Growing Pains: The Emergence of Super-Regional Banks

In a speech given in April 2022, Acting Comptroller of the Currency Michael Hsu recalled the ‘chaos’ driven by a series of bank failures during the Global Financial Crisis (GFC) . This resulted in a flurry of acquisitions and unorderly liquidations thrown together to prevent further disruption to the financial system. This experience eventually led to the Dodd-Frank Act, which created heightened resolvability expectations for the U.S. Globally Systemically Important Banks (G-SIBs).

Hsu asked whether how a large regional bank, not subject to the same array of regulations, would be resolved in a similar situation with minimal disruption to the banking system. Some large regional banks have grown rapidly in the past decade, with several super-regional banks now approaching or surpassing Lehman Brothers’ total assets at the time of its bankruptcy. Hsu’s speech suggested new rules, now being proposed by regulators, to address the risk to the financial system should one of these super-regional banks fail. If the new regulations go into effect, they may provide potential benefits for institutional cash investors.

In October, the Federal Reserve Board and FDIC jointly developed an advance notice of proposed rulemaking seeking input on the costs and benefits of imposing G-SIB. The proposed rules are similar to the resolvability measures already imposed on large banking organizations (LBOs). The filing cites the growth of Category III banks’ (most considered regional banks) average assets, which increased from $413B in December 2019 to $554B in December 2021, and the financial stability risks associated with the failure of super-regional banks of this size. While these firms’ share of total banking system assets has remained roughly the same since the GFC, their increased size and greater reliance on uninsured deposits has made it clear that resolvability regulations need to change with the banking system. Additionally, the proposed alterations could significantly impact super-regional banks and cash portfolios.

The advance notice of proposed rulemaking specifically seeks public comment on the costs and benefits of LBOs to determine:

- If they should adopt a clean holding company structure which prohibits bank holding companies from engaging in certain financial arrangements that could impede a resolution.

- If they should be subject to the same resolution planning and disclosure requirements as G-SIBs.

- Whether LBOs should identify business lines and products that are easy to sell if stressed, commonly known as separability requirements.

- If LBOs should be subject to long-term debt (LTD) requirements, and if LTD requirements should be applied at either the holding company or operating company level.

