Shifting Tides: Inflation and Recession Risk

Inflation and recession, two words on the top of every investor’s mind right now.

In our recent post on Inflation Winners and Losers, we talked about how the near-term outlook for inflation is relatively entrenched. This matters because the Fed has thrown the weight of its credibility on reducing inflation, raising interest rates aggressively since March to make up for its initial mistake of treating inflationary pressure as “transitory.” The fear amongst market participants now is that this rapid tightening may lead to a bullwhip effect, overshooting the Fed’s goal of simply bringing down inflation and instead resulting in a recession. Exacerbating this fear is that the Fed has little in the way of real-time calibrating mechanisms to ensure that its policy is on course in real-time. Much like a pilot with a faulty radar, the Fed is flying blind.

Where We Are Now

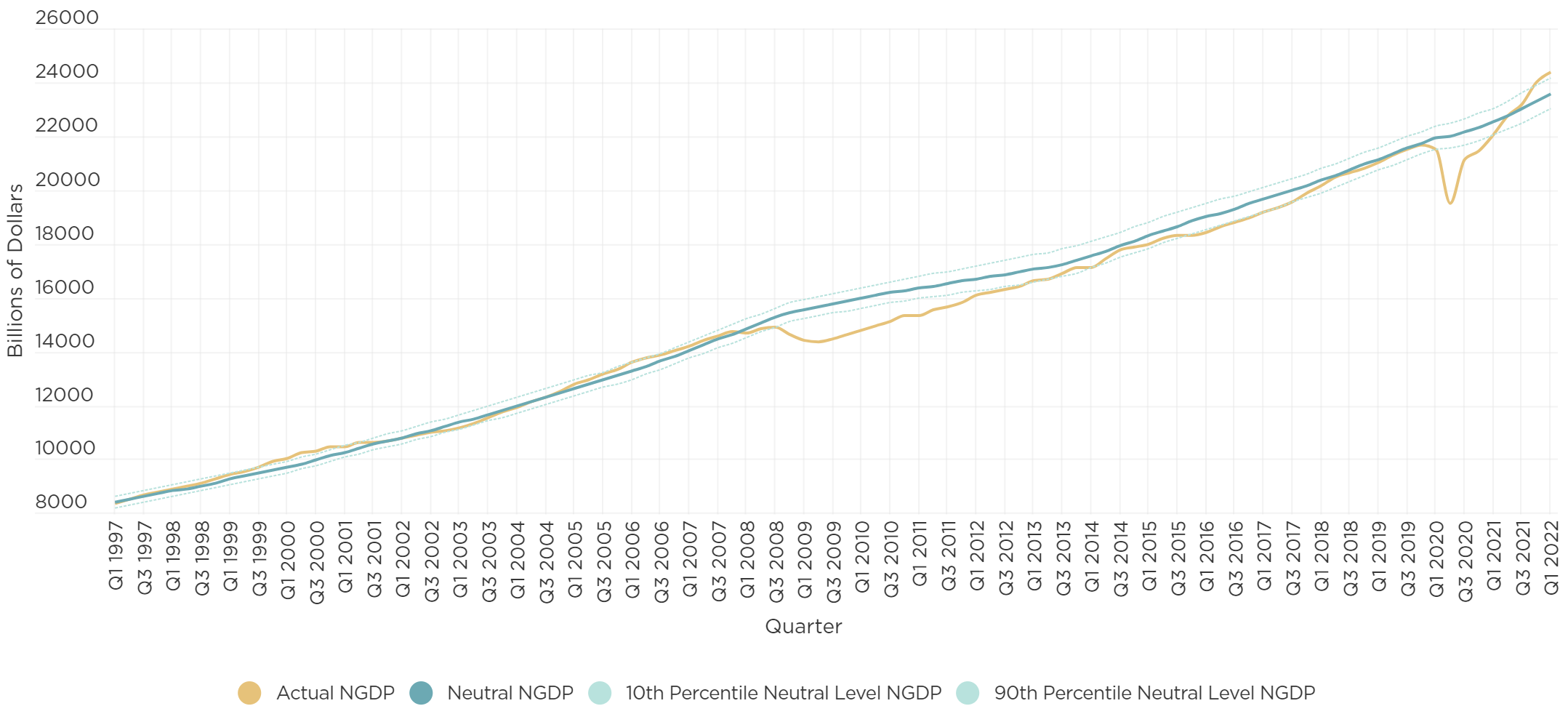

Despite what some reports suggest, the economy is not necessarily in a recession. It is now probable that Q2 will mark the second consecutive quarter of negative real GDP growth, clearing one of the markers that generally constitutes a “technical” recession. However, without a commensurate reduction in employment and/or income growth, it is unlikely that this technical downturn will result in the underlying financial or economic damage that would generally be associated with a recession. Moreover, with the labor market still red hot and nominal GDP running above trend (Figure 1) the current situation is more akin to an economy slowing, rather than falling.

