Media – Whitepapers

May 12, 2021

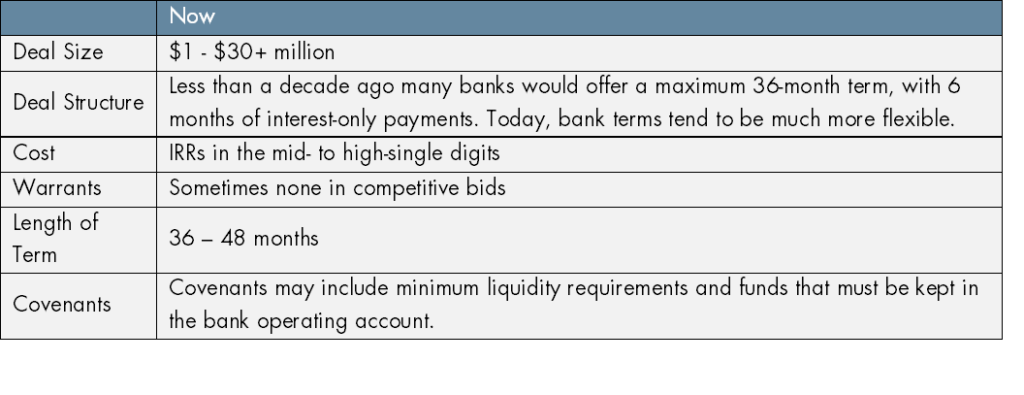

Capital Advisors Group has written extensively in the past about the when and how a company can maximize the utility of venture debt financing, focusing on variables such as the company’s financial profile, its growth and development strategy, and management’s priorities. With this information in hand, Capital Advisors Group can

Read more

August 25, 2020

DOWNLOAD FULL REPORT Capital Advisors Group is a Boston-area based institutional investment advisor that has been helping venture-backed companies invest their cash assets for more than 22 years. Its debt finance consulting division helps venture-backed companies determine their optimum capital structures, identifies appropriate lenders, sources term sheets and negotiates deals.

Read more

July 9, 2020

DOWNLOAD FULL REPORT Abstract After sudden shareholder redemptions in March stressed money market funds, it became clear that several rounds of reforms since the 2008 crisis have failed to bolster institutional prime money market funds as liquidity vehicles. While extraordinary government measures once again helped to stabilize the market, they

