First Annual Checkup on Reformed Institutional Prime Funds

Abstract

In the year since the SEC instituted new rules governing money market mutual funds, institutional prime funds have recaptured some lost ground, although balances still lag government funds. Fund characteristics returned to pre-reform levels with wide dispersions and concentrated exposures to non-US financial issuers. Asset-backed instruments also increased. While prime fund yields benefitted from higher fed funds rates, the current prime-to-government yield spread may be insufficient to bring back most investors.

We think that structural changes have reduced prime funds’ appeal to a subset of previous shareholders, with their main utility changed from overnight, stable value deposit equivalents to return-oriented reserve instruments. We are optimistic that prime assets will continue to grow, but are likely to be in the shadow of government funds for some time. Investors with slightly longer time horizons and tolerance for interest rate volatility may consider portfolios of separately managed securities as suitable alternatives.

Introduction

It has been over a year since the SEC’s revised rules governing money market mutual funds went into effect on October 14, 2016. The requirements to float net asset values (NAVs) and impose redemption restrictions resulted in large scale asset migration from institutional prime funds to government funds. As the regulatory dust settled and the yield environment improved, there have been signs of awakened interest in institutional prime funds. In fact, group assets increased 45% between October 31, 2016 and October 31, 20171. The addition of approximately $56 billion outpaced the decline of $33 billion in institutional government funds over the same period.

At the one-year anniversary of the SEC regulatory changeover, we take a metaphorical temperature on institutional prime funds and look for insight into their growth potential.

Prime Assets Steadily Climbed

Below is a high level summary of the “unified framework for fixing our broken tax code” released on September 27, 2017.

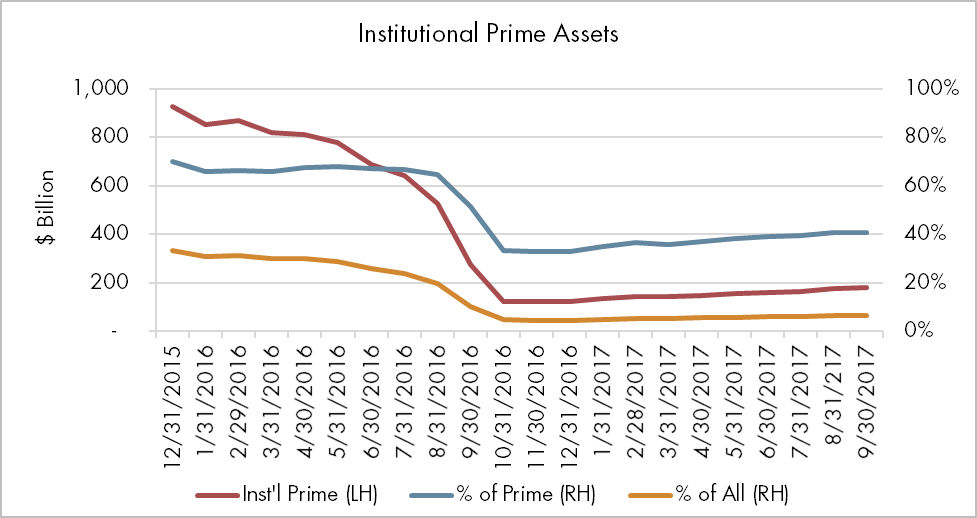

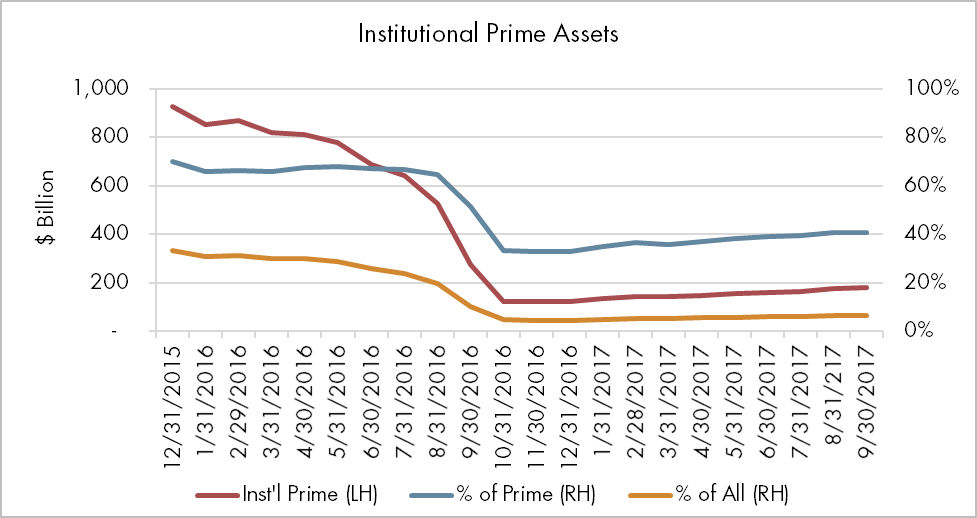

Figure 1: Institutional Prime Relative to Prime and Overall MMF Assets

Source: iMoneyNet Domestic Market Share

(Figure 1) captures the dramatic $800 billion (86%) decline in institutional prime assets between December 2015 and October 2016. Since then, institutional prime assets grew in absolute terms as well as in proportion to overall prime assets and the money market fund (MMF) industry. The growth rate of 45% from a smaller base excited some market participants, while the $26 billion in net growth (prime – government) indicates new cash flowing in the direction of prime funds.

Of note, if the regulators’ goal was to reduce systemic exposure of the financial system to institutional prime funds, they appear to have achieved it. The funds used to represent 33% of all money assets, but are now at merely 7% as indicated in (Figure 1).

DOWNLOAD FULL REPORT

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

1Based on monthly iMoneyNet Domestic Market Share reports.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.