Figure 1: Nominal GDP (Actual vs Neutral)

Source: Mercatus Center at George Mason University, https://www.mercatus.org/publications/monetary-policy/measuring-monetary-policy-ngdp-gap

That being said, forward looking indicators are blaring red. Financial conditions are tightening rapidly amidst the combination of a bear market in equities, rising long-term interest rates and an appreciating dollar (Figure 2). Risk assets such as high-growth tech stocks and cryptocurrencies have been in free fall as investor sentiment has turned sour. Mortgage rates have reached multi-decade highs, resulting in a decline in housing sales activity. Retailers are accumulating unwanted inventory as consumer demand for goods (which surged during the height of the pandemic) has begun to dampen. Most significantly, the yield curve is now inverted outside of a year. The closely followed 2-to-10-year spread is -0.22% as of 7/20/22, and an inversion of the 3 month-to-10 year spread seems all but inevitable. As a result, the probability of a recession in the near-term is unusually high; a recent Fed paper put it at >50% over the next twelve months.

Where Do We Go from Here?

Consensus is that the current situation is untenable, but how it plays out is anyone’s guess. In assessing the path ahead there are a few things investors should keep in mind.

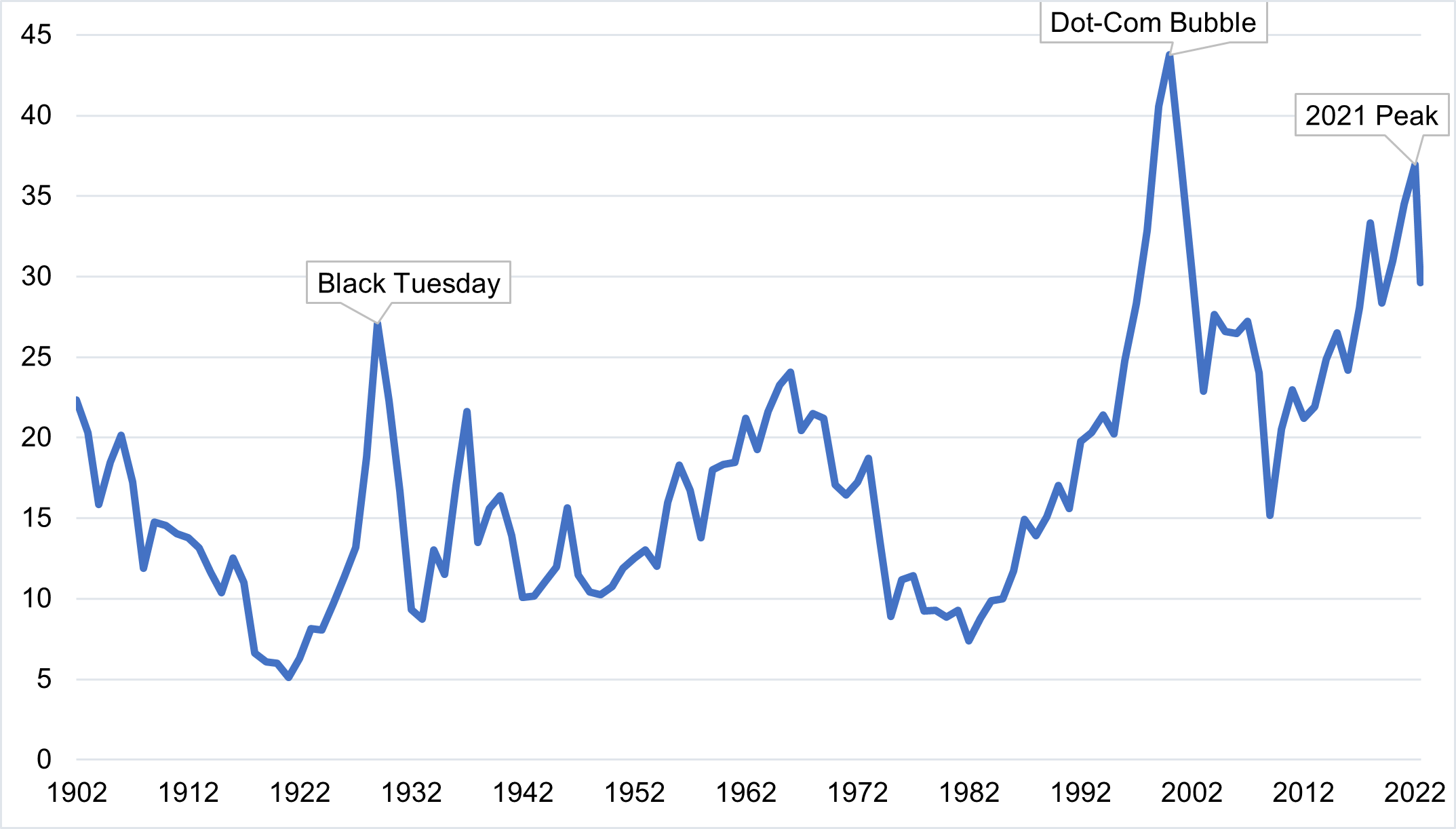

1. The Current Situation Bears Some Resemblance to the Dot-Com Bubble

In many ways the post-pandemic period parallels what happened during the Dot-Com Bubble of the early 2000s. Much like today, that period saw investors flock to high-growth companies based on the promise of a burgeoning technology: the Internet. This exuberance sent valuations soaring to levels unmatched since (Figure 2).

Figure 2: Shiller Cyclically Adjusted Price-to-Earnings (CAPE) Ratio

Source: Robert Shiller, Yale University, http://www.econ.yale.edu/~shiller/data.htm

That sentiment was crushed by the onset of the Fed’s tightening cycle. The Fed raised interest rates from 4%-to-7% over the eighteen-month period from December 1998-to-June 2000, leading to a 78% collapse in the Nasdaq from peak-to-tough.

Despite the damage to equity markets, the broader economy emerged relatively unscathed. The Fed was able to reverse course on rates and the subsequent recession lasted just two quarters, over which time real GDP declined by less than 1% and unemployment rose by less than 1.5%.

The positive case for the outcome over the next 12-to-24 months is similar. A slowdown or minor recession is possible, triggered by a blowup in the technology space, which results in a bear market for equities but doesn’t trigger a wider financial panic that impacts the real economy.

