Federal Reserve’s Economic Projections

FOMC Meeting

The Federal Reserve left interest rates unchanged at yesterday’s meeting on monetary policy, and in the statement accompanying the meeting, the Fed commented that “Economic activity and employment have picked up in recent months but remain well below their levels at the beginning of the year.” And while “Overall financial conditions have improved in recent months”, considerable uncertainty remains regarding the path of the economy. The FOMC continues to believe that “The ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.”

Acknowledging the high levels of uncertainty, Chair Powell commented during his press conference following the meeting: “Effectively, we’re saying rates will remain highly accommodative until the economy is far along in its recovery”. This stance is in line with recent changes to the Fed’s long-term policy framework in which the central bank indicated that it’s prepared to tolerate inflation levels that run above 2% for some time and low levels of unemployment.

Federal Reserve’s September Summary of Economic Projections

Alongside its regular statement on monetary policy, the FOMC provided an update to its Summary of Economic Projections for the first time since June. Of note, the Committee is currently forecasting that the overnight lending rate will remain unchanged through 2023, a year longer than the estimate provided last quarter. The Fed’s report was generally more optimistic than the previous version, with a few additional highlights to mention:

- Unemployment rate: projected to decline to 7.6% by the end of 2020, to 5.5% by late 2021 and at 4.0% by 2023. June’s estimates stood at 9.3% for 2020 and 6.5% for 2021 (no projection previously provided for 2023).

- Core PCE inflation: projected at 1.2% by the end of 2020, 1.7% by late 2021 and at 2.0% by 2023. June’s estimates stood at 0.8% for 2020 and 1.6% for 2021 (no projection previously provided for 2023).

- GDP: projected at -3.7% by the end of 2020, 4.0% by late 2021 and at 2.5% by 2023. June’s estimates stood at -6.5% for 2020 and 5.0% for 2021 (no projection previously provided for 2023).

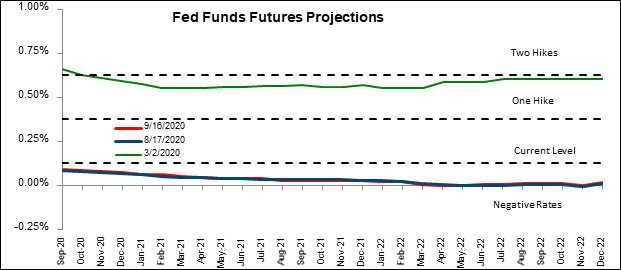

Fed Funds Futures Contracts

Futures contracts continue to indicate that the effective Fed funds rate is likely to decline toward the bottom of the Fed’s target range from its current level near 0.08%.

Source: Bloomberg

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.