A Decade of the Commercial Paper Market and Its Role in Institutional Liquidity Portfolios

Abstract

Many liquidity investors came to know commercial paper (CP) through holdings in prime money market funds (MMFs). We notice higher interest in direct CP investing since the 2016 MMF reform. This paper provides an overview of the market over the last decade and evaluates financial vs. non-financial, U.S. vs. foreign, and Tier 1 vs. Tier 2 characteristics. The recent AFP liquidity survey suggests treasury organizations are carefully considering cash management alternatives that include CP and Separately Managed Accounts. Top-tier CP investments may help replenish lost yield potential in government funds. For certain organizations, Tier 2 CP may be appropriate in a broad liquidity portfolio to diversify risk and improve income potential.

Introduction

Total CP outstanding in the U.S. rose back to more than $1 trillion as of June 2018. This marks a significant milestone since the balance crested at more than $2 trillion just prior to the 2007-2008 financial crisis. Year-end balances declined in nine of the last ten years before reversing directions in 2017. Meanwhile in recent years, interest in CP as a liquidity vehicle for institutions has grown steadily.

In this monthly research installment, we explore the CP market’s recent trends in the U.S., including balance distribution by issuer types, regions of origin and buyer behaviors. We address several key yield spreads over short-term benchmarks. Responding to market interest, we also provide insight on the Tier 2 (A-2/P-2/F2) space. From recent survey results, we glean how the corporate treasury community considers this market segment. We conclude with some practical tips for liquidity investors on utilizing CP investments in their portfolios.

After a Decade of Decline, a Reversal

In the years leading up to and after the financial crisis, the CP market paralleled the growth and decline of the larger capital markets. Credit markets flourished from cheap short-term funding via asset-backed CP, structured investment vehicles (SIVs) and non-bank financial entities (think GE Capital Corp). For a brief period in 2007, borrowings from various asset-backed commercial paper (ABCP) programs accounted for more than half of the $2-trillion CP market.

Though not well documented, turmoil in CP-land preceded the seminal Lehman Brothers bankruptcy by more than a year. In August of 2007, a pair of mortgage-backed ABCP programs ran into liquidity problems. Soon after, most SIVs were unable to find investors to finance their portfolios of esoteric securities and were eventually absorbed by their bank sponsors. Runs on prime market funds immediately after the Lehman bankruptcy led to the CP market’s virtual shutdown before the federal government nurtured it back to health through several extraordinary programs.

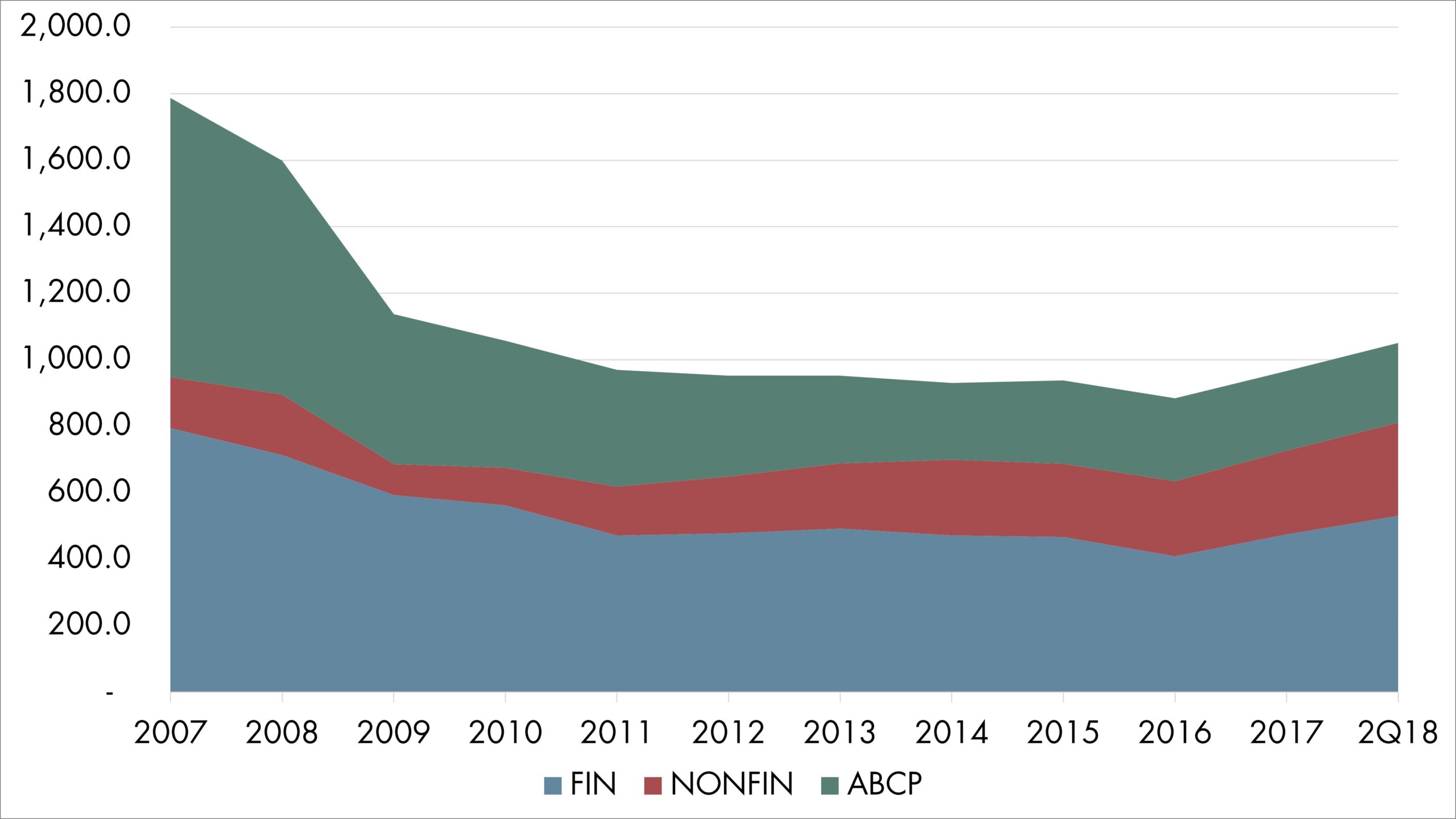

Figure 1: Total CP Outstanding 2007-2018 Source: Federal Reserve Bank of St. Louis FRED economic data, as of 6/30/2018

Source: Federal Reserve Bank of St. Louis FRED economic data, as of 6/30/2018

The financial crisis was followed by a long period marked by reduced demand for consumer credit, stricter bank regulations, credit rating downgrades and corporate balance sheet deleveraging. These factors affected both the demand and supply sides of the CP market. As a result, balances dropped precipitously through 2009 and continued to decline for several more years (Figure 1).

- From year-end 2007 to year-end 2016, total CP outstanding dropped 50.5% (from $1.8 trillion to $885 billion).

- Former “star performer” ABCP fared the worst, losing 70.2% from $840 billion to $250 billion. Financial CP also declined 48.5% from $794 billion to $409 billion.

- Non-financial CP, however, saw a gain of 47%, from $183 billion to $225 billion (more on this later).

- Since year-end 2016, total CP outstanding has been on an upswing, growing 18.5% to $1.0 trillion at June 30, 2018.

- Financial and non-financial sectors also grew in the same period, gaining 30% (to $531 billion) and 24.4% (to $280 billion), respectively.

We think the recent growth in CP outstanding reflects the healthier economy and more confidence in capital markets as the nation came out of the shadows of the Great Recession. With the end to crisis-era support programs, more prudent financial regulations, and higher short-term interest rates, a resurging CP market reflects a back-to-the-the-norm market sentiment, in our opinion.

A Rearranged Deck of CP Borrowers

Commercial paper as an unsecured short-term promissory note was first introduced more than a century ago. New York merchants sold their I.O.U.’s at a discount to dealers such as Marcus Goldman of Goldman Sachs, who re-offered to banks and other investors. The borrowers would repay the notes at full face value at maturity1. Over the decades, CP financing expanded from meeting business needs to include consumer credit, from corporate issuers to banks, from domestic to foreign entities.