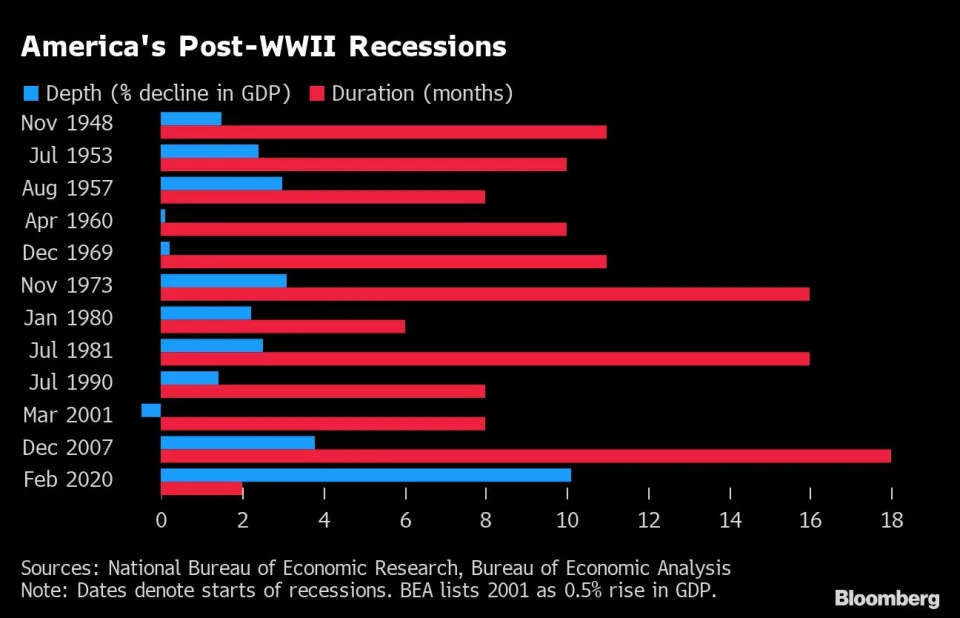

2. The Dot-Com Bubble Was the Exception, Not the Rule

In recent times, however, recessions have tended to be longer and more severe than the Dot-Com episode. A glance at the data reveals that over time, the duration of the U.S. business cycle has lengthened, with longer periods of expansion post-1970 complemented by longer recessions (Figure 3). The exception here is the COVID-shock, which has no precedent in the post-Depression era.

Figure 3: America’s Post-WWII Recessions

Source: Bloomberg, Yahoo Finance, https://ca.news.yahoo.com/long-moderate-painful-next-us-140001861.html

