ESG: A Credit Investor’s Oldest New Friend

How the availability of ESG data is changing the way investors can apply ESG to their decision-making process

Much of the commentary surrounding ESG investing hails it as an approach which has largely been developed and risen to prominence in recent years. While its rapid rise in popularity since the COVID pandemic has led to a much wider integration of ESG considerations across an ever-growing universe of applications, ESG has long been central to credit investors’ analysis. When discussing how this was done in the past, governance considerations are perhaps the first to come to mind, however, environmental and social factors have always been pertinent to credit profiles. For example, consider a property and casualty insurer’s exposure to hurricane, flood or wildfire prone areas, or the regulatory risks faced by a manufacturer related to labor conditions within their supply chain. These environmental and social considerations, respectively, were a part of the investment analysis process well before the term ESG was coined. In recent years, improving data sources on ESG issues has allowed investors to highlight these considerations in ways not previously available, to the benefit of asset owners. This realization has led investors, rating agencies and management teams to increasingly consider ESG data in their assessment of downside risk. Simultaneously, the degree that investors allow these factors to influence their decision-making process can lead to a range of opportunities for their potential application.

ESG Implications on Operating Environments

ESG considerations are increasingly incorporated into company strategy due to their ability to have both immediate and long-term implications on a company’s operating environment. The inability of management teams to mitigate these risks can have negative implications stemming from regulatory, reputational, and operational fronts. These implications range from excessive losses due to a property and casualty insurer’s exposure to high-risk areas to fines levied on a manufacturer for improper supply chain labor standards as mentioned above. They can also include far more vague consequences such as a company losing their social license (the perception by stakeholders that a company is acting fairly or justly) which can lead to execution risks surrounding strategic initiatives such as an IPO.

Risk Transmission

An equity focused 2019 study by MSCI found these risks used three primary transmission channels to effect company performance.

– Cash Flow Channel: Companies with strong ESG profiles generate a competitive advantage by better managing resources, human capital and innovation initiatives and are typically better at developing long-term business plans, which leads to abnormal returns and higher profitability.

– Idiosyncratic Risk Channel: ESG leaders tend to have stronger risk controls and compliance standards across their company and supply chains. This means they are less frequently subject to isolated negative events which can impact the company’s financial standing.

– Valuation Channel: Strong ESG performers tend to be better positioned to defend against systemic shocks. Lower systemic risk grants these issues easier access to funding markets.

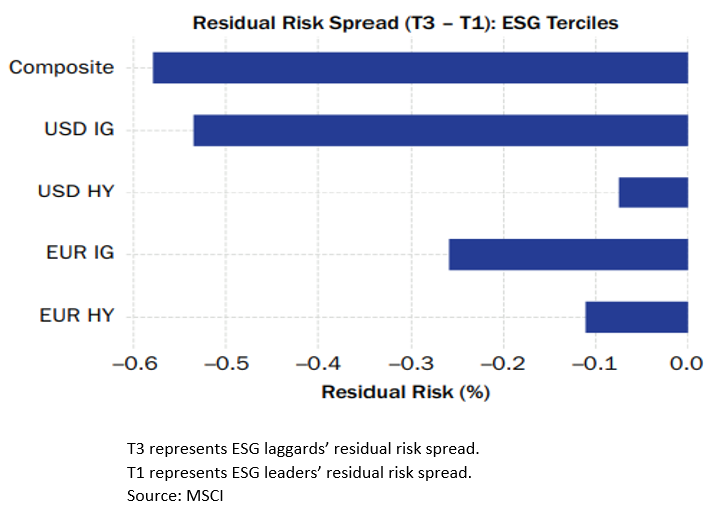

MSCI later expanded upon this study, finding ESG considerations significantly reduced downside risks to credit profiles via these transmission channels. This in turn manifested itself through lower observed price volatility of ESG leaders’ bonds.

ESG Impact on Credit Ratings

Additionally, the above mentioned study that ESG considerations provide complimentary, material information to credit ratings, signaling ESG considerations provide value beyond the conclusions drawn from traditional financial analysis. This is reflected in the actions of all three major credit ratings agencies, which have each launched some form of ESG scores and analysis. Notably, Moody’s Corporation and S&P Global each acquired an established ESG data and rating businesses to support their ESG research and ratings offerings.