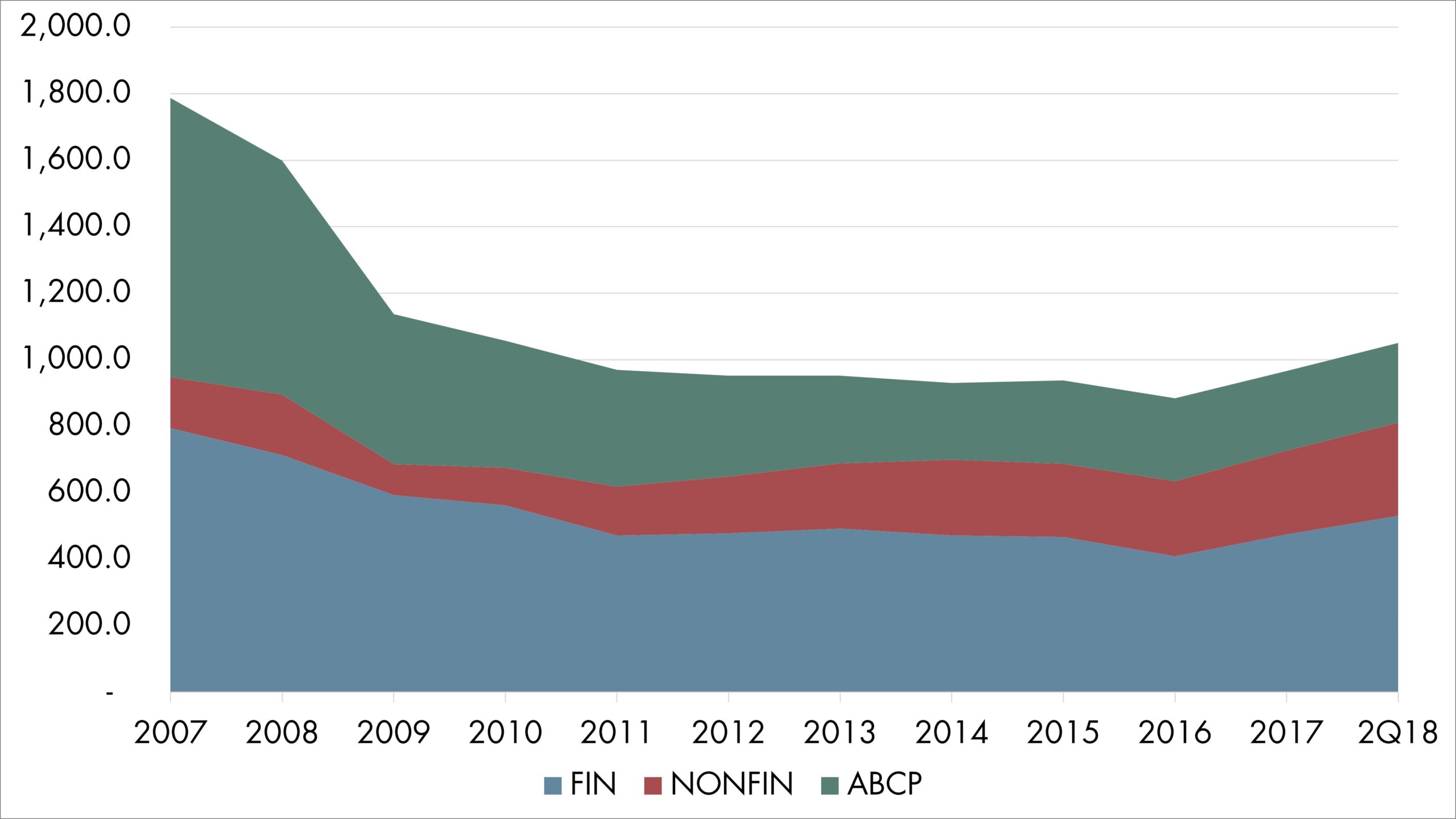

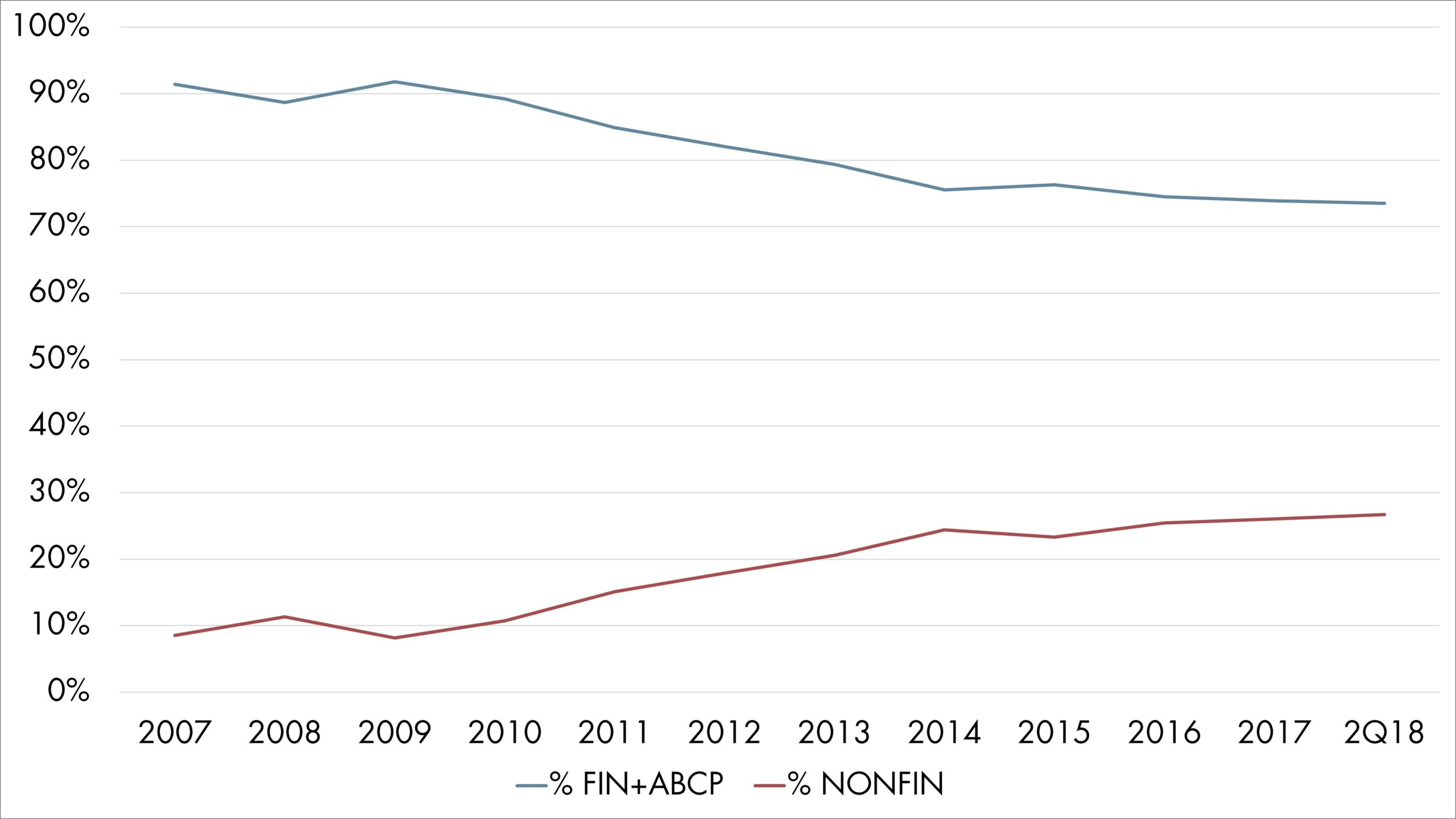

Figure 2: Financial vs. Non-financial Borrowings Source: Federal Reserve Bank of St. Louis FRED economic data, as of 6/30/2018

Source: Federal Reserve Bank of St. Louis FRED economic data, as of 6/30/2018

Financial vs. Non-financial: As Figure 2 indicates, combined CP outstanding from financial and ABCP borrowers accounted for 91% of the market in 2017, while non-financial borrowers (such as Boeing and IBM) took up the rest. The ABCP slump and high reserve balances at most banks resulted in a notable reduction of financial and ABCP balances, to a still high 74% as of June 2018. Non-financial CP balances, on the other hand, climbed to 26%.