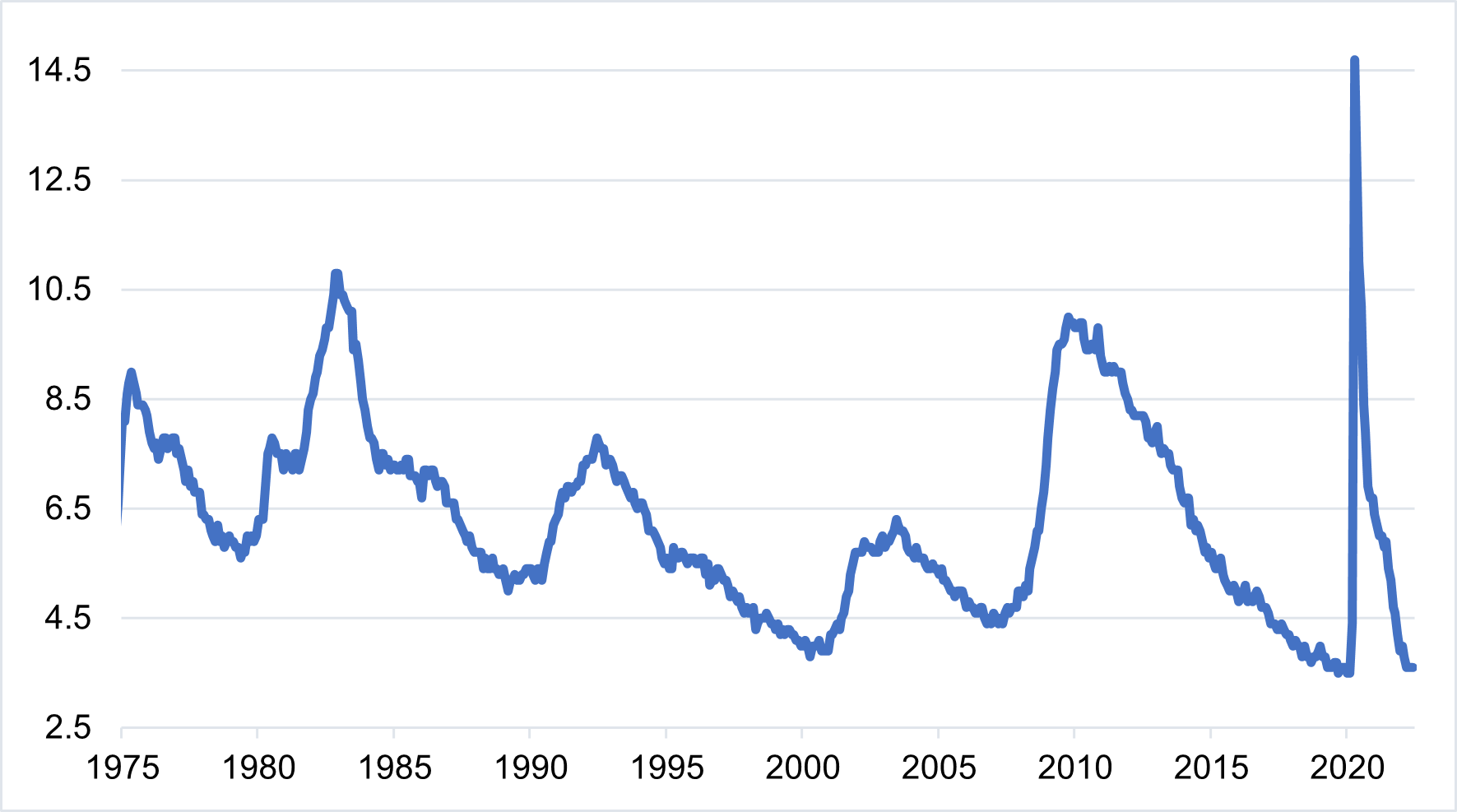

While a 2008-type event seems unlikely given the severity of that decline, it is probable that the current combination of rising interest rates and tighter financial conditions will put downward pressure on business investment and consumption. The risk is that this pressure may lead to a swift tidal change in the labor market, as historically the unemployment rate tends to fall slowly but rise rapidly (Figure 4).

Figure 4: U-3 Unemployment Rate

Source: FRED, BLS

3. The Fed Is the Swing Factor

Ultimately, much depends on the Fed’s reaction. In the near-term, the Fed is on a pre-set course to tighten policy until it reaches a restrictive level and brings down inflation. For what is most likely the remainder of 2022, the question from meeting to meeting will not be whether the Fed will raise rates, but rather by how much.

Once the impacts of tightening start to kick in, however, the Fed’s task will get more complicated. For the first time since the pre-Great Recession era, it will have real scope to significantly cut interest rates to fight a downturn.

However, there’s no guarantee it will be able to cut rates at that point. Inflation expectations remain well anchored, meaning that the risk of the sort of wage-price spiral seen in the 1970’s is minimal, and that inflation should be expected to come down over time. But it is difficult to predict with any degree of certainty when that will occur. As such, the Fed may face a situation where the economy is headed into recession, but inflation readings are still uncomfortably high.

The existential question at this point will be, what part of its dual mandate does the Fed prioritize, inflation or full employment? The market is relatively sanguine on this, projecting that the Fed funds rate will decline only slightly after it peaks in early 2023. However, given the magnitude of recent central bank moves we would expect a starker move in rates, in either direction.

4. Europe

Europe could be the canary in the coal mine for the U.S., depending on how events transpire over the course of the year. A resolution to the conflict in Ukraine would be a clear positive for the global economy, as it would allow for a rebuilding of Ukraine, bring down commodity prices, and ease the strain on global food supplies. Even without a removal of the sanctions on Russia, there would be positive spillover effects to the U.S. by way of lower inflation, higher trade activity and marginally better growth. In turn, this could prove significant in allowing the Fed to thread the needle of achieving its desired soft landing.

