Offshore Money Market Funds in an Age of Change

Abstract

- Offshore institutional money market funds (MMFs) have largely sat in the periphery for US-centric liquidity investors, but European reform and repatriation of overseas profits may result in transformational changes.

- Offshore fund investors will have few alternatives other than low volatility net asset value (LVNAV) funds. Public debt funds may not accommodate large inflows. A new EC ruling on share cancellation will be challenging for euro funds.

- Repatriation of overseas profits may be more manageable as a large part of “trapped cash” is in fixed income securities outside the realm of MMFs.

- A separately managed portfolio may provide flexibility not available to commingled funds. While many questions remain unresolved, multiple liquidity solutions can help to cope with change.

Introduction

Even for US-centric institutional cash investors, developments in the offshore money market fund space are difficult to ignore. The interconnectedness of global financial markets results in domestic and offshore liquidity funds sharing a common set of debt issuers and market liquidity. Many US-based treasury organizations also have offshore subsidiaries or affiliates with investments in offshore funds that require attention.

Interest in offshore liquidity has intensified in recent months due to several key developments: the passage of MMF reform in Europe, a new tax law in the US, and Great Britain’s imminent exit from the European Union (Brexit). For institutional liquidity purposes, we will focus on funds belonging to the Institutional Money Market Funds Association (IMMFA), a trade association representing the European MMF industry.

Since our interest is primarily on dollar-denominated (USD) funds, we will skip the Brexit topic here. Likewise, institutional funds domiciled elsewhere are significantly smaller in size and are not the focus of this article.

A Survey of Offshore Market Share

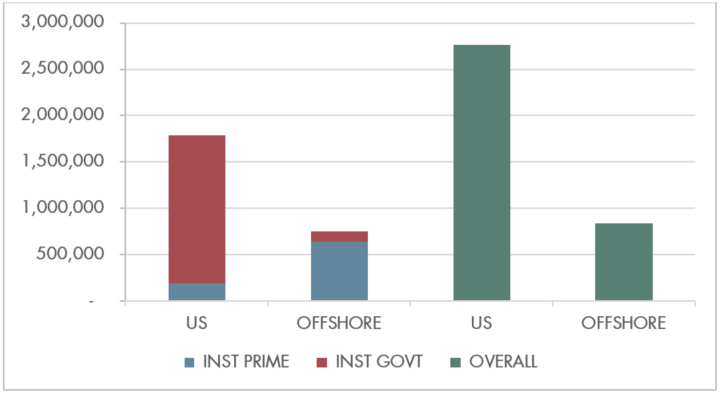

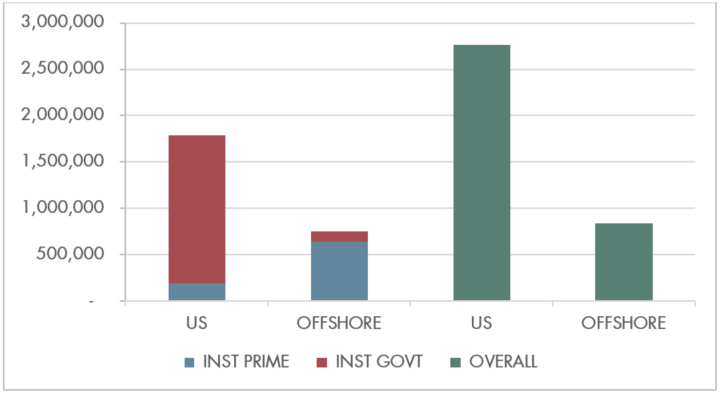

Compared to the $2.7- trillion domestic US MMF market, the combined dollar, sterling (GBP) and euro offshore fund market is a modest $833 billion in size (Graph 1) as of March 2018, according to fund data firm iMoneyNet. IMMFA funds, with self-enforced standards of conduct comparable to US MMF standards, garnered $747 billion.

Graph 1: US and Offshore MMF Balances as of March 2018

Source: iMoneynet.com Offshore Market Share as of March 2018

Graph 1 also shows that, as an aftermath of US reform that forced institutional prime funds to adopt variable net asset values (VNAVs), government fund assets currently dominate the domestic institutional landscape. Prime assets represented only 10%. By comparison, the IMMFA group assets are mostly in prime funds (86%).

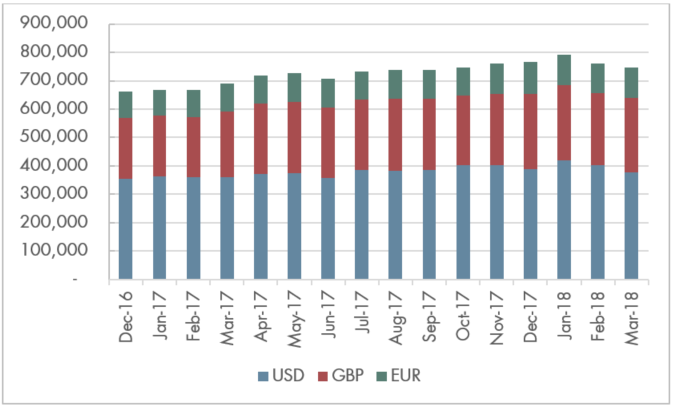

Graph 2: European MMF Assets by Currencies

Source: iMoneynet.com Offshore Market Share as of March 2018

Graph 2 provides a recent history of offshore MMF balances by currency, which had a generally upwards trend until last January. The graph also indicates that over half of fund assets (50-54%) are denominated in US dollars. Sterling funds account for roughly 1/3 of the balances, while euro funds make up the rest (13-15%).

US-based treasury organizations may have more balances in USD funds than the other currencies. The European fund reform will cause changes in funds of all currencies, but EUR funds will likely feel the most pinch from a regulator’s new interpretation. The US tax reform should affect USD funds more than EUR and GBP funds.

DOWNLOAD FULL REPORT

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.