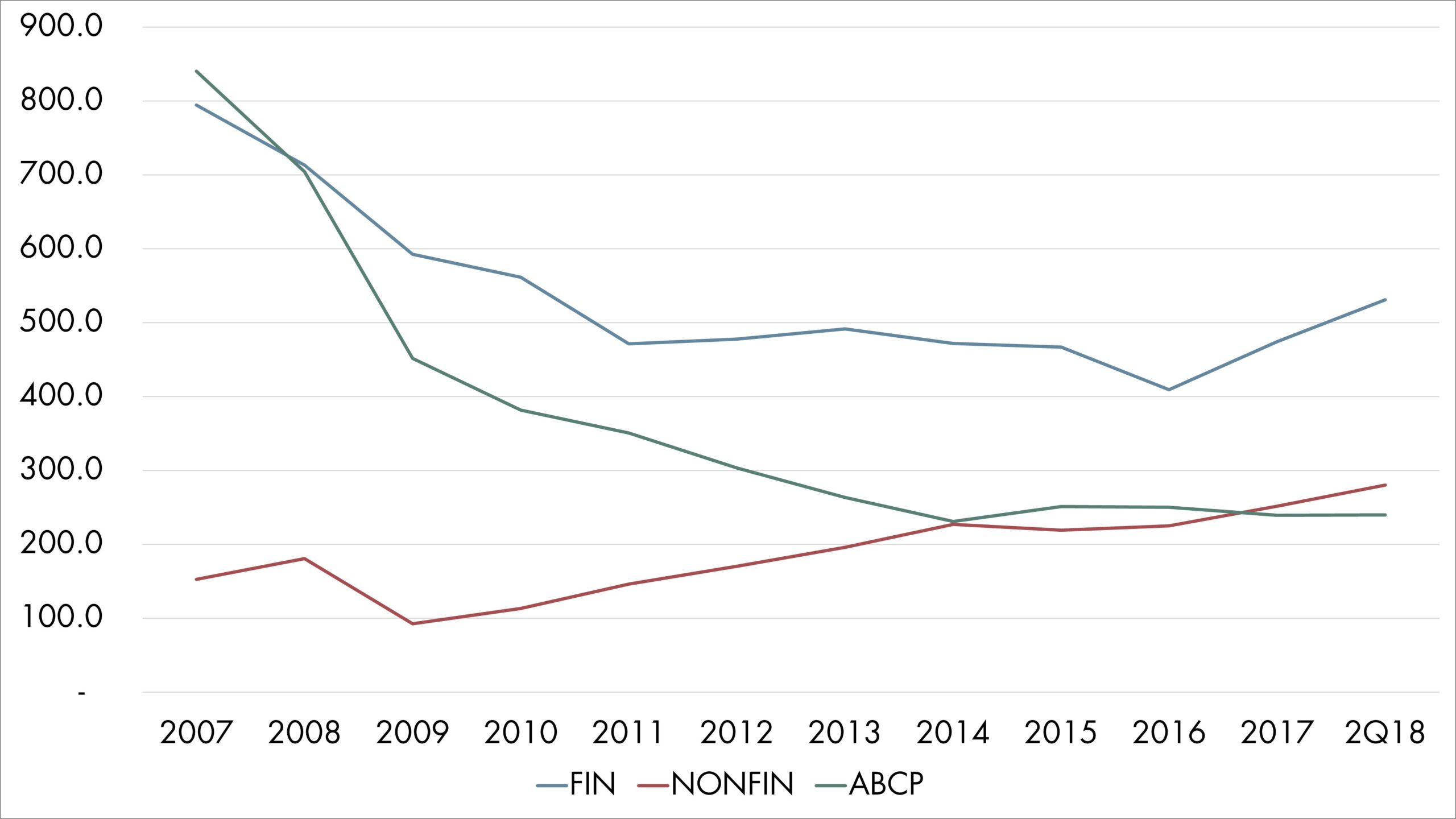

Note that non-financial CP outstanding ($280 billion) is higher than ABCP outstanding ($240 billion) at June 2018 and is poised to trend even higher. (See Figure 3)

Figure 3: Segments of the CP Market Source: Federal Reserve Bank of St. Louis FRED economic data, as of 6/30/2018

Source: Federal Reserve Bank of St. Louis FRED economic data, as of 6/30/2018

US vs. Foreign: For much of its recent history, the CP market in the US has been dominated by borrowers from outside the U.S. Multinational corporations often blur the line between the “U.S.” vs. “foreign” labels, and the fact that foreign-domiciled companies establish US funding companies to tap the market here makes the distinction even more challenging. Still, it’s an important factor to consider for investors mindful of systemic liquidity concerns. Recall that the Federal Reserve endured sharp criticism for bailing out the CP market during the financial crisis, with critics considering their actions as providing US taxpayer funds to subsidize foreign banks.

Figure 4: US vs. Foreign CP Outstanding Source: Federal Reserve Bank of St. Louis FRED economic data, as of 6/30/2018

Source: Federal Reserve Bank of St. Louis FRED economic data, as of 6/30/2018

In Figure 4, we group the CP market into three categories: Non-financial, U.S. financial, and Foreign financial. For the last group, we combine foreign issuers and domestic issuers with foreign parents into one.

- Foreign financial CP commands the largest segment hovering around $400 billion and, at $455 billion at June 2018, has almost fully recovered to the 2007 level.

- Borrowing by US financial firms decreased precipitously after the crisis and, at below $100 billion recently, is no longer a major segment.

- Foreign financial borrowing may represent the firms’ genuine funding needs or may be driven by opportunistic profit motive in the U.S. money markets.

Tier 1 vs. Tier 2: The tiers refer to short-term credit ratings from major rating agencies. For example, CP rated Tier 1 may carry A-1 or above ratings from S&P, P-1 from Moody’s and/or F1 or above from Fitch. Money market funds and institutional liquidity portfolios typically buy CP rated Tier 1 only. Tier 2s (A-2/P-2/F2) are lower tier investment grade ratings (the equivalent of mid-BBB to low-A long-term ratings) with incrementally higher credit risk.

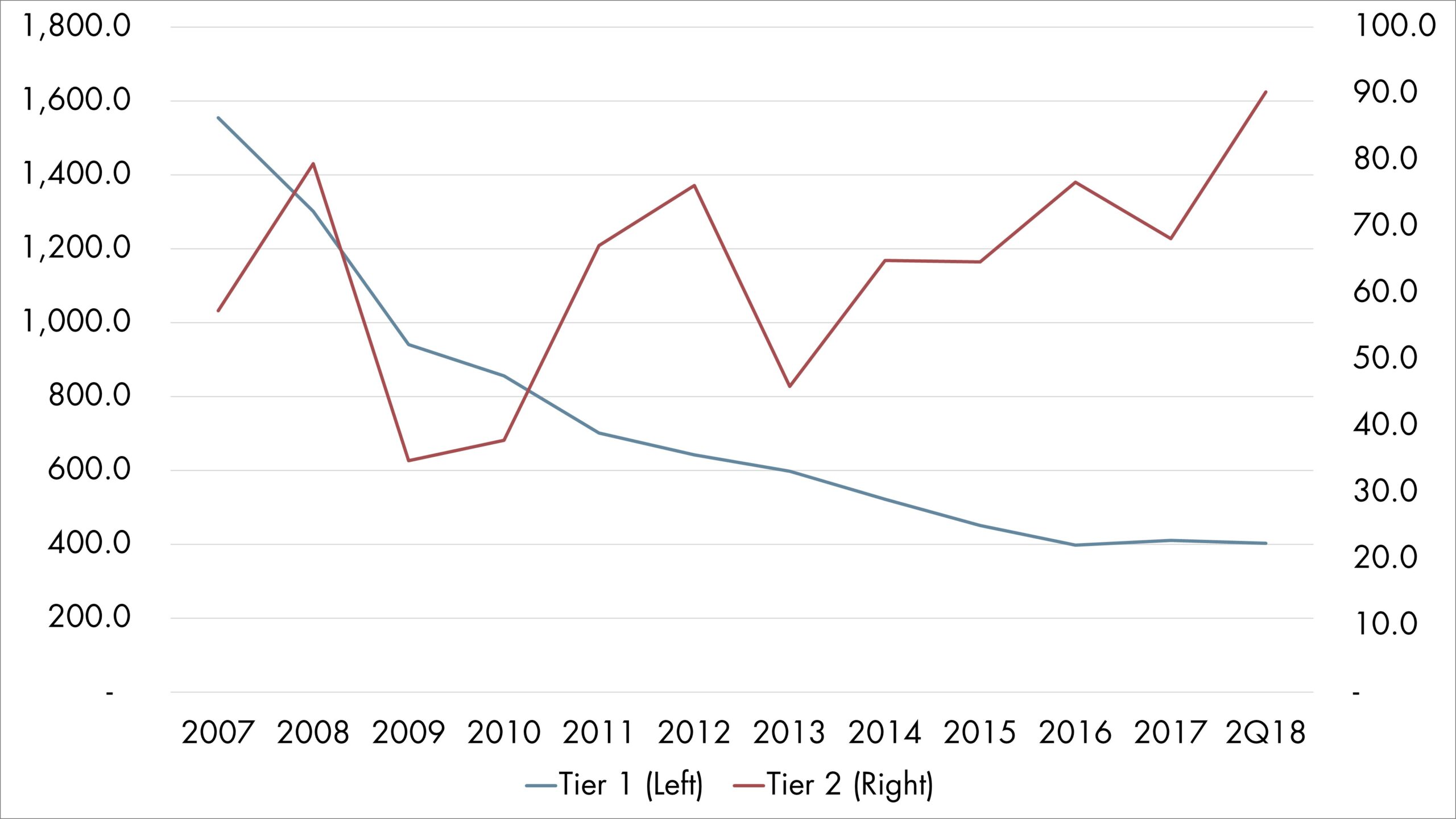

Figure 5: Tier 1 vs. Tier 2 CP Outstanding Source: Federal Reserve Bank of St. Louis FRED economic data, as of 6/30/2018

Source: Federal Reserve Bank of St. Louis FRED economic data, as of 6/30/2018

- Between 2007 and June 2018, Tier 1 CP (eligible for MMFs per SEC definition) decreased steadily by 74% from $1.6 trillion to $403 billion (Figure 5).