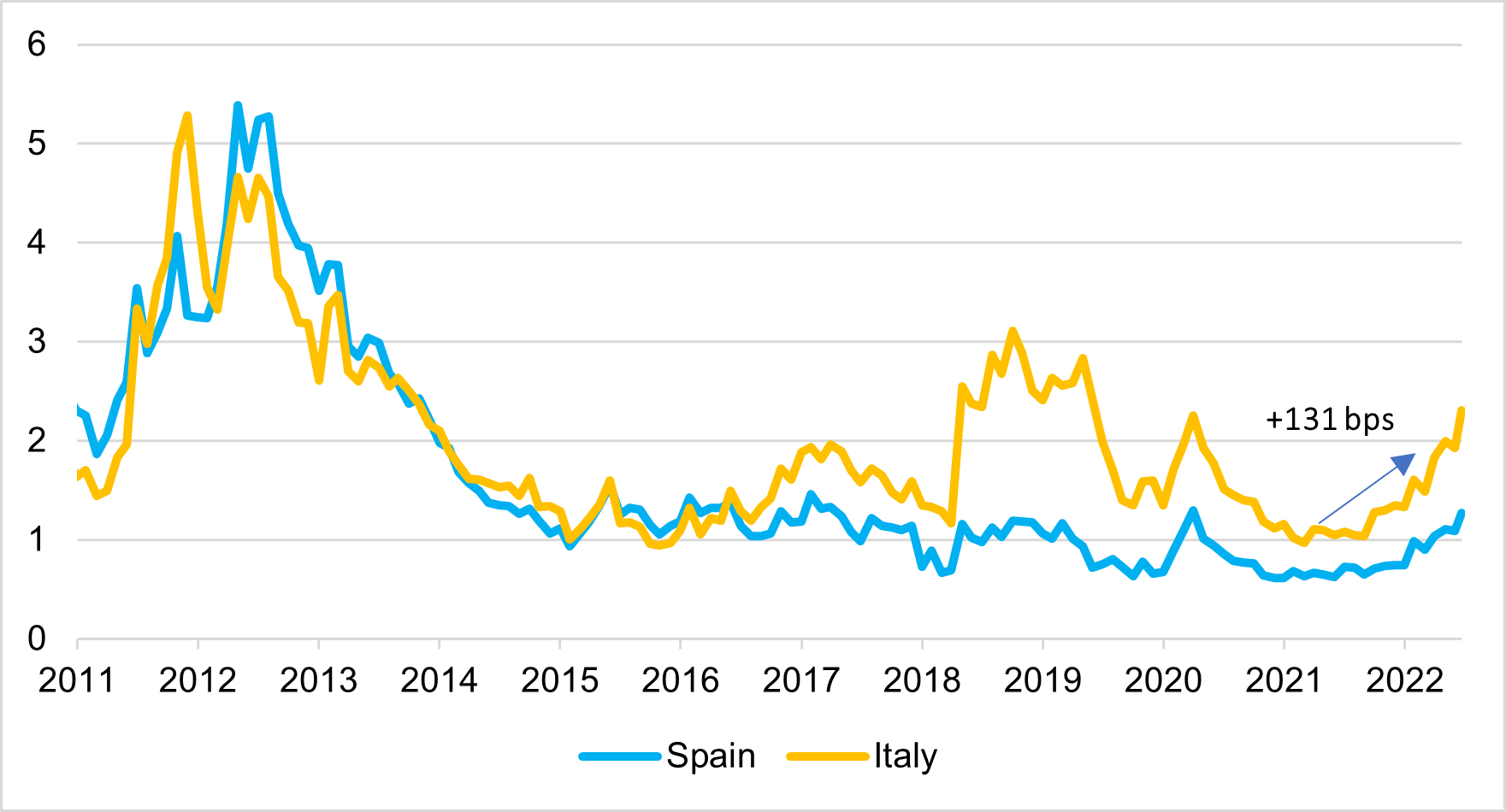

Conversely, the conflict may well drag on for much longer, and Europe is already showing signs of stress. The ECB has only now begun to tighten policy, just as the euro has fallen to parity with the dollar. The ongoing threat of Russia closing the Nord Stream natural gas pipeline raises concerns of potential energy rationing which would result in further price pressures and constraints on industrial production. Further, sovereign bond spreads of peripheral EU nations are widening out, always a red flag for European investors (Figure 5). Should these symptoms manifest themselves as a recession there, it could be a signal to U.S. investors to expect the same here.

Figure 5: European Government Bond Spreads Over Germany (%)

Source: : Bloomberg

Conclusion

The question for investors is how this impacts their portfolio strategy. With the economy possibly headed into a recession, the rule of thumb would be to extend maturities due to the expectation that the Fed will need to cut rates in the future to combat it. However, the added variable of high inflation complicates this logic. As Dario Perkins points out, stable inflation is the entire rationale for central bank existence and independence. When push comes to shove, no central banker wants the legacy of Arthur Burns, the man who let inflation spiral out of control in the 1970’s.

For this reason, there is upside risk to rates, at least in the short term. In the 1980’s Paul Volcker raised the Fed funds rate to as high as 18% to break the back of inflation. And while no one would argue for a similar move today, with core inflation running at approximately 5%, and one-year-ahead expectations in the 6% range, the market’s current projection for a peak fed funds rate of approximately 3.5% looks rather light. Moreover, with the yield curve so flat beyond a year, it’s arguable that investors aren’t being properly compensated for maturity extensions that come with increased duration and credit risk.

On the flip side, there are already signs that headline inflation is coming down. Gas prices have fallen from a nationwide average peak of $5.01 per gallon in June to $4.49 per gallon by the end of July. Supply chain constraints are generally easing, and some private sector data suggests that rent prices may start coming down in the next 6-12 months. Should all of that happen, the Fed may end up having the scope to aggressively ease policy next year. Either way, rate volatility looks here to stay.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.