Venture Debt: Why Timing is Everything

The old adage in corporate debt financing is “The best time to borrow is when you need it the least.” But the concept of timing when it comes to debt financing can take many different forms. This blog post intends to address some of the potential timing issues around debt financing and where and how time can either help or hurt a deal.

1. Cash Runway Extension – Optimal Timing

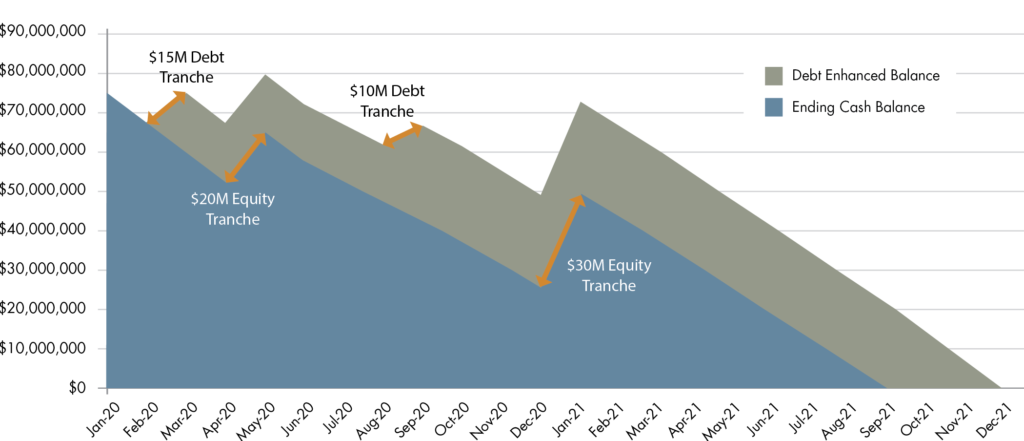

This is a classic use of proceeds for many cash-burning companies. Whether raising additional cash through debt is a means to achieve a critical milestone, or a bridge to profitability or an IPO, this less-dilutive form of financing requires some consideration when it comes to timing. It starts with a simple calculation of projected cash needs, with a debt financing layered on top of available cash to assess any likely extension of cash life. Available leverage typically may allow a company to extend its cash life from 3-to-8-plus months, and the 5-plus month delta between minimum and maximum cash life extension can be critical:

Example: Cash Runway Extension  Source: Capital Advisors Group, Inc. For illustrative purposes only.

Source: Capital Advisors Group, Inc. For illustrative purposes only.

However, maximizing cash life extension with debt financing requires careful consideration of the timing of the transaction. The calculation is most critical (but oftentimes simpler) for companies that do not generate revenue. In these circumstances, financing for maximum runway extension can typically be found with between 12 and 18 months of remaining cash. If a company is too late in seeking debt (i.e. with only 12 months of remaining cash or less, without near-term plans to raise additional funds) lenders may shy away from a deal. Conversely, while a company with too much cash on hand may be attractive to lenders, pure runway extension may be diminished over time as term loans begin to amortize.

If a company is generating revenue and demonstrating solid growth, there are certainly more factors in play when considering debt financing. However, pure runway extension is not always the goal for such companies. Typically, debt is used in these cases to further support growth and expansion. These cases lead to our second point.

2. Timing of Equity Versus Debt

For revenue-generating companies, debt financing may serve many purposes along the growth path. Typically, debt is used to spur growth. Sales and marketing investment, acquisition of a smaller competitor or complementary technology, or inventory or equipment purchases may all be good uses of funds via debt. Obviously, timing is critical in each scenario. They need to boost sales and marketing before revenue plateaus or dips; an acquisition must be fully considered and well underway (i.e. cost negotiated and LOIs signed) before lenders might feel comfortable financing such a move; and equipment purchases should be made in order to support growth, not stem the bleeding.

All too often we find ourselves having conversations with companies that are just a bit late coming to the debt market. Often, they are seeking debt to get through a rough patch or are hoping to slow high churn, which is likely more of an operational than financial issue. Lenders can see right through the story one hopes to tell in these cases, because the numbers don’t lie. Oftentimes, when performance has leveled off or declined and cash is dwindling, lenders will utter a very common phrase: “This one looks like equity risk.”

3. Timing of the Deal Itself

Among the most common question we get from companies is simply, “How long does it take?” There are many considerations that factor into the answer to this question. First, are all the stakeholders in this transaction aligned and on board? Or, is management on board, but the board of directors wants to kick the tires of financing options? Is the company confident that the deal size and structure is appropriate and available? The industry is rife with examples of companies coming to market seeking far too much leverage or trying to structure transactions in ways that would be unsuitable from any lender’s perspective. Such inappropriate asks can lead to significant wasted time. Finally, is the company prepared to potentially face covenants and give up warrants depending on certain lenders’ requests? If such conditions aren’t expected going into a deal and/or won’t be accepted by the board, negotiations will likely stall the process.

Under ideal conditions, when all stakeholders are aligned, when deal size and structure expectations are appropriate, and when all potential conditions of a loan are understood and expected (and no external events negatively impact the company in the midst of the deal), a competitively sourced transaction with multiple potential lenders engaged should take around 6-to-8 weeks, plus or minus a week or two, from kick-off to signed term sheet. Then, confirmatory due diligence and final documentation may take an additional 2-to-4 weeks. There are many factors that can shorten these timelines or significantly extend them. However, as companies consider debt financing and the oftentimes critical timing of it all, these are general deal timelines to consider.

The examples above are just a few of many reasons timing is critical when it comes to debt financing. In all cases, knowledge is key. Sometimes an advisor, well versed in the debt markets, can help cut through the clutter to provide the necessary insight that will save the company time and hassle when it comes to securing this specialized form of financing for growing companies.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.