Read more

May 14, 2020

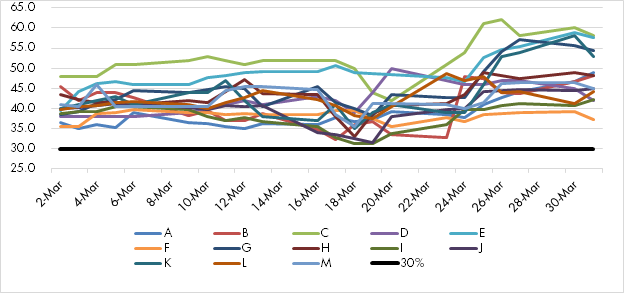

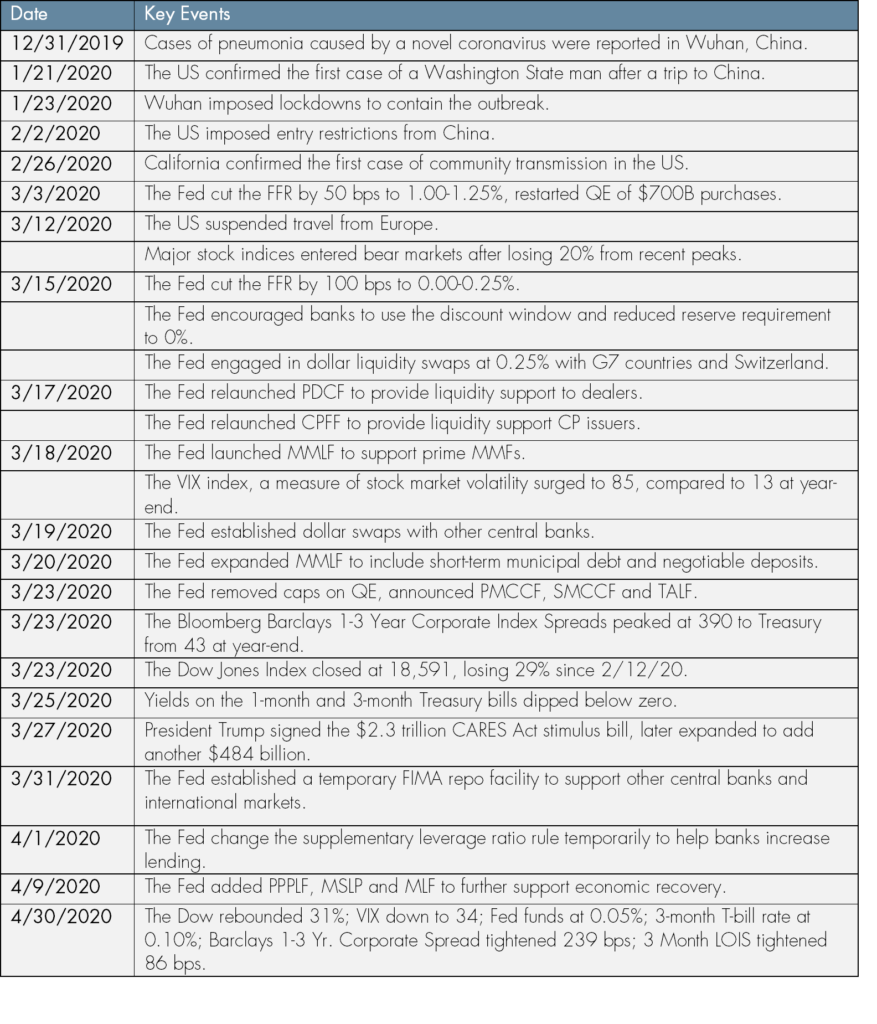

DOWNLOAD FULL REPORT Abstract Extraordinary market volatility from COVID-19 led to a complete reset of portfolio strategies and expectations in cash investments. While liquidity has turned the corner, the path to recovery and a normal investment environment may be a long one. Fighting credit issues on one hand and the

Read more

March 20, 2020

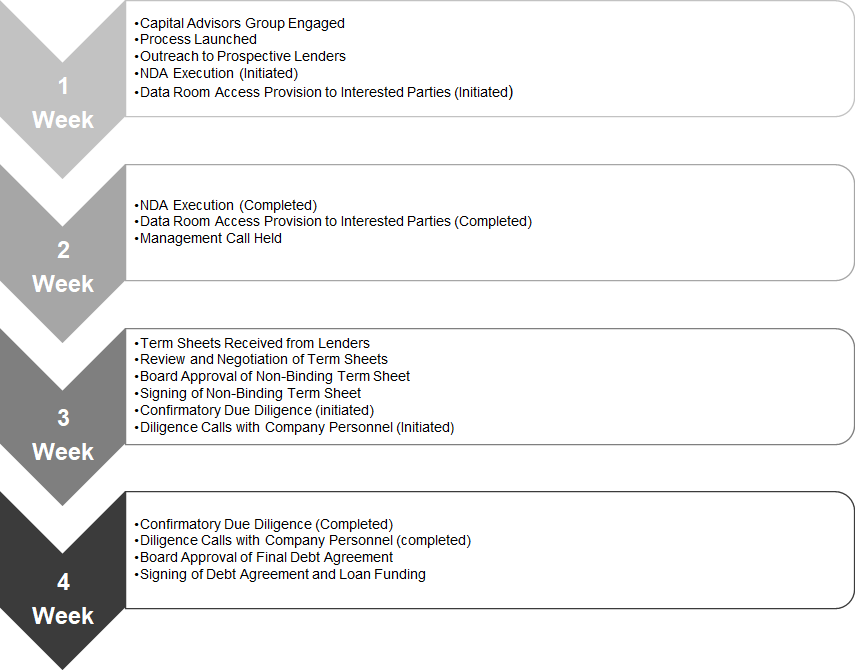

DOWNLOAD FULL REPORT Introduction At Capital Advisors Group, we have advised hundreds of early-stage companies on billions of dollars of debt transactions over the past 17 years. You might think that we’ve seen it all—but we haven’t, not even close. Every deal is different, and every company’s capital structure is