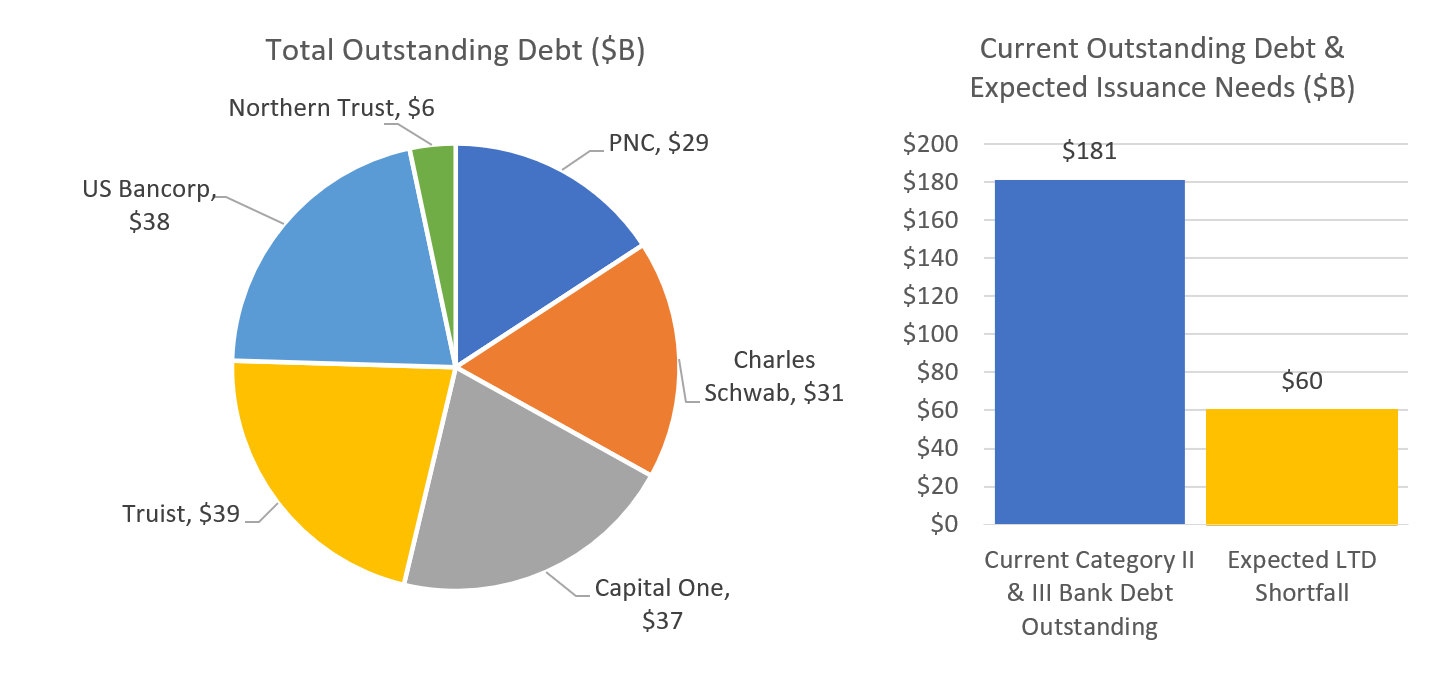

If implemented, these changes would likely be targeted at the Category II and III banks: Northern Trust, US Bancorp, PNC, Truist, Capital One and Charles Schwab. These reforms would mitigate boosting ‘too big to fail’ risk in the banking system by giving the FDIC greater options when resolving or recapitalizing an LBO beyond selling the failed bank to a G-SIB, thereby increasing its systemic impotence or to another LBO, thereby creating another G-SIB.

The most significant piece of the proposal is the idea of implementing G-SIB-like LTD requirements, and whether these requirements should be applied at the holding or operating company level. While the proposal does not disclose where minimum LTD requirements would be set, we can look at G-SIB requirements for guidance. G-SIBs must keep either the higher of 6.0% of risk-weighted assets (RWA) plus the greater of the bank’s method one or method two G-SIB surcharge, or 4.5% of the bank’s total leverage exposure. LBO requirements would likely be set at a similar level, minus the G-SIB surcharge.

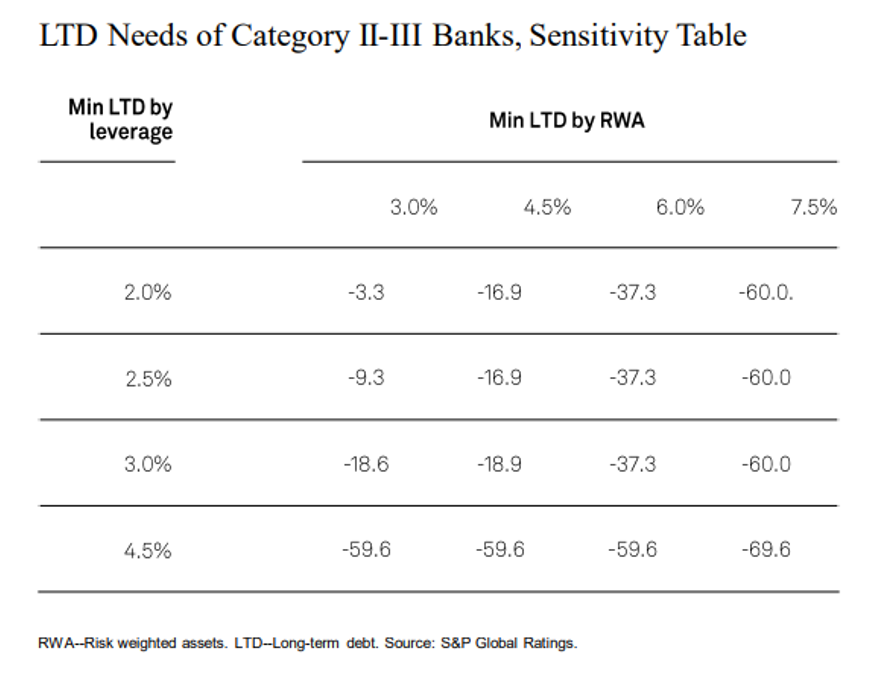

This could lead to significant issuance needs for affected LBOs. S&P, Fitch and Bloomberg have estimated this shortfall of eligible debt, which for the G-SIBs is defined as straight debt securities issued from the holding company with a maturity greater than one-year, to be potentially in the $90 billion rage depending on minimum requirements. S&P Global Ratings estimate’s for LTD shortfall by Category II and III banks are shown below.

Source: S&P Global Ratings

As of November 16th, 2022, the six Category II and III banks had ~ $181B of outstanding debt. Both Fitch Ratings’ and S&P Global Ratings’ estimate the banks would need ~ $60B of issuance to meet LTD requirements if set at the higher of 4.5% of leverage exposure or 6.0% of RWA. This equates to about 33% of current total outstanding debt.

