Media – Whitepapers

September 26, 2019

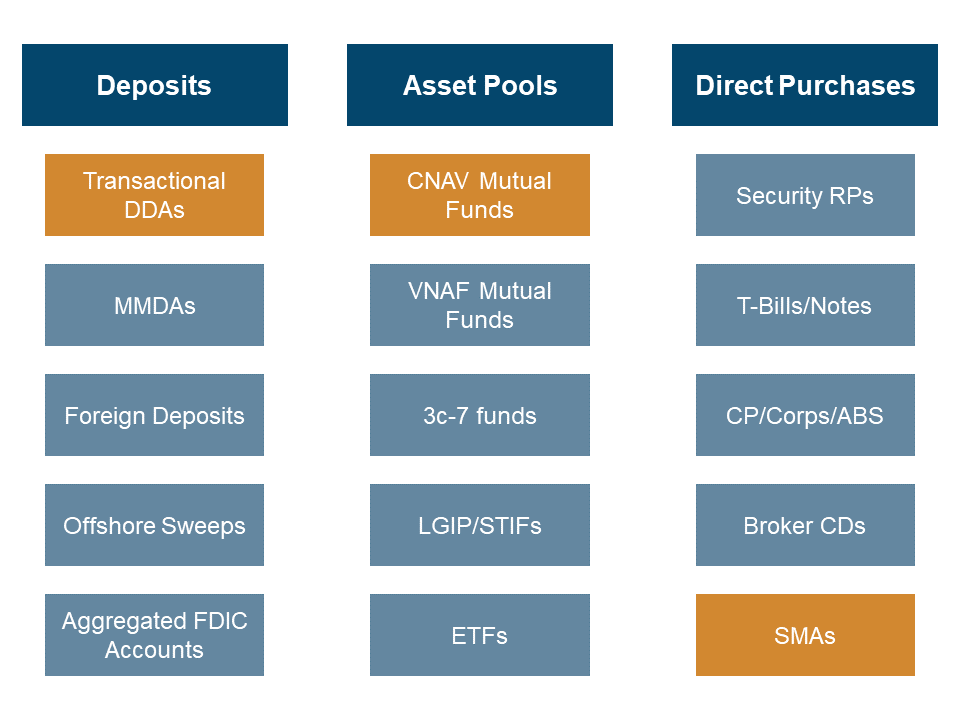

Co-authored by: Spyros Qendro, CFA®, and Carter Bourassa DOWNLOAD FULL REPORT Abstract In an environment characterized by limited forward visibility, it's more crucial than ever for cash investors to understand the landscape and the risks and opportunities it creates. In this paper, we will evaluate what makes a successful cash

Read more

September 16, 2019

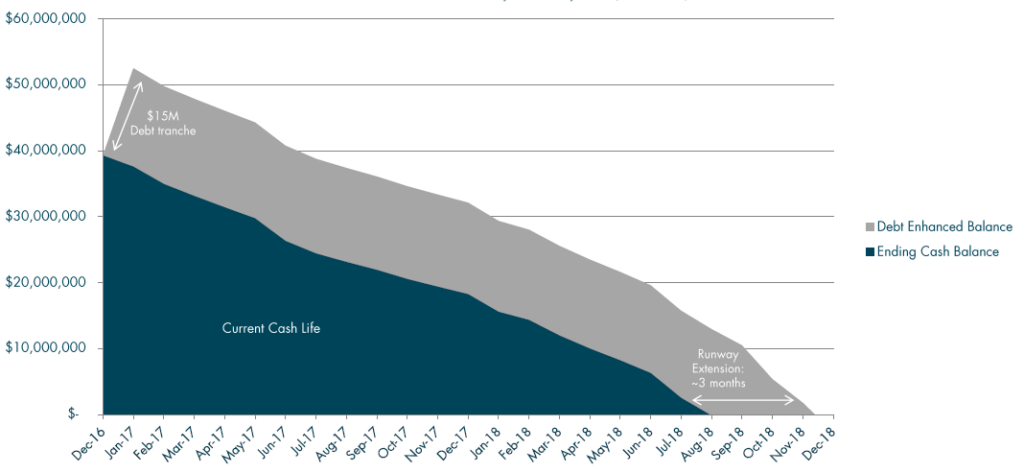

DOWNLOAD FULL REPORT Abstract Having advised hundreds of companies on billions of dollars of debt transactions over the past 16 years, Capital Advisors Group has encountered many common misunderstandings about early-stage debt financing. To address possible misperceptions at the outset, we always ask would-be borrowers three important questions: When are

