July Month-end Portfolio Update

The Fed is ‘Data Dependent’, as Always

As was widely expected, the Fed increased their policy rate last week by 25 basis points to a new range of 5.25%-5.50%. This level is a 22-year high and it marks the 11th time since March of 2022 that the Fed has raised their target rate. The official FOMC statement was little changed from their June meeting, with only a mild upgrade on the assessment of the economy: they said activity has been expanding at a “moderate” pace compared to June’s “modest” pace. In his press conference, Fed Chair Powell made numerous references to the FOMC’s data dependency and meeting-by-meeting approach. He avoided saying the next FOMC meeting in September was “live”, but still conveyed that a hold or hike decision will be dependent on the two inflation and employment reports due for release prior to that meeting. Powell mentioned that the Fed staff is no longer forecasting a recession in their projections (which are independent of those issued by policymakers themselves). Although the Fed is still factoring in one more rate hike, according to its recently updated year-end projections, the market is not fully pricing in any additional rate hikes at the 3 remaining meetings this year (September, November, December) and expects interest rate cuts to begin in March of 2024.

Q2 GDP is Supportive of a Soft Landing

The first reading of second quarter GDP growth came in at +2.4% which was higher than expectations of +1.8%. The data also marks the 4th consecutive quarter of growth at 2.0% or better. Personal Consumption rose 1.6%, which was also above expectations of +1.2% but down from the +4.2% in the first quarter, primarily due to slowing purchases of durable goods (big ticket items). Business investment grew 7.7% with all 3 major categories moving higher (equipment, commercial construction, and intellectual property). This was a significant jump from the first quarter’s reading of +0.6%, which contributed 1% to the overall GDP reading. Part of the increase in business investment is attributed to the Inflation Reduction Act, which is spurring manufacturing investment. This report has supported the soft landing narrative that many economists, including Fed Chair Powell and Treasury Secretary Yellen, believe is still possible.

Earnings Season Underway

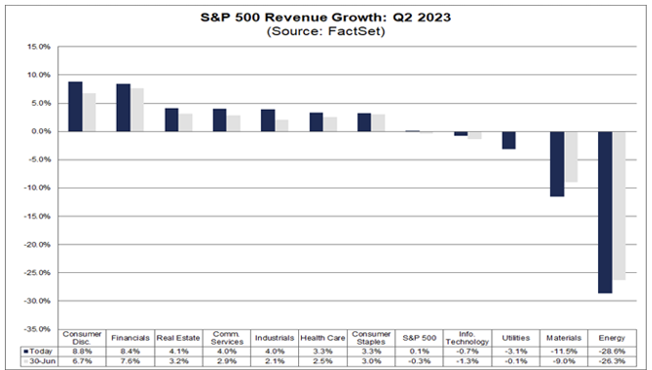

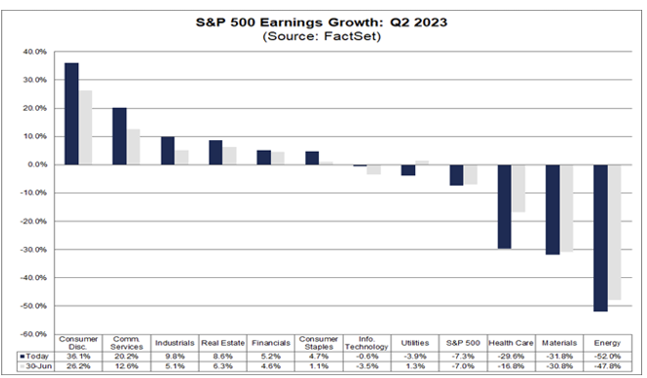

At this stage, a little over 50% of S&P 500 companies have reported second quarter earnings. According to Factset, 80% of the reported companies have reported actual EPS above estimates, which is above the 5-year average of 77% and above the 10-year average of 73%. The earnings decline for the quarter so far is at -7.3% and expectations are that Q2 earnings will be the lowest point for earnings in the current cycle after 5 consecutive quarters of declining earnings expectations. Of the 11 subsectors of the S&P index, Consumer Discretionary is leading in terms of both earnings and revenue growth.

Source: Factset

Risk-Asset Rally

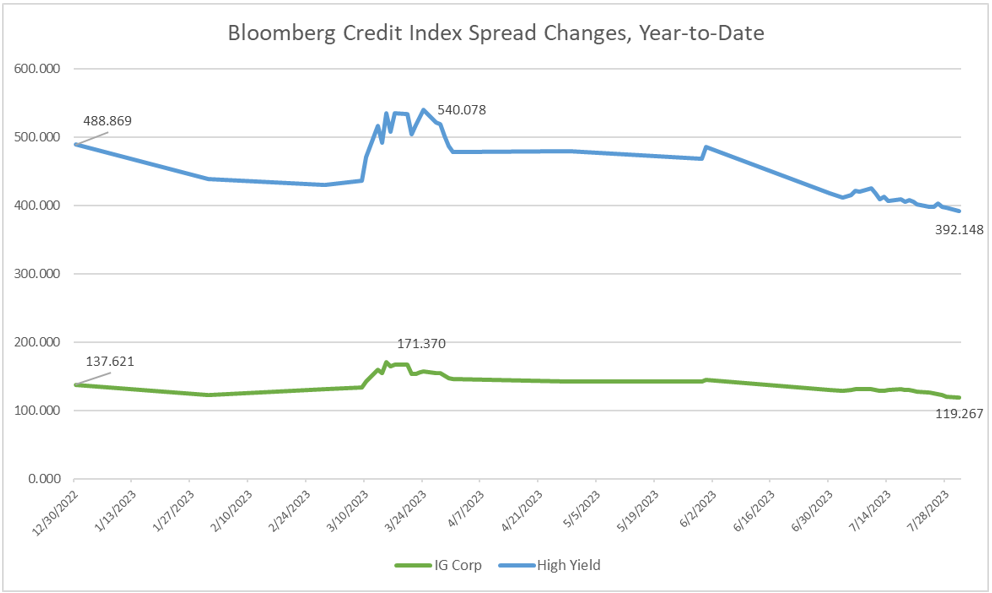

Equity and Credit indexes delivered great performances in July. The Dow Jones Industrial Average climbed for 13 straight sessions, the longest winning streak since 1987. The S&P is now up over 28% from its 52-week low (reached on October 12th) and it secured its 5th consecutive month of gains, the longest streak since August 2021. Corporate bond spreads tightened in July for both investment grade (IG) and high yield securities, with the Bloomberg main IG Corporate and High Yield Indexes improving to the tightest spread levels of the year at +119 and +392, respectively.

Source: Bloomberg

Source: Bloomberg

Fitch Downgrades the US Rating to AA+ from AAA

On August 1, 2023, Fitch Ratings downgraded the United States of America’s Long-Term Rating to ‘AA+’ from ‘AAA’. The Rating Watch Negative was removed and a Stable Outlook assigned. Fitch said the downgrade reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.