Credit Card Asset-Backed Securities – So Far, So Good

Because credit card asset-backed securities (ABS) are tied directly to the strength or weakness of consumer finances, economic downturns can be perilous to their health. Therefore, it’s no surprise that the high unemployment and low consumer spending in the current economic downturn are putting ABS under scrutiny. So far, however, this class of securities has fared relatively well. Since the 2008 financial crisis, the trusts that hold the securities have maintained higher-quality collateral, and defense mechanisms in their charters have further reduced risk. Moreover, fiscal and monetary support from the Fed and Treasury have moderated economic stress on consumers so far. But as the pandemic continues, the road ahead is anything but certain.

Overview of Current Conditions

The coronavirus pandemic heavily affected economic activity and employment in the US, resulting in a direct negative impact on household finances nationwide. Social isolation measures all but froze the U.S. economy in its tracks, ending the longest economic expansion in U.S. history. Importantly, the crisis also impacted consumers disproportionately, with the worst impact on industries typically employing lower income workers, such as hospitality and retail. Today, the unemployment rate remains above 10%, reflecting the extent of the damage, while consumer spending contracted dramatically as a result of financial strains and the decrease in spending opportunities that the lockdowns precipitated.

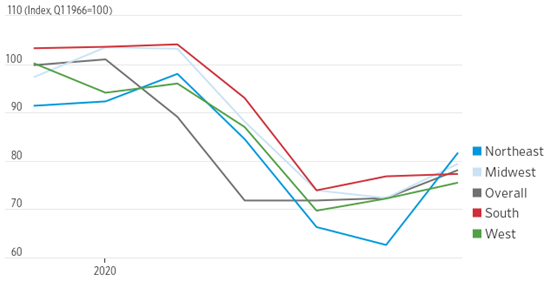

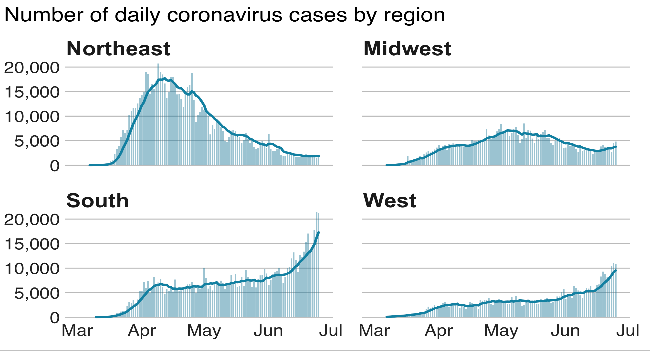

Despite the gradual reopening, economic activity has rebounded only slowly, with consumer confidence remaining below pre-crisis levels, correlating at least in part with the virus’ spread (Figures 1 & 2). This dynamic is likely to persist until the development of a vaccine, which under optimistic assumptions is likely to arrive sometime in 2021.

Figure 1: University of Michigan Index of Consumer Sentiment, by Region

Source: Surveys of Consumers, University of Michigan

Figure 2: Outbreaks are Growing in Some Areas of US

Source: BBC, COVID Tracking Project data using Census Bureau regions.

How Do Credit Card Trusts Deteriorate?

Due to the close correlation between credit card trusts’ collateral performance and consumer finances, credit card ABS will be impacted negatively by higher unemployment, lower consumption, and lower incomes, which reduce the capacity of households to service their debts. The impact of such macroeconomic shocks would normally be seen in lower repayment rates as households conserve liquidity, in lower collateral yields as consumption falls, in a decrease in transaction volumes and interchange fee collections (which accounts for about 30% of credit card yields), and in higher delinquencies leading to charge-offs, which reduce the size of the collateral pool. Combined, these effects would weaken a trust’s credit enhancements and, absent support from the originator, could trigger an early amortization event.

Early amortization is a defense mechanism that utilizes the trusts’ cash flow discretion to ensure certificate holders are made whole. It diverts interest and principal cash flows from both repaying and performing accounts to pay off the trusts’ certificates, thereby reducing investor exposure to further collateral deterioration. Despite support from this mechanism, a severe enough shock could still result in principal erosion for investors.