While their incorporation into the credit analysis process is not novel, quantitatively tracking the effects of ESG factors in a consistent manner has meant material, mostly negative, changes to the credit profiles of many companies. Asset management firm Robeco has incorporated ESG information into their investment analysis since 2010, and have found that these considerations are financially material to investment decisions in 24% of cases. Most of the time, these ESG considerations negatively impact Robeco’s fundamental view of an investment.

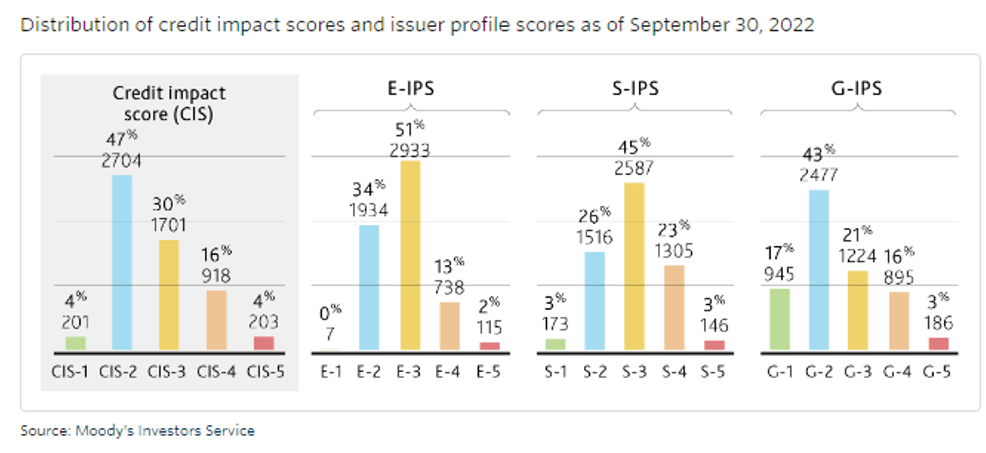

The negative impact that ESG considerations have on issuer profiles is also reflected by Moody’s findings that ESG factors have negatively impacted 20% of scored entities credit profile’s and an additional 30% of scored entities face potential future negative impacts from ESG issues.

S&P Global Ratings has found a similar pattern, documenting 371 rating actions that ESG credit factors were a key driver of in 2022, 61% of which were negative rating actions. The nature of the topics which ESG considerations cover naturally skews the results of their incorporation to the downside. As Head of Credit Research at Robeco, Taeke Wiersma put it “A good risk management system at a bank does not lead to a strong improvement in credit quality; a weak one, though, could lead to its total collapse.” This makes ESG investing a key tool for highlighting downside risk in investments, aligning it well with the downside risk focused credit investor.

The Influence on Investment Decisions

Some investors prefer to leave their ESG strategy to just factor incorporation to pick up risks which may have been overlooked otherwise. In this scenario, ESG factors do not sway investment decisions any more than traditional financial inputs. However, the spectrum of how much investors allow ESG factors to influence investment decisions allows for many different use cases. ESG metrics can take an outsized role in the investment process, even being the deciding factor as to whether to include an issuer in a portfolio. Decisions could be made based on a company’s overall ESG score, some sub-score or even based on their performance in a particular field. How ESG gets used is up to the individual investor, and therefore how, or if, they want ESG to make an active impact is as well. Particularly when institutional investors incorporate ESG considerations into the investment process, companies will work to appease them by integrating these factors into corporate strategy, allowing ESG to be a vehicle for change, placing more meaning behind otherwise benign investments.

Integrating ESG considerations into cash portfolios is becoming increasingly critical as these factors take a larger role in corporate strategies and how the public perceives the companies they interact with. The use of ESG data allows analysts to get a better understanding of the downside risks associated with a company, making it uniquely suited for all credit investors. However, the degree to which investors allow ESG factors to influence their decisions can make ESG integration an important tool for analysis or a vehicle for change. This provides investors with the option to use ESG as a tool to achieve a variety of outcomes from improved downside risk mitigation, to actively impacting company strategy.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.