- Between 2009 and June 2018, Tier 2 CP grew 159% from $34.8 billion to $90.3 billion with some bumpy rides along the way.

- The rise in Tier 2 CP outstanding suggests a more sanguine view by liquidity investors towards the stability and creditworthiness of Tier 2 non-financial corporate borrowers.

Doing Fine Since the MMF Reform

It was often said that commercial paper and prime MMFs represent a hand-and-glove relationship. MMFs help satisfy corporate, financial and municipal borrowers’ short-term funding needs. The borrowers in turn supply the funds with eligible money market instruments with greater yield potential than deposits or Treasury securities. This symbiotic relationship partially explained the federal government’s extraordinary support mechanism for both MMFs and major CP programs after the crisis.

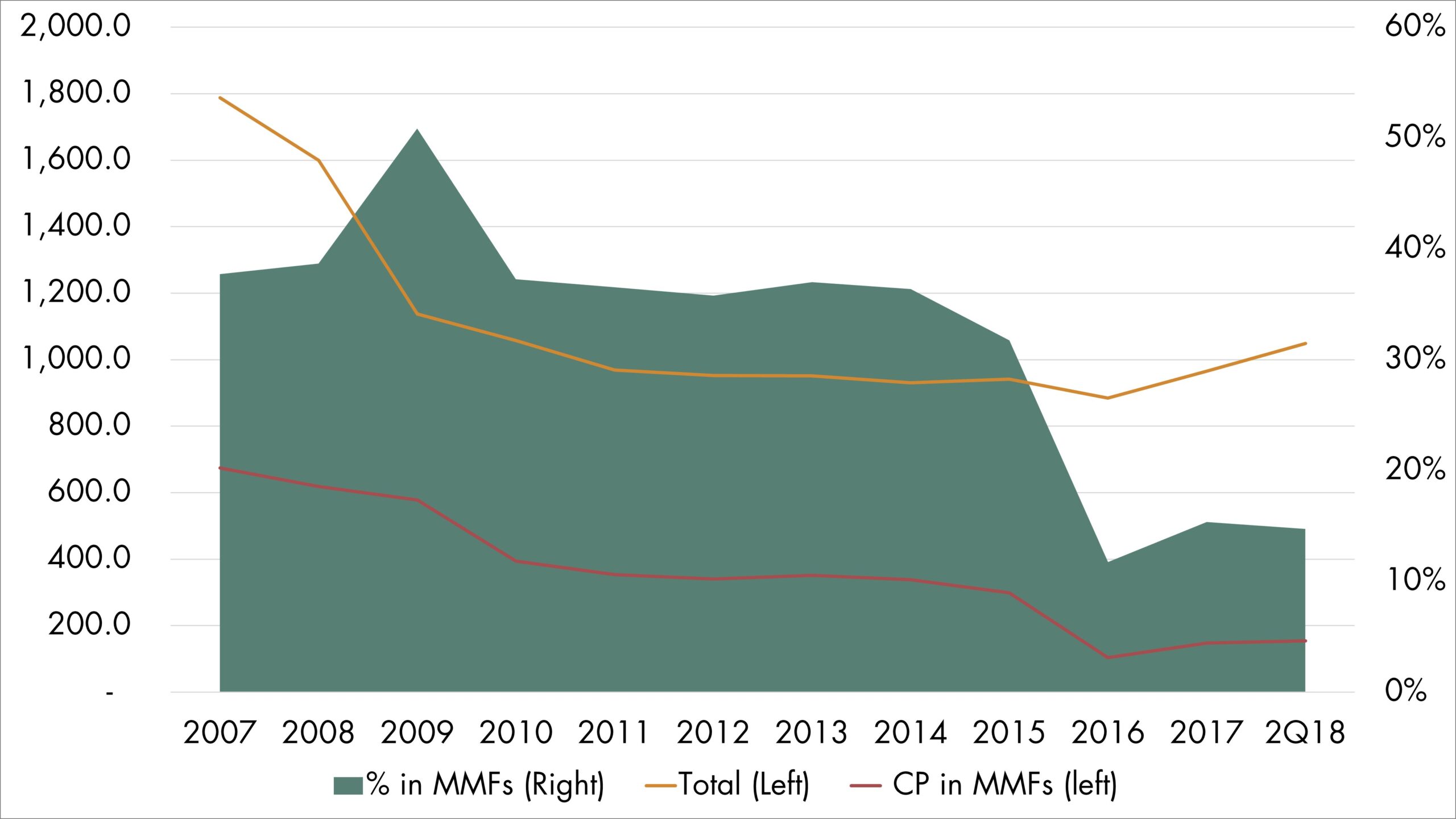

Figure 6: CP Holdings in MMFs Source: FRED economic data and Federal Reserve Board’s flow of funds report as of 6/30/2018

Source: FRED economic data and Federal Reserve Board’s flow of funds report as of 6/30/2018

Prior to the implementation of the 2016 MMF reform, there was a nervous period when market participants feared that a substantially smaller appetite for prime MMF assets post-reform could be catastrophic on the demand for CP investments. The concern proved to be unwarranted in retrospect (see Figure 6).

- It is notable that CP concentration in prime MMFs fell significantly from over 50% in 2009 to 15% at June 2018.

- CP concentration roughly tracked overall MMF outstanding until 2015, when it dropped further. We think this was due to fund managers’ preemptive moves to build liquidity by switching to overnight repurchases agreements (repos).

- Contrary to initial concerns, CP concentration among MMFs increased after 2016 both in dollar and percentage terms from $104 billion (12%) to $154 billion (15%).

- Despite initially reduced demand from smaller prime funds, the overall growth of CP outstanding by $107 billion in the 2015-2018 period (refer to Figure 1) points to stepped-up purchases by other money market investors such as bond funds and separate accounts.

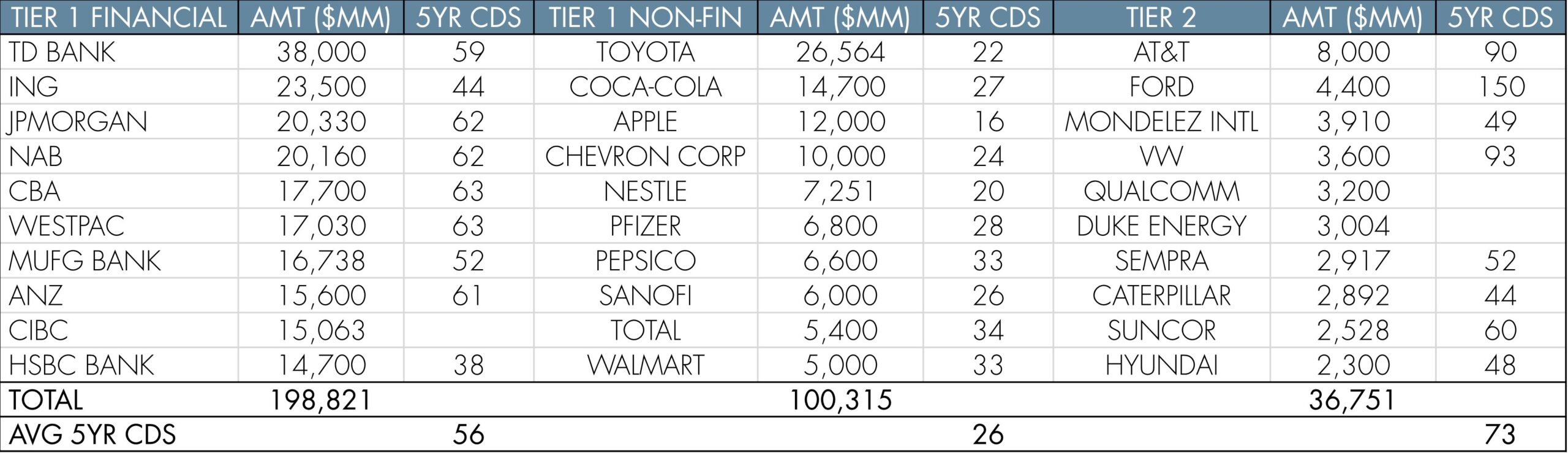

A Snapshot of Top Issuers

For illustration purposes, we’ve compiled a list of Top 10 CP issuers in each category, ranked by the amount outstanding as of June 2018. These rankings, though they change from month to month, provide a general picture of major players in the U.S. CP market.