Additionally, early amortization events effectively shut down the trusts. And because trusts tend to represent the main sources of funding for credit card issuance, there are strong incentives for an originator to intervene and keep the trust operational. This can be done by selling receivables to the trust at a discount to boost yields, as well as via collateral substitution (swapping non-performing accounts with performing ones), amongst other means.

Consequently, a trust’s effective performance is largely grounded on the originator’s financial strength and the resulting ability to provide support. In fact, rating agencies partly base credit card ABS ratings on the ratings of their originators.

What this means from a credit perspective is that, absent an inability by the originator to provide support, or absent an inability by the trust to liquidate its receivables in the secondary market, a trust is unlikely to experience a downgrade and/or enter early amortization. This helps explain why of all structured products, credit card ABS have historically been one of the most resilient.

Where We Are Today

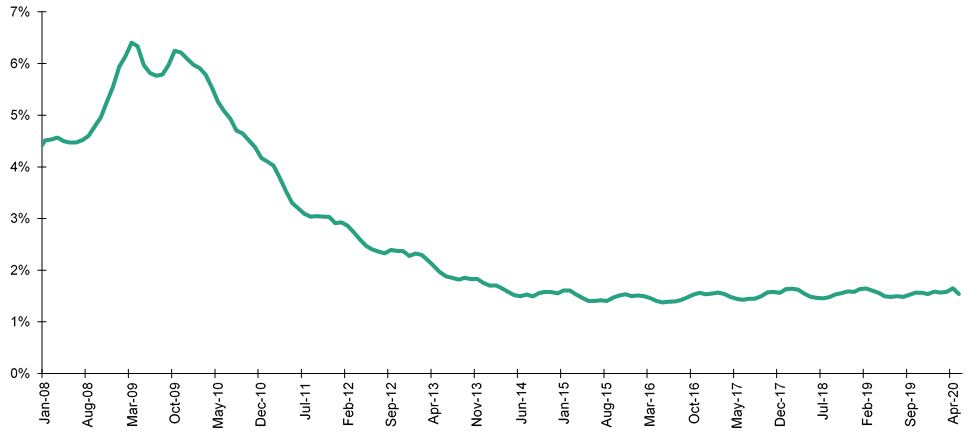

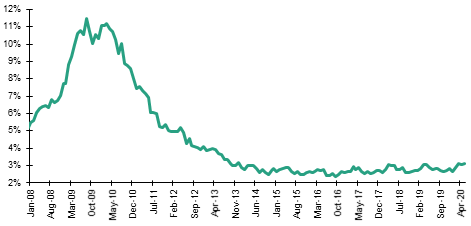

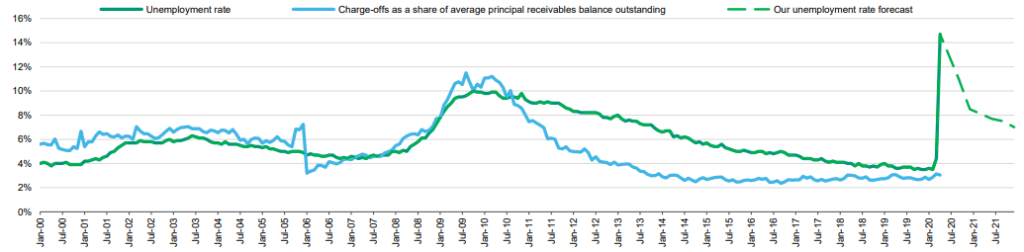

As the impact of the coronavirus crisis became apparent, economists forecasted a downturn that was likely to overshadow the 2008 financial crisis. In response, the federal government and state authorities embarked on an unprecedented round of stimulus to support economic activity. This has provided significant support to consumers, and by extension helped put a backstop in the deterioration of credit card trust collateral performance metrics. As Figures 3, 4 and 5 show, delinquencies and charge-off have remained low despite a dip in repayment rates. At the same time, interestingly, the historically high correlation between the unemployment rate and charge-offs has moderated (Figure 6).

