manner, summarizing three major categories of available cash investment vehicles: deposits, pooled assets and direct purchases.

Read more

July 16, 2018

One of the great lessons we learned from the 2008 financial crisis was that the world is not as safe as we often think. That’s as true today as it was then, even after extensive industry and regulatory efforts aimed at the financial system. Corporate cash investors are confronting a

Read more

July 16, 2018

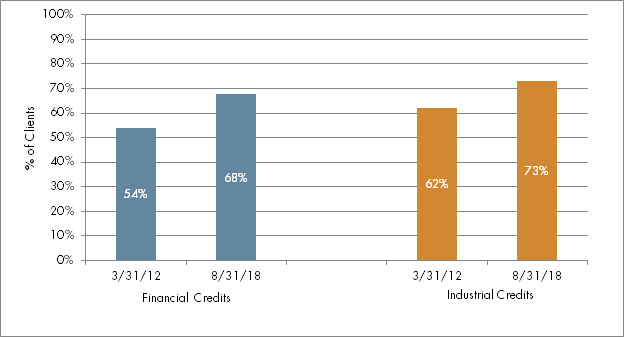

Abstract Experience has taught us that counterparties can fail with little warning. Counterparty risk management has become more challenging in recent decades due to concentrated exposures, complex financial instruments and evolving bank credit. Corporate and treasury organizations should manage this risk proactively, have an integrated risk policy across business lines,

Read more

June 11, 2018

Abstract Deposit rates are starting to increase as we move further into a rising rate environment. Banks still have not rewarded depositors sufficiently with a 21% average deposit beta, although some executives expressed moving it above 50%. The wait for higher rates continues unless depositors are willing to consider market-based

Read more

June 10, 2018

Introduction With relatively abundant availability of private financing, many companies today are choosing to remain private. And in recent years, privately held start-ups and growth stage companies seeking financing have increasingly looked to venture debt and other early-stage debt structures as extensions of their equity investments. Such funding, which tends

Read more

May 9, 2018

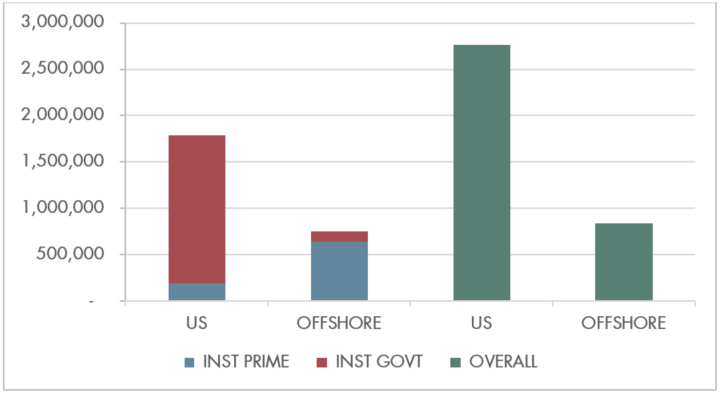

Abstract Offshore institutional money market funds (MMFs) have largely sat in the periphery for US-centric liquidity investors, but European reform and repatriation of overseas profits may result in transformational changes. Offshore fund investors will have few alternatives other than low volatility net asset value (LVNAV) funds. Public debt funds may

Read more

April 9, 2018

Abstract Trade tensions between the U.S. and China have been making headlines recently. The Trump administration recently rolled out plans to place 25% tariffs on $50 billion of Chinese imports, to which China responded in kind. In the near-term, tensions may continue to escalate, but ultimately a negotiated settlement is

Read more

March 13, 2018

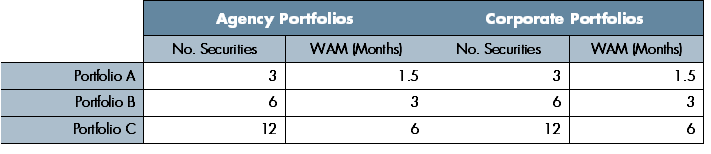

Abstract For institutional cash investors unsure of separately managed accounts in a rising interest rate environment, our scenario analysis suggests that a laddered portfolio of agency and corporate securities with a modest WAM could outperform the government money market fund proxy with negligible unrealized loss concerns. Both agency and corporate

Read more

February 8, 2018

Abstract Jerome Powell is the new Chair of the Federal Open Market Committee (FOMC) following Janet Yellen’s retirement from the Fed. In the near-term, Powell is likely to continue on the projected path of gradual interest rate hikes while also focusing on transparency and deregulation. However, as his background is

Read more