Source: Bloomberg

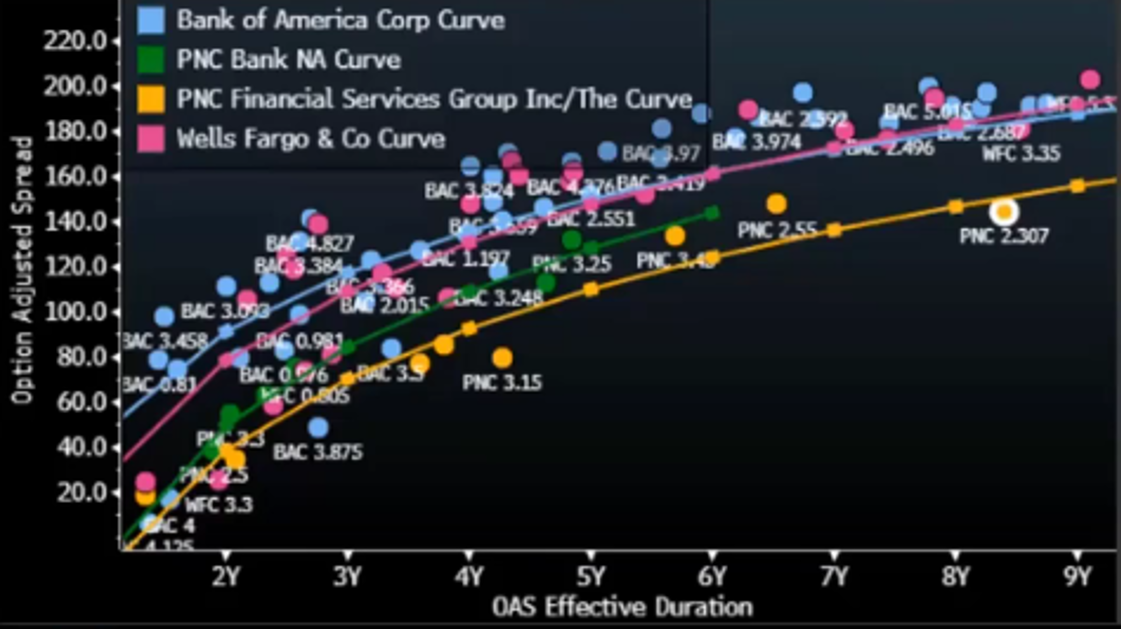

One byproduct of this potential scale of issuance is that it will likely lead to wider spreads for affected super-regional banks. For example, option adjusted spreads of PNC are materially tighter than similarly rated G-SIBS Wells Fargo and Bank of America. While this can’t be pinned on any individual factor, increased issuance in order to meet LTD regulatory minimums certainly contributes. Imposing these requirements on LBOs would likely tighten the gap between these spread levels. While it is expected that there would be a phase-in period of a year or two to allow these banks to meet minimum requirements, thereby spreading out this issuance, the higher yields and Category II and III banks’ larger participation in markets could provide opportunities to scoop up high quality securities at attractive prices for cash investors.

Source: Bloomberg

In addition, the implementation of LTD requirements would likely have positive rating implications. If these requirements were imposed at the holding company level, thereby creating a single point of entry (SPOE) resolution strategy, the higher level of holding company debt would reduce the expected severity of loss given failure at the holding company level. This may put upward pressure on the banks’ Moody’s and Fitch ratings’. S&P rating’s only account of the probability of default, thus holding company ratings would not be uplifted by implementing an SPOE resolution strategy. An SPOE strategy may be the most likely as this is considered the cleanest option in a resolution situation and is the resolution strategy imposed on the G-SIBS.

If LTD requirements were imposed at the operating bank level, thereby continuing the current multiple point of entry (MPOE) resolution strategy, then the rating implications would be less clear. The FDIC would have to provide guidance as to the most likely option to resolve an LBO under a MPOE strategy to understand how creditors would be affected. Generally speaking, the implementation of LTD requirements at either the holding company or operating company level would be a credit positive as positive effects of increased LTD in a resolution event would more than offset the negative ratings pressure of increased leverage driven by the need to meet requirements.

As the banking system continues to evolve, regulatory measures must evolve as well. Regional banks’ growth in the previous decade poses increased risks to the financial system if one were to fail. With a few approaching and surpassing Lehman Brothers’ total assets at the time of its bankruptcy, it is becoming increasingly clear these banks must be resolved in an orderly fashion if one were to become insolvent. LTD requirements for LBOs would create a more stable banking system, while providing benefits to cash investors. LBOs increased issuance could give investors greater opportunities to purchase these highly rated names at attractive spreads, providing both issuer diversification benefits and greater returns.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.