Figure 7: Top 10 CP Issuers at June 2018 Source: JPMorgan Securities’ website of active CP outstanding as of June 30, 2018. CDS spread from Bloomberg.

Source: JPMorgan Securities’ website of active CP outstanding as of June 30, 2018. CDS spread from Bloomberg.

Figure 7 provides indicative 5-year credit default swap (CDS) spread levels as a proxy of the issuers’ perceived credit risk. As expected, the market views Tier 1 non-financial CP debt with lowest default risk, follow by Tier 1 financial debt and Tier 2 debt.

- Not surprisingly, nine of the top 10 financial issuers are foreign banks, with JPMorgan Chase the lone U.S. issuer ranked in 3rd place.

- Top 10 non-financial issuers represent a diverse group by country as well as industry with six of the 10 based in the U.S.

- Many of the top Tier 2 issuers are household names from diverse industries with the majority based in the U.S.

Yield Spreads vs. Benchmarks

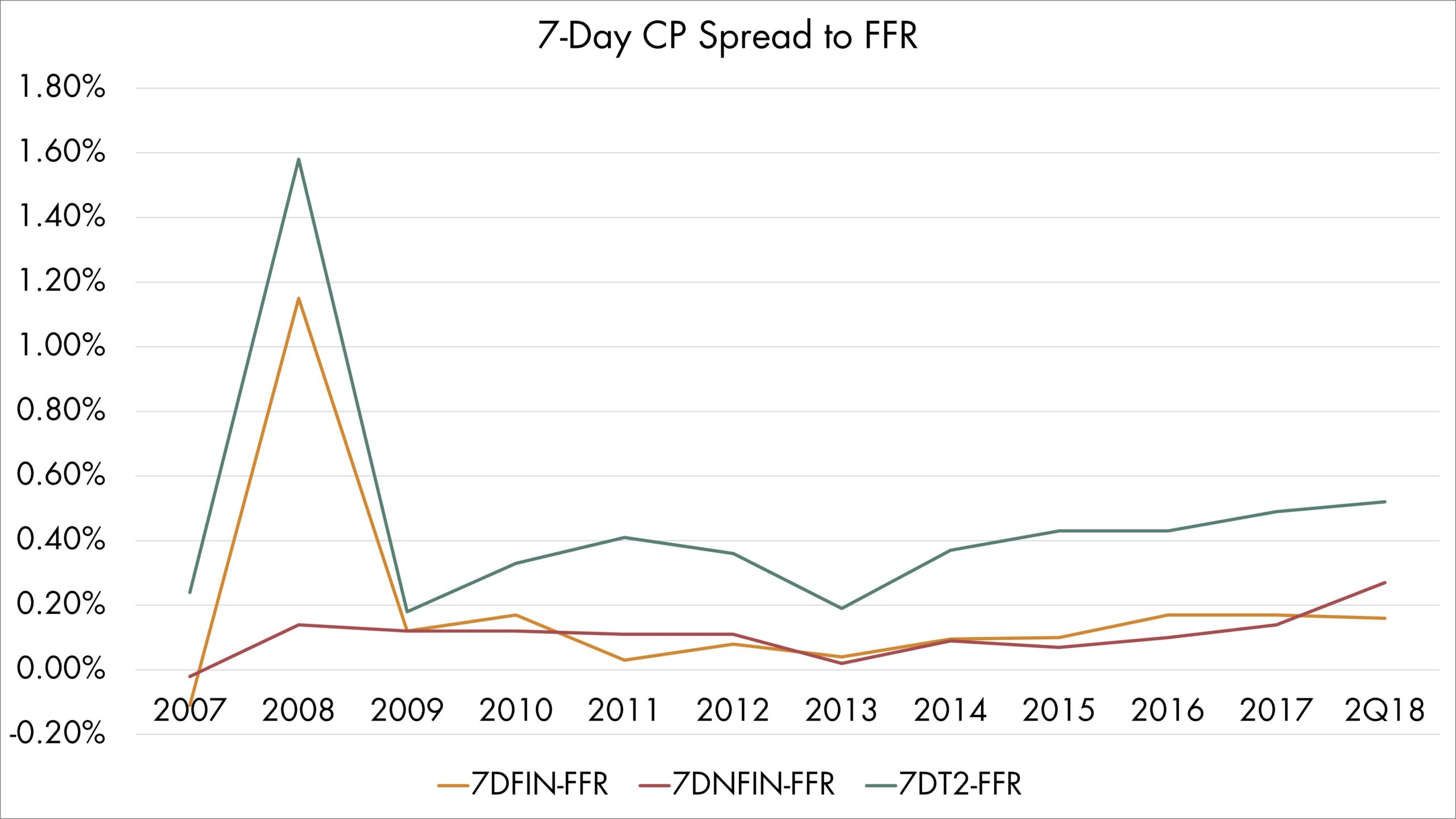

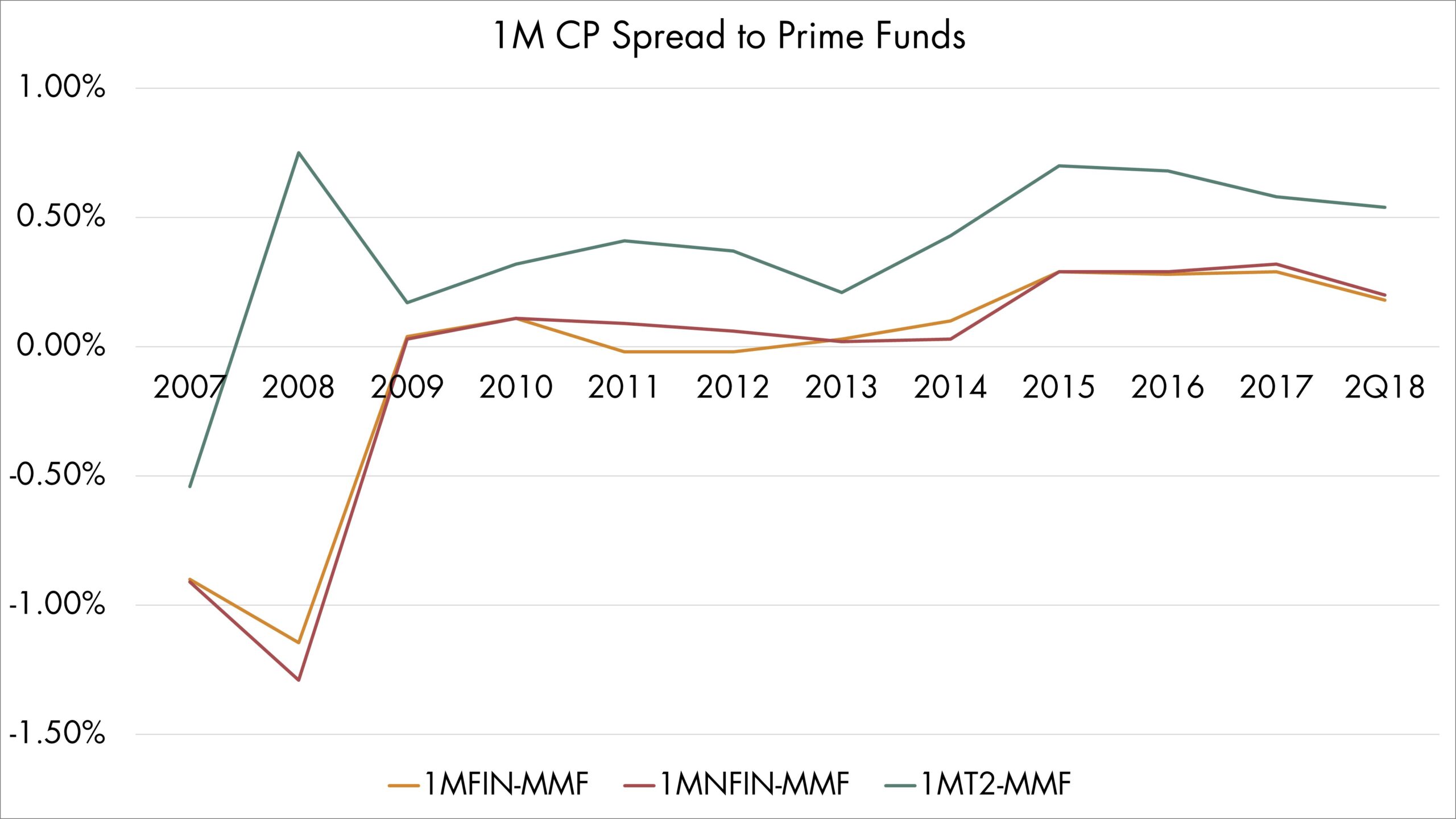

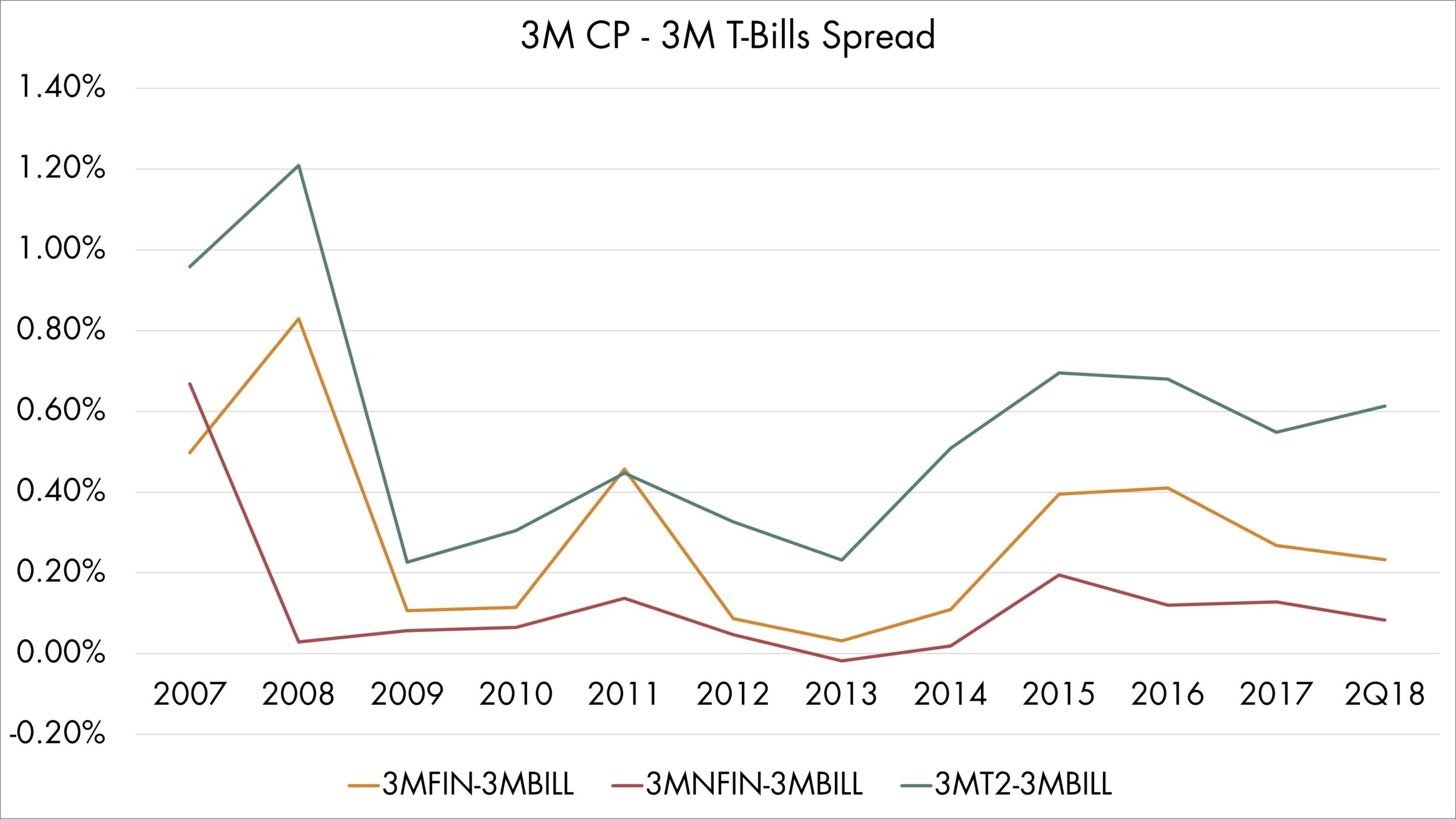

Figure 8: Yield Spreads to Benchmarks by Terms

Source: FRED, Crane Data, Bloomberg

Source: FRED, Crane Data, Bloomberg

As an alternative cash instrument to deposits and Treasury Bills, commercial paper provides higher yield potential governed by market forces. CP yields adjust quickly in response to changing market conditions such as interest rate, credit or liquidity. Figure 8 and Figure 9 provide a sample of these yield spreads to comparable benchmarks.

For simplicity’s sake, we use the lower bound of the Fed funds rate (also the Fed reverse repo rate) as the benchmark for 7-day CP. For 1-month maturity, we use the Crane Prime Institutional MMF average. The 3-month Treasury Bill is selected as the benchmark for the 3-month CP debt.

Large volatility for CP yield spreads across maturity is present during the 2007-2009 period, which was attributed to the financial crisis. Since 2009, CP yields for all three maturities have outperformed their respective benchmarks.

Figure 9: Average Yield Spread over Benchmarks Source: FRED as of June 30, 2018

Source: FRED as of June 30, 2018

Figure 9 is a snapshot of the average yield pickups of respective maturities from 2009 to Q2’18.

- In general Tier 1 CP delivered a double digit (bps) yield advantage over their benchmarks, while Tier 2 CP delivered significantly more.

- Yield pickups generally increased as maturities increased.

Readers should take note that, due to calendar effects, yield data as of quarter- and year-ends may not be fully representative of the market on normal days. On these dates, borrowers’ funding needs may differ with an eye towards regulatory liquidity requirements and balance sheet appearance. Some data distortion is unavoidable and difficult to correct.