Figure 3: Total Delinquency Rate

Source: Moody’s Investors Service, based on company filings

Figure 4: Charge-off Rate

Source: Moody’s Investors Service, based on company filings

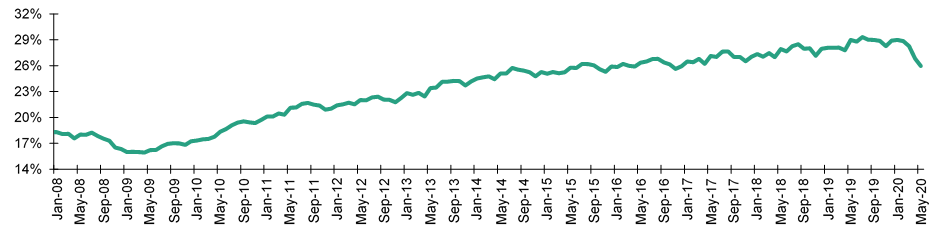

Figure 5: Payment Rate (3-mo avg)

Source: Moody’s Investors Service, based on company filings

Figure 6: Credit Card Charge-offs Not Rising as Notably as Unemployment Yet

Source: Bureau of Labor Statistics, Moody’s Investors Service, company filings.

While fiscal support has certainly been a main contributor to the benign deterioration in collateral performance metrics, it is important to note that risk profiles of both the credit card originators and the collateral pools have improved since the last financial crisis. This is in part reflected in the historically high collateral performance seen prior to the pandemic (Figures 3 & 4).

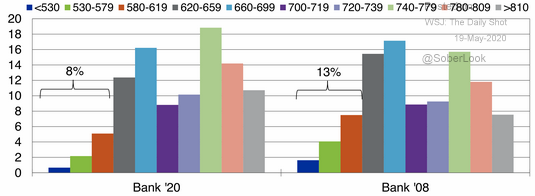

The enactment of the Credit Card Act of 2009 forced credit card originators to revisit their practices, as tighter regulation and lesser ability to extract fees pressured revenues. Originators responded, among other ways, by tightening credit standards to reduce credit costs, resulting in higher quality collateral (Figure 7).

Figure 7: % of Outstanding Balances by Risk Score Band

Source: Equifax, Creditforecast.com, Moody’s Analytics

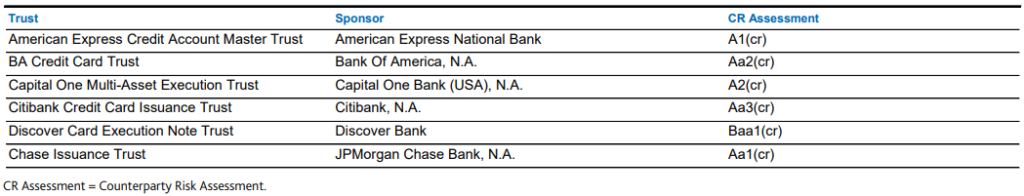

Furthermore, post-crisis capital regulations increased the resiliency of financial institutions and, by extension the resiliency of the overall financial system. Credit card originators today are highly rated (Figure 8), well capitalized, and have diversified income streams.

Figure 8: Big Six Sponsors have Robust Credit Strength

Source: Moody’s Investor Service

What This Means for the Future

Due to inherent delays in the flow-through of economic conditions to collateral performance metrics, the extent to which stimulus measures have mitigated the economic hit to households remains uncertain. Forbearance policies put in place by card issuers to support households add an additional element of complexity, as they can mask the true credit impact of the crisis.

Even so, uptake of these measures by consumers has been low in the case of credit cards, with some continuing to make payments even post-enrollment to such programs. The utility of credit card accounts is higher during times of financial stress since they can serve as a temporary substitute to income. This creates an incentive for consumers to continue making payments in order to retain access to charging privileges. While fiscal support for households remains instrumental until conditions normalize, the Federal Reserve has also stepped forward with the revival of its term asset-backed securities loan facility (TALF). This hints at the systemic importance of these vehicles in the provision of credit to consumers.

Nevertheless, while taking comfort from the mitigating effects of the extraordinary policy support currently at play, investors must remain vigilant. The uncertain nature of the current crisis, both in terms of its length as well as its potential breadth, leaves a lot of unknowns regarding its long-term implications for the U.S. economy, the U.S. consumer, and the path to recovery. Close monitoring of one’s portfolio, the changing dynamics of the pandemic, and its effects on the economy remain paramount to a resilient investment policy.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.