Disruptions and Fed Tightening

The global economic landscape and cash investing have experienced sizeable market shifts in the past year due to the ongoing disruptions to supply chains, geopolitical tensions with the conflict in Ukraine, rising inflation across the globe and the Federal Reserve’s interest rate tightening cycle. Institutional cash investors will need to monitor all these ongoing disruptions as they assess cash portfolios in the coming months. Rising interest rates could be in the cards for a longer period than expected as the Fed combats inflation and attempts to guide the economy to a soft landing.

Consumers spending: Consumer pocketbooks have remained robust, supported by strong household balance sheets that were propped up by government subsidies during the pandemic. While demand is expected to stay strong for the remainder of the year, consumers face a tough environment as they deal with rising inflation costs in almost all categories. The post-pandemic consumer has been eager to go to restaurants, travel and make up for lost time. Labor shortages remain a concern, with job postings staying elevated and businesses unable to fill much needed positions to satisfy increasing demand for services and goods.

Supply chain disruptions: The supply chain slowdowns that were a big part of the initial inflation surge had shown signs of easing in February. The backlog at major inbound ports in Los Angeles and Long Beach has fallen by half as exports from China have fallen by 30% due to a mix of pandemic-related lockdowns and lower consumer demand for goods. However, the good news may not last as retailers adjust to earlier shipment schedules to beat the rush for inventory buildup for the Christmas season, while any easing of lockdowns in China could ramp export levels higher. Furthermore, geopolitical risks with the Russia-Ukraine conflict have caused rising energy prices, disrupted trade routes, inflated transportation costs and caused shortages of food and materials. Energy prices have also remained elevated with the US and UK banning Russian oil imports as the European Union pushes its member states to adopt similar policies.

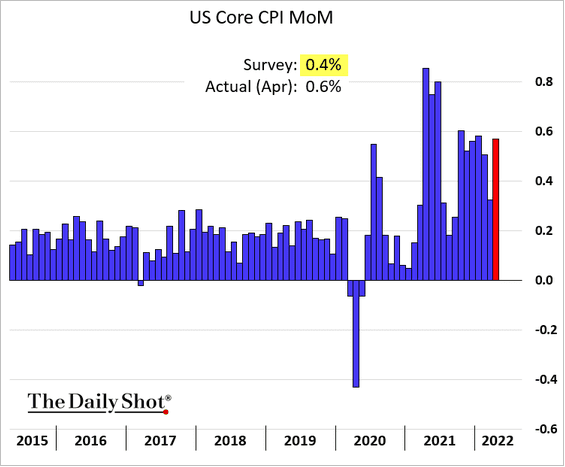

Source: The Daily Shot

Inflation: Consumer Price Index reading in April showed a still elevated annual rate of 8.3%, drifting slightly lower from 8.5% the previous month. The headline number primarily reflected lower gas and used cars prices while groceries, air travel, dining at restaurants and new vehicles prices rose. On a monthly basis, CPI rose 0.3% and core-CPI, CPI after stripping out volatile food and energy, rose 0.6%. Persistently high inflation will lower real wages and household purchasing power, which could potentially tip the economy into a recession by lowering overall demand.

Interest Rates: To combat the surge in prices, the Federal Reserve has transitioned to a new rate tightening cycle and increased interest rates by 75 basis points since the beginning of the year. Expectations are that they will continue to aggressively raise rates until inflation is under control, and the next two meetings could see a minimum 50 basis point increases each. Recent Fed commentary has emphasized the importance of bringing inflation down, regardless of its effect on the economy. This could put the Federal Funds Rate in the range of 2.50%-2.75% by year end, a dramatic increase from just a year ago.

In this environment, cash investors need to account for the rapidly rising interest rate regime. As the Fed hikes rates aggressively, cash investors should position portfolios for shorter maturities until there are signs of inflation levels easing. Positioning the portfolio for greater liquidity also has the advantage of keeping adequate capital in case the Fed is unable to guide the economy to a soft landing. Fed tightening cycles have frequently led to recessions by driving slower demand. In the coming months, investors should continue to monitor inflation-related data, the strength of consumer demand, resiliency of corporate profits, and follow through by Fed to aggressively raise rates.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.