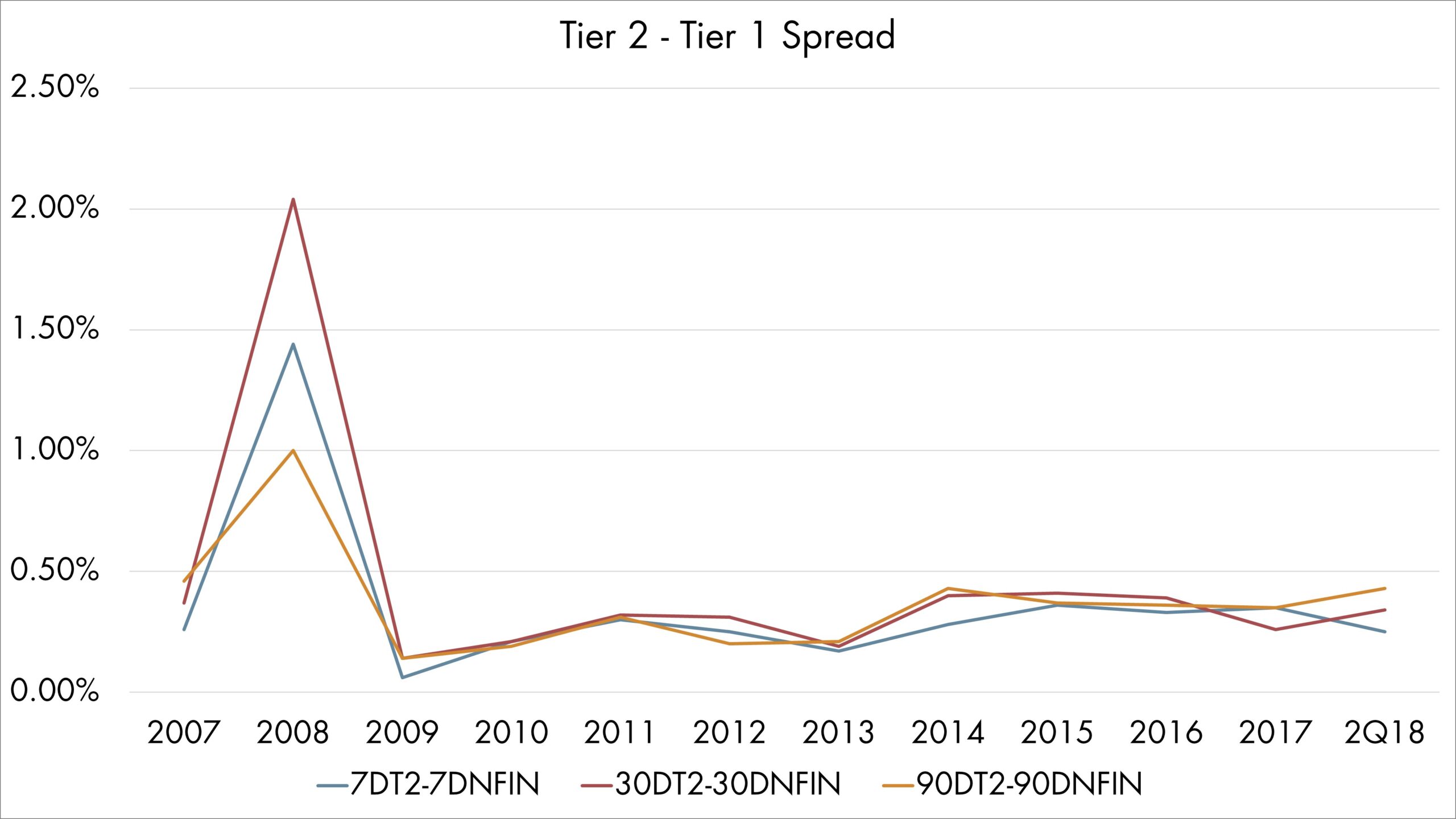

Figure 10: Tier 2 over Tier 1 2009-2Q’18 Source: FRED as of June 30, 2018

Source: FRED as of June 30, 2018

Lastly, we present the history of yield spreads between the two top short-term credit rating tiers.

- Clearly, Tier 2 CP offered significant yield pickups over Tier 1 non-financial debt for all three maturities and throughout the post-crisis era, averaging 25-40 bps.

- Tier 2 debt may be suitable for a segment of the liquidity management community, but investors need to be more mindful of specific issuers’ idiosyncratic risks.

Foreign Sovereign and Agency Debt

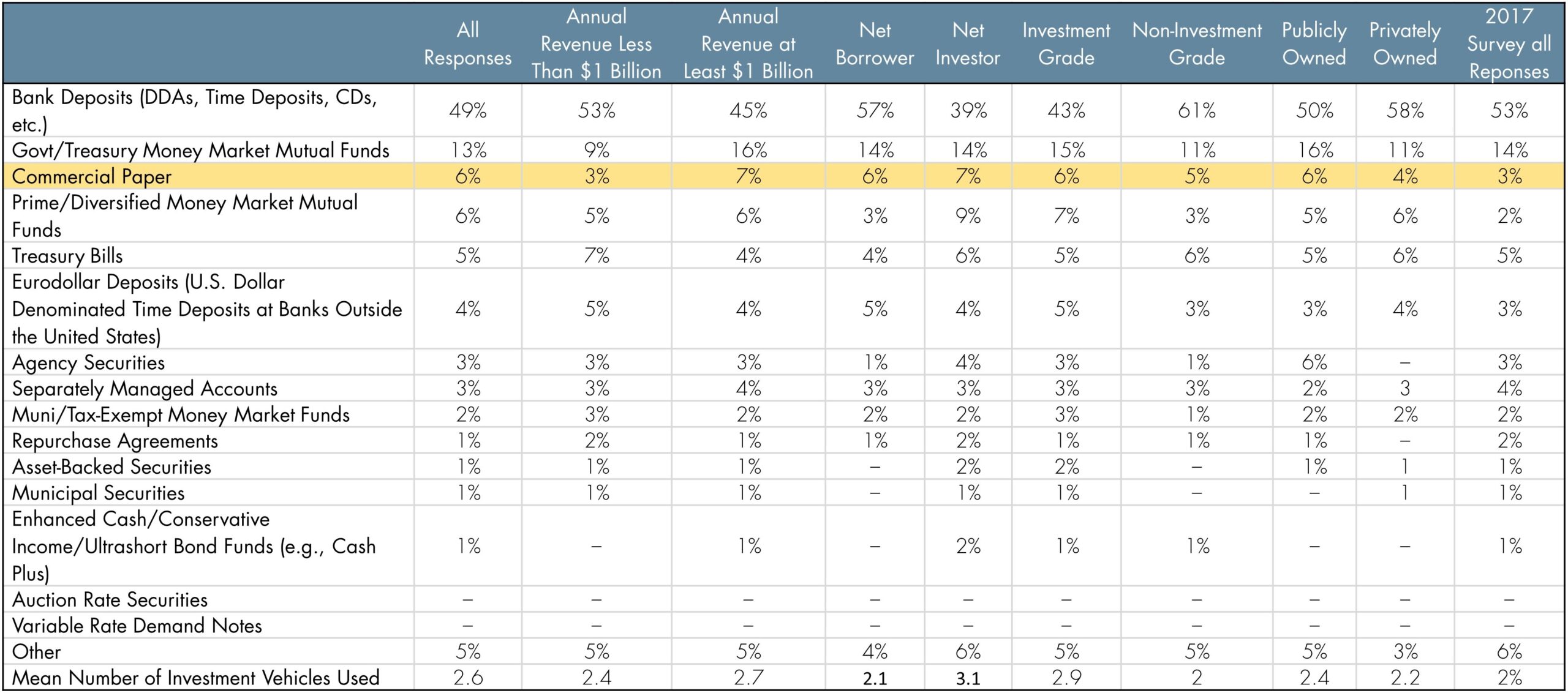

The treasury management community generally accepts top-tier CP as an eligible investment class for liquidity investments. In the past, it generally did not invest in this asset class directly but rather indirectly through their holdings of prime money market funds. Results of the 2018 AFP liquidity survey show that industry respondents now hold 6% of their liquidity portfolios in direct CP investments. Though not a very high level, this represents a 100% jump from 3% in the 2017 survey.

Percent of Organization’s Short-Term Portfolios Allocated to Specific Investment Vehicles

(Mean Percentage Distribution of Cash and Short-Term Investment Holdings) Source: Association for Financial Professionals, 2018 AFP Liquidity Survey Report

Source: Association for Financial Professionals, 2018 AFP Liquidity Survey Report

CP Investments in the post-MMF reform era: We’ve written in the past that corporations used to employ CP and other short dated instruments more widely before institutional MMFs became popular among institutional portfolios. With day-to-day decisions delegated to professional fund managers, corporate treasurers are a step removed from the nuances of CP investments.

Structural changes in institutional prime funds since the 2016 reform resulted in a large shift of assets to government funds that do not hold CP. All things considered, this shift led to lower portfolio yield potential. The yield gap grew as the benchmark fed funds rate lifted off in late 2015 and has since increased above 2%. Liquidity investors hoping to recapture lost yield in the prime-to-government transition may do well to reconsider CP investments.