Read more

February 13, 2020

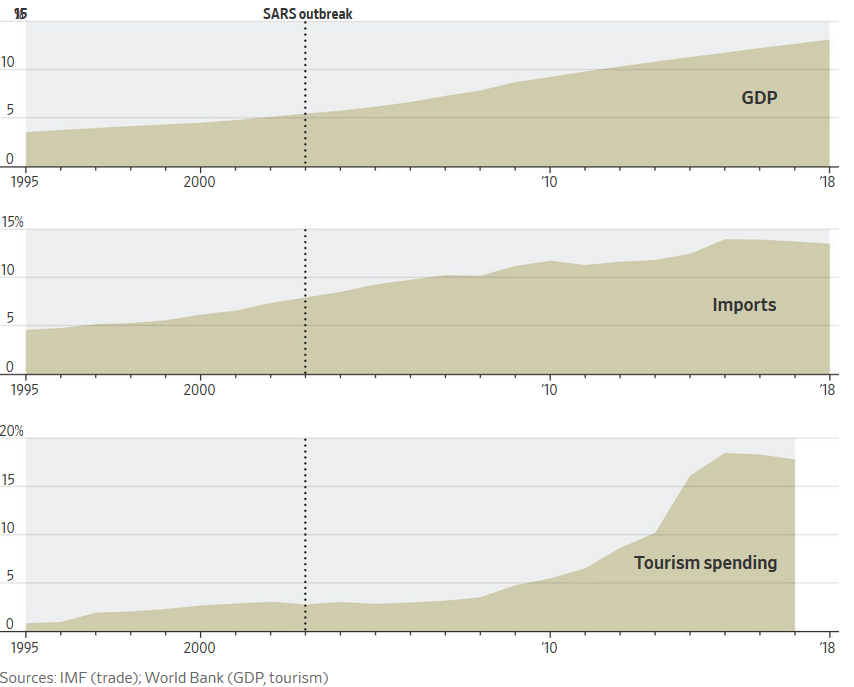

DOWNLOAD FULL REPORT Abstract While the flood of information on the new coronavirus can be overwhelming, treasury professionals should consider how the outbreak may affect their liquidity portfolios. The consensus market view is that the epidemic will have a moderate and temporary impact on the world economy. We think the

Read more

January 13, 2020

DOWNLOAD FULL REPORT Abstract We identify three themes to watch for cash investors each year. For 2020, we comment on the Fed’s neutral stance, the continued non-solution for repo market liquidity, and the popularity of ESG (environmental, social and governance) investing. Introduction At the start of each year, we typically

Read more

December 20, 2019

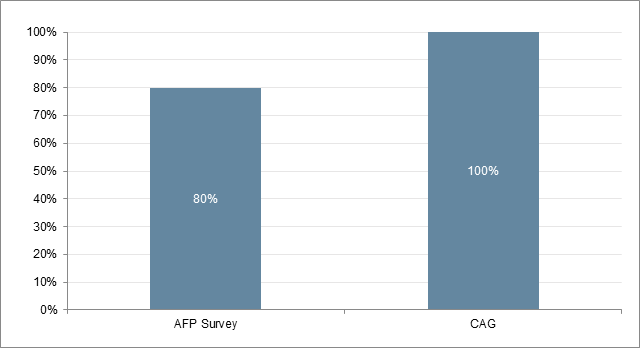

DOWNLOAD FULL REPORT Abstract We set out to answer 10 of the most common questions that arise when writing investment policy statements (“IPS”) for cash portfolios. In doing so, we will provide a number of peer group data comparisons to add insight and context to the process. The 10 questions

Read more

November 13, 2019

DOWNLOAD FULL REPORT Abstract The pause by the Fed after three rate cuts removes some near-term uncertainty for short-term interest rates. On balance, we think the economy faces more headwinds than tailwinds, and thus the probability of further cuts is significant enough to warrant some portfolio readjustment. A yield curve

Read more

October 18, 2019

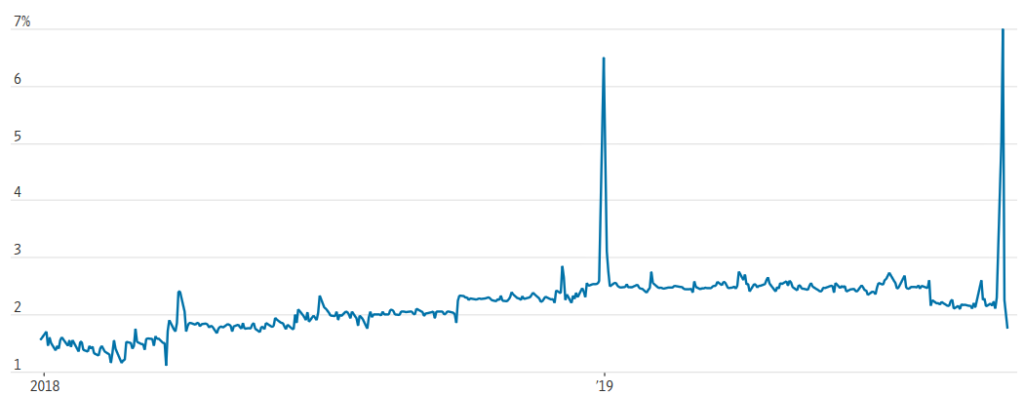

DOWNLOAD FULL REPORT Abstract Rather than dismissing September’s repo turbulence as stemming from idiosyncratic events easily rectified by the Fed, we think that the event reveals broader vulnerabilities within the hidden plumbing of our financial system. Although not all institutional cash portfolios directly use repo, this squeeze should concern us

Read more