Read more

August 22, 2019

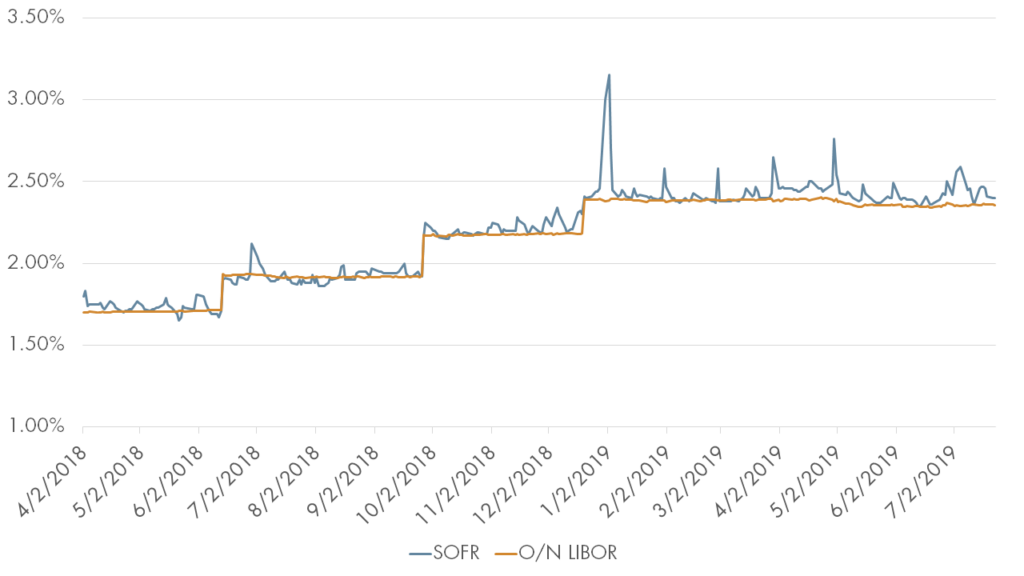

DOWNLOAD FULL REPORT Abstract The era of LIBOR (the London Inter-Bank Offered Rate) is coming to an end. The rate, which underpins some $200 trillion in floating-rate bonds, loans, securitizations, and derivatives contracts, is broken—at least according to the international regulatory community. In the U.S., this has led to the

Read more

July 10, 2019

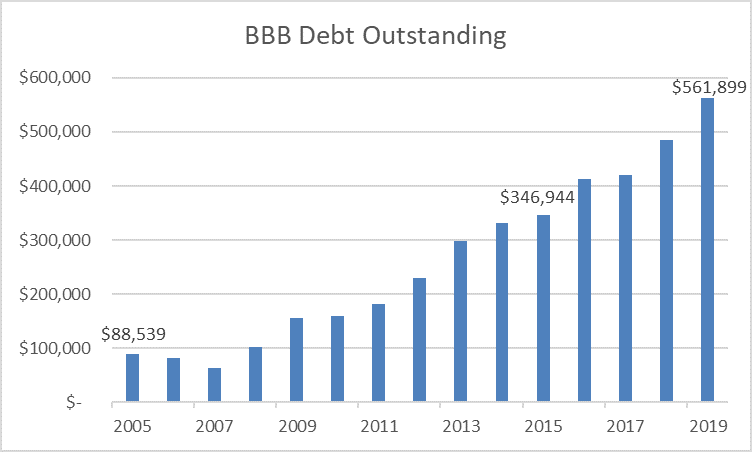

Co-authored by: Matthew Paniati, CFA® DOWNLOAD FULL REPORT Abstract BBB-rated debt continues to offer new possibilities for cash investors. Though it involves taking on incremental credit risk, allowing the purchase of these securities may help alleviate supply shortages while also offering additional return opportunities. Should investors investigate adding BBB names

