Media – Blog

May 18, 2017

The rapidly changing global risk management landscape has created new challenges for corporate cash managers. Money market fund reforms, rising interest rates, regulatory uncertainty and geopolitical upheavals have elevated potential risks, inviting ever-closer board scrutiny of Treasury operations. Our white paper this month, Separately Managed Accounts in Counterparty Risk Management,

Read more

April 11, 2017

It may be time for a refresher course on the pros and cons of bank deposits as the primary repository of corporate cash. In the wake of last fall’s transition to floating net asset values (NAVs) at institutional prime money market funds, treasurers were already going through a once-in-a-generation rethink

Read more

April 3, 2017

Perhaps no word better describes the start of 2017 than “transition.” The year began with the White House’s transition from the Obama to the Trump administration, continued with the rise of European populism, and recently culminated in the official beginning of Britain’s transition out of the European Union. Somewhat less

Read more

March 29, 2017

When British citizens voted to leave the European Union last June, markets reacted strongly: the pound dropped 11%, the FTSE 100 (an index of British stocks) fell 9%, and equity markets from the United States to Japan sold off as well. Although much of the value lost in these markets

Read more

March 2, 2017

Potential sweeping changes in fiscal and monetary policies, a new order in international relations, and ongoing political conflicts are creating heightened uncertainty for institutional cash investors in 2017. The eventful first weeks of the Trump administration saw a rapid succession of executive orders impacting healthcare, trade, hiring, energy, education, border

Read more

January 23, 2017

Remember the debt ceiling fights of 2011 and 2013? They may be in the back of many investors’ minds now, but will likely be front and center again leading up to March 15, when the suspension of the federal government debt ceiling expires. Any institutional cash investor who lived through

Read more

November 11, 2016

Our panel session at this year’s AFP Conference on “Managing Liquidity in a Post-Reform World” came at an opportune time—just after new SEC regulations on institutional prime money market funds went into affect that have already started to dramatically transform the cash management landscape. So it was no surprise when

Read more

October 1, 2016

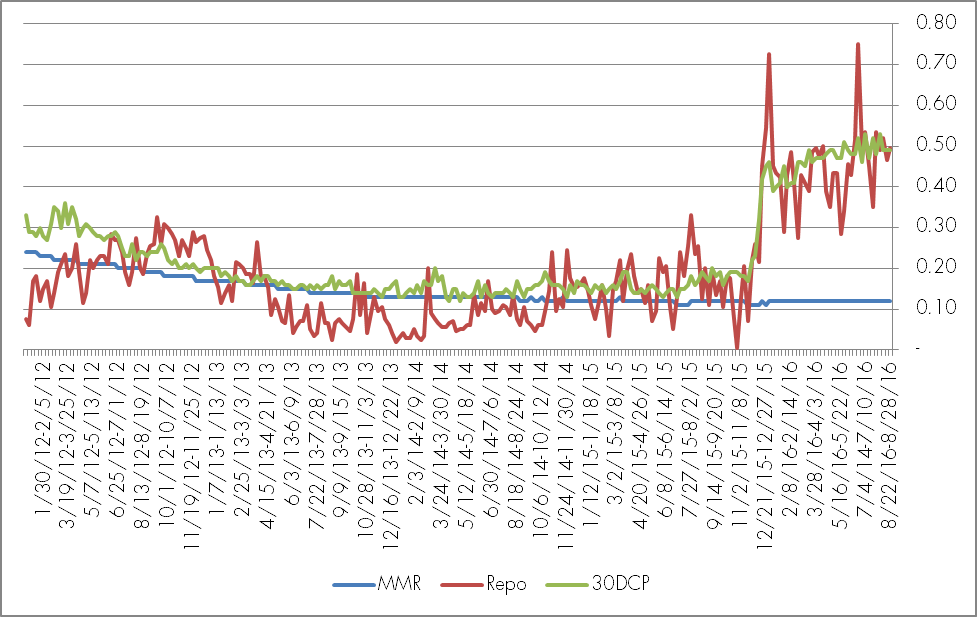

The day we’ve all been anticipating is here. SEC-mandated floating net asset values (NAVs), redemption fees and liquidity gates are going into effect at institutional prime money market funds today. But markets have already started to answer our questions about the impact of the changes. And this month’s Capital Advisors

Read more

September 14, 2016

Are you moving most of your cash to the sidelines? With new and uncertain risk profiles looming for prime money market funds when SEC-mandated floating net asset values (NAVs), redemption fees and liquidity gates go into effect Oct. 14, many corporate cash managers are defaulting to traditional “safe havens.” More

Read more

August 1, 2016

On October 15, institutional cash investors entering the uncertain world of floating net asset values (NAVs) on institutional prime money market funds may be looking for alternative liquidity vehicles. While government money market funds may be the first obvious choice because they will still offer stable NAVs and no redemption

Read more