Higher Deposit Rates – Where Art Thou?

Abstract

The return of yield opportunities presents institutional cash investors with fresh challenges. Higher rates have driven up the cost of staying with ultra conservative instruments. Money market fund reforms have left corporate cash managers with few clear choices to add yield. And historically popular cash vehicles that have undergone significant changes demand a fresh look. After revisiting several investment scenarios with updated income figures, we suggest that a multi-pronged investment strategy, including separately managed accounts (SMAs), may help improve one’s risk/reward profile.

Introduction

In the years after the 2008 financial crisis, the Federal Reserve maintained a zero- interest-rate policy (ZIRP) to boost economic recovery until December 2015, when it slowly started to lift the short-term rates off the floor. When risks were plentiful and yield was nonexistent, institutional cash investors were concerned with the return of their investments, meaning principal preservation, than with traditional return on investments.

In February 2012, we published a whitepaper titled “All Pain, No Gain” that discussed several types of stylized cash vehicles with vastly different risk profiles but essentially the same return profile – zero. Now, with the Federal Reserve well on its way to interest rate normalization, we thought it appropriate to revisit the subject, identify changes in risk/reward characteristics of several sample portfolios, and discuss ways to improve their risk/reward balance.

Tales of Four Cash Investors

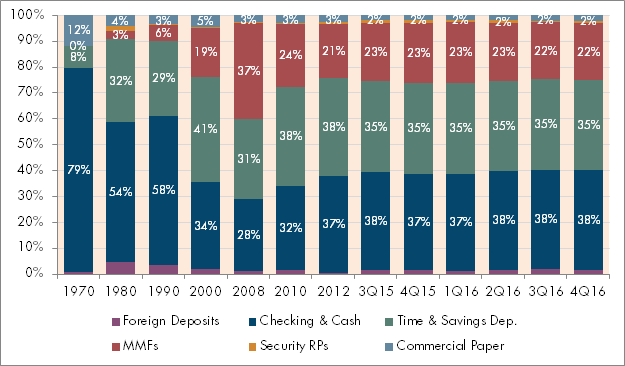

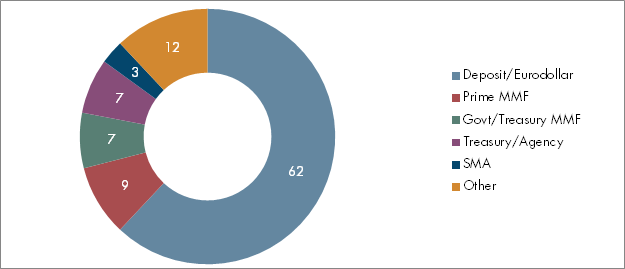

Bank accounts have been a main liquidity tool for as long as modern banking has existed. Beginning in the late 1990s, however, their popularity declined as investment in money market funds (MMFs) surged. This trend continued until the financial crisis of 2008 forced investors to reassess the latter’s resilience as stable liquidity vehicles during market tumults. Since then, as the Federal Reserve’s Flow of Funds report (Figure 1) indicates, the combined savings and checking account balances have consistently accounted for nearly three quarters of the liquid balances at non-financial firms in the United States.

Figure 1: Liquid Balances at Non-Financial Firms

Source: Federal Reserve Board, Financial assets of the United States 1970-2016, L102

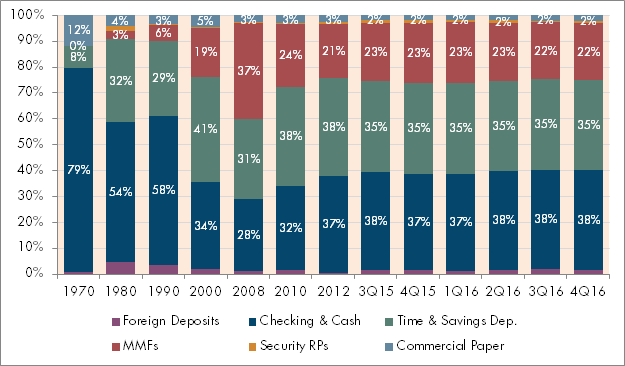

Survey results from institutional liquidity investors confirm deposits’ popularity. A 2017 liquidity survey of 683 institutional investors by the Association for Financial Professionals found that 59% of the organizations’ short-term portfolios are allocated to bank deposits and Eurodollar deposits (Figure 2).

Figure 2: Short-term Portfolio Allocations (%) by 2017 AFP Survey Respondents

Source: 2017 AFP Liquidity Survey: Report of Survey Results, Page 10

The 2016 MMF reform that requires prime institutional funds to float their net asset values (NAVs) and impose redemption fees and gates in times of stress also seems to have encouraged more cash to flow into deposits. While some participants believe that the reform merely resulted in the reshuffling of fund assets between prime and government funds, the Fed’s Flow of Funds reports (Figure 3) tells a different story.

DOWNLOAD FULL REPORT

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.