Read more

May 29, 2019

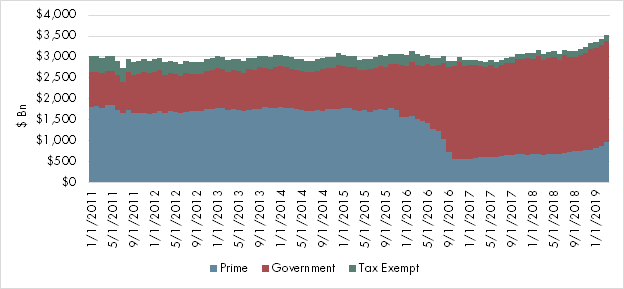

DOWNLOAD FULL REPORT Abstract The 2014 money market fund reform brought forth drastic change to the corporate cash management landscape, significantly impacting investors, issuers and fund sponsors. While there is little doubt that money market funds are more resilient following the implementation of the reform’s higher credit, liquidity, transparency, and

Read more

April 9, 2019

DOWNLOAD FULL REPORT Abstract The March Federal Open Market Committee (FOMC) decision was a major market event that directly resulted in an inverted yield curve. The Fed’s interest rate and growth outlook change echoed other recent moves by central banks that may indicate the end of a tightening monetary cycle.

Read more

January 3, 2019

Abstract We have identified the Fed and a flattening yield curve, trade wars and a global slowdown, and Brexit and other uncertainties as the three main themes to watch in 2019. Compared to 2018, we think 2019 will be a bit more challenging for short-term liquidity investors. A flatter yield

Read more

December 13, 2018

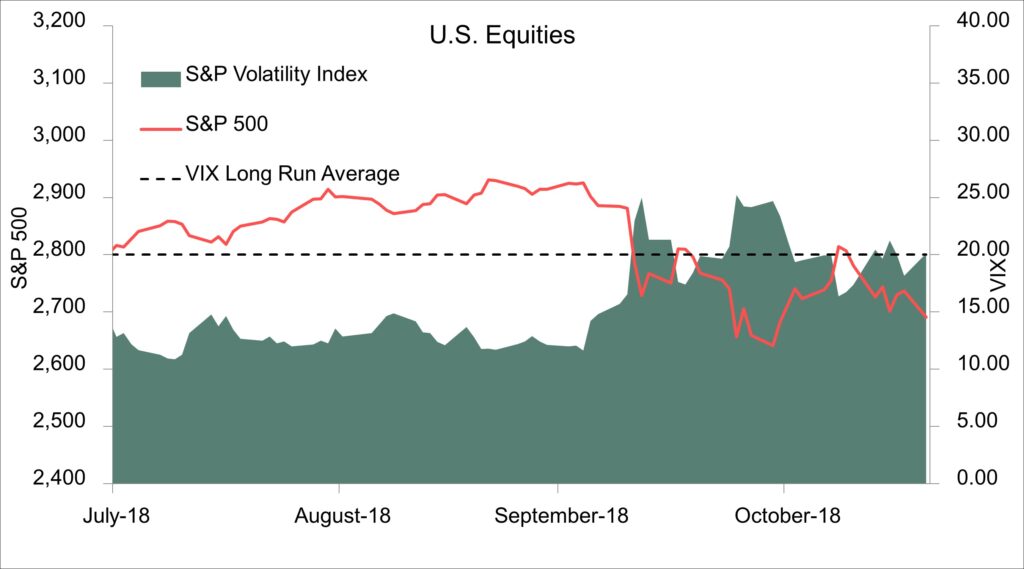

Co-authored by: Matthew Paniati Abstract The past few years have been mostly predictable for investors, with an expanding economy accompanied by steadily rising interest rates and asset prices. In this two-part series, we examine some recent developments and their implications for the current environment. In part two, we look at