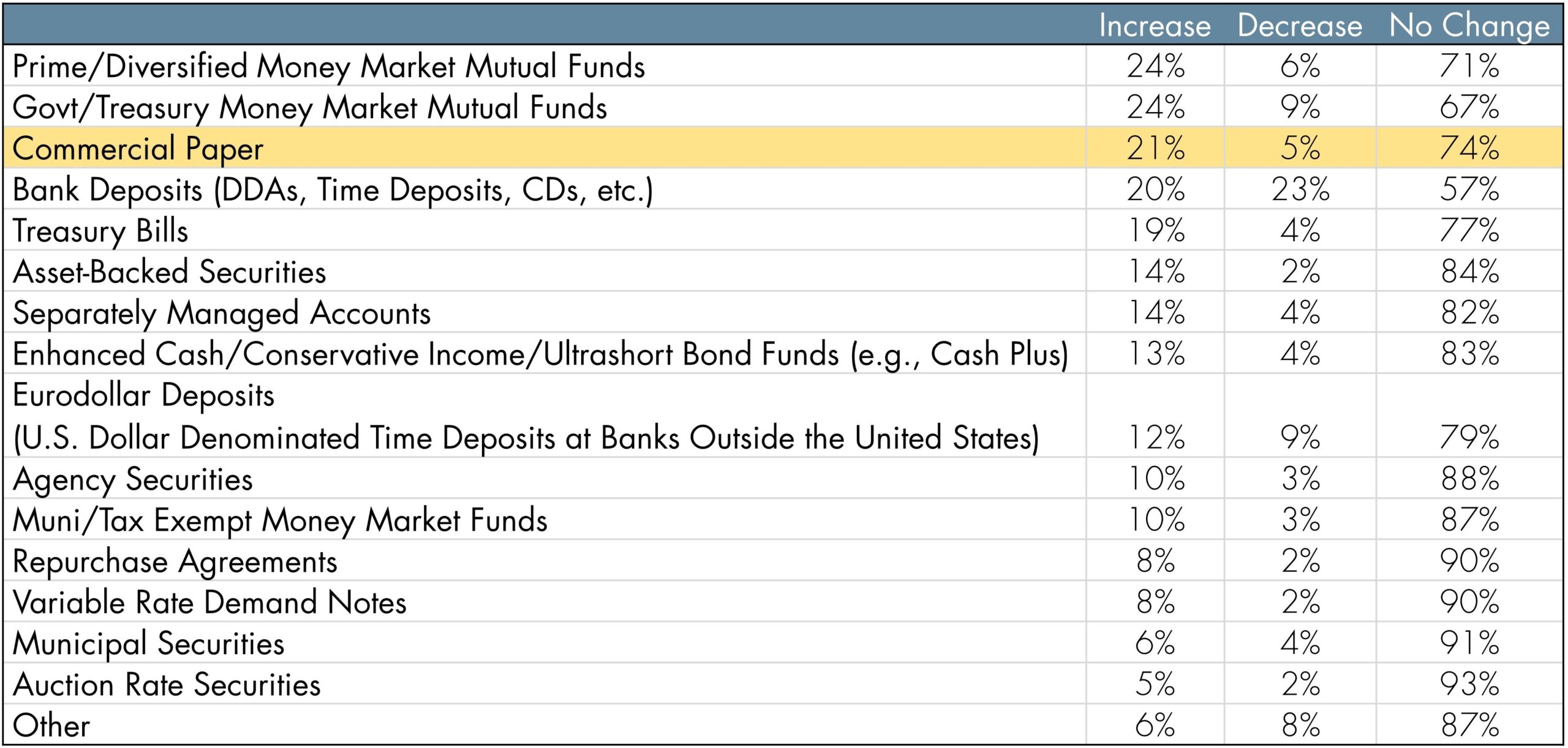

Survey shows increased interest in CP: The 2018 AFP survey seemed to confirm this consideration. When asked about anticipated changes in their investment mix, about 21% of the respondents considered increasing CP holdings. This was the third highest increase behind diversified and government MMFs (both at 24%) and ahead of deposits (20%) and Treasury Bills (19%).

Anticipated Changes in Investment Mix

(Percentage Distribution of Organizations that Anticipate Changes in Investment Mix) Source: Association for Financial Professionals, 2018 AFP Liquidity Survey Report

Source: Association for Financial Professionals, 2018 AFP Liquidity Survey Report

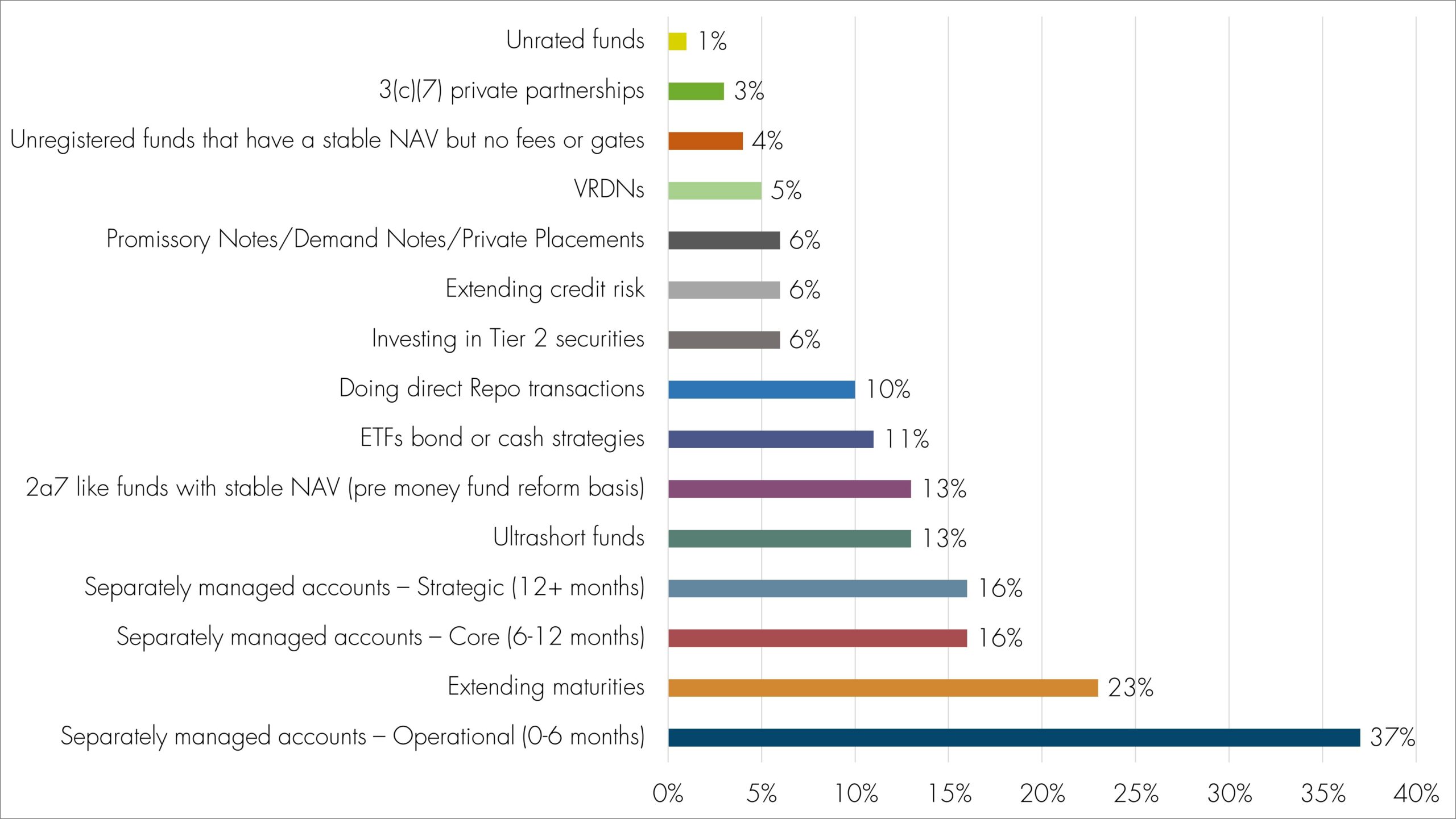

Robust interest in SMAs and Tier 1 debt: A final item of note from the AFP survey relates to separately managed accounts (SMAs). When asked about alternative investment options, respondents named three classes of SMAs among top choices. Tier 2 securities also appeared in the top 10.

Alternative Investment Options Organizations Are Considering to Complement Current Investment Selection

(Percent of Organizations) Source: Association for Financial Professionals, 2018 AFP Liquidity Survey Report

Source: Association for Financial Professionals, 2018 AFP Liquidity Survey Report

This is interesting as it aligns the respondents’ intent to find alternative cash investment options and the viable tools to achieve this goal. While SMAs and Tier 2 debt may not be suitable for every treasury organization, appropriately sourced and researched CP offerings may become beneficial parts of these strategies.

Conclusion – Include CP Investments in Liquidity Portfolios

Commercial paper investments may not be a new concept for treasury professionals, but many of us came to know them through holdings in prime MMFs. As the recent reform reduced appetite for prime funds, we noticed renewed interest in CP investing, either through in-house accounts or through SMAs.

This paper provides an overview of the CP market over the last decade. After declining for several years, outstanding CP started to grow again since 2016. While foreign financial CP continues to be a major presence, ABCP outstanding has fallen significantly. On the other hand, the market saw increased non-financial CP outstanding, including issues rated below Tier 1.

While much of the last decade was marked by a “no yield, low yield” environment, CP of various maturities provided meaningful spread advantage over their respective benchmarks. Maturity and credit factors influence yield spreads, although calendar effects present data challenges to understanding yield pickups.

Citing the recent AFP liquidity survey, we think treasury organizations are carefully considering cash management alternatives. While situations differ from organization to organization, we urge institutional investors to seriously consider direct investments in top tier commercial paper, either through internal staff or SMAs. For certain organizations, it may be appropriate to think beyond the stigma associated with Tier 2 CP ratings and consider certain names in a broad liquidity portfolio to diversify risk and improve income potential.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

1Mark P. Cussen, An Introduction to Commercial Paper, Investopedia, Updated April 23, 2018.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.