Read more

November 26, 2018

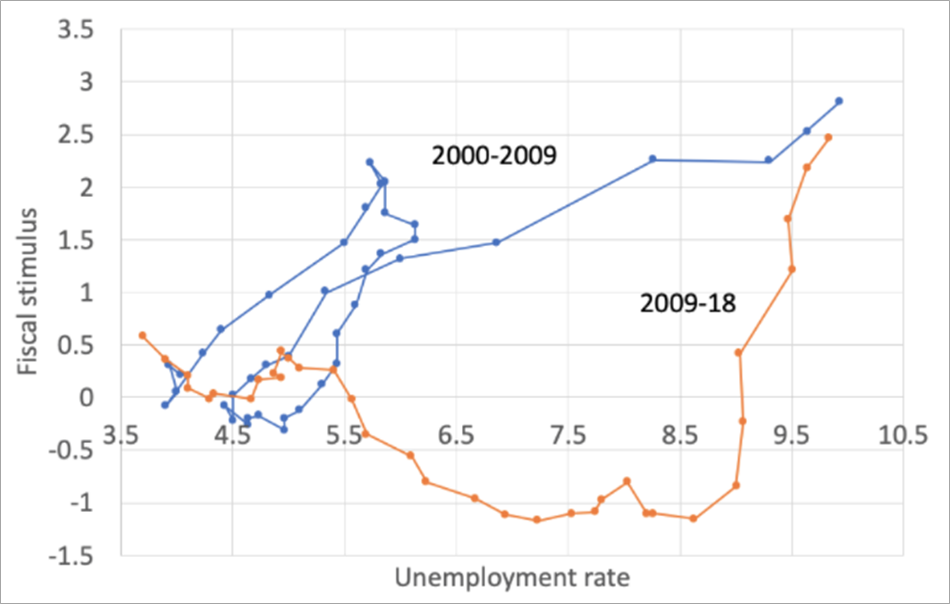

Co-authored by: Spyros Qendro, CFA Abstract The past few years have been predictable for investors, with an expanding economy accompanied by steadily rising interest rates and asset prices. In this two-part series, we look at some recent developments and their implications for the current environment. In part one, we look

Read more

October 22, 2018

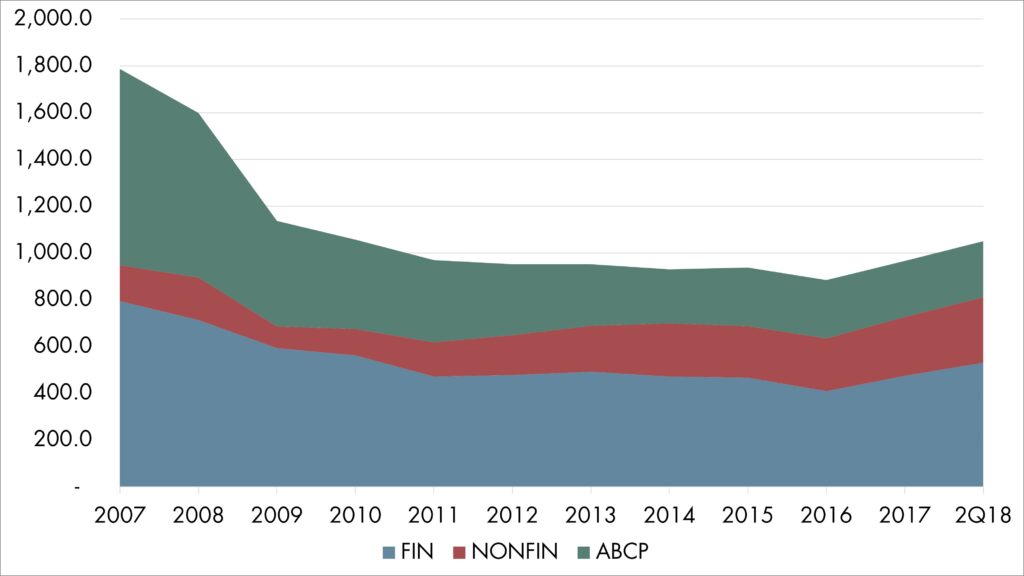

Abstract Many liquidity investors came to know commercial paper (CP) through holdings in prime money market funds (MMFs). We notice higher interest in direct CP investing since the 2016 MMF reform. This paper provides an overview of the market over the last decade and evaluates financial vs. non-financial, U.S. vs.

Read more