Interest Rate Outlook: Markets Hopeful

Protesting Police Brutality

Nationwide protests continued for the seventh day and night following the killing of George Floyd while in the custody of Minneapolis police. President Trump has considered invoking the Insurrection Act of 1807, which would allow the deployment of active-duty military personnel in response to civil unrest. The law was last used in response to civil disturbances following the assassination of Martin Luther King Jr. and in Los Angeles in 1992. During a call with state governors on Monday President Trump maintained an aggressive tone and stated, “I wish we had an occupying force.”

Markets Hopeful

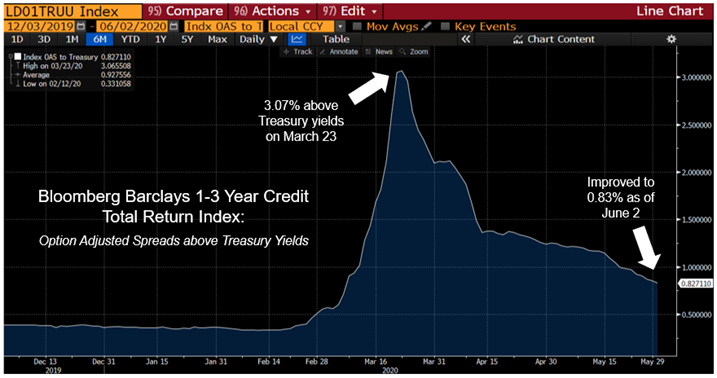

Equity markets are hopeful for positive developments despite highly unpredictable economic and health risks as states continue reopening efforts. The S&P 500 continues to regain ground and is now down only about 5% for the year. High-quality bond yields have compressed further since yield spreads peaked in late March; the 2-year Treasury yield is down to 0.17% while the 10-year currently yields 0.67%. Bid-to-ask spreads in secondary markets indicate robust and efficient trading across the range of investment-grade ratings.

Source: Bloomberg

Fed Meeting

The Fed’s Open Market Committee meets next week on the 9th and 10th and, given Fed unanimity against negative interest rate targets, the Committee is expected to address asset purchases and forward guidance. The FOMC’s potential policy tools could include explicit rate caps on benchmark Treasury yields or a framework for asset purchases and overnight rates tied to inflation targets.

The Fed began purchasing enormous amounts of Treasury and agency mortgage backed securities in March (totaling more than $2.2 trillion since then) in response to market disruptions and has gradually been reducing the pace of its purchasing. Planned weekly purchases are down to $22.5 billion for next week compared to as much as $375 billion a week in the March timeframe. The Fed’s stated goal for the recent asset purchases was to restore normal market function – which appears to have been achieved. Nevertheless, the Fed may continue weekly asset purchases and adjust its rationale for them; from 2012 to 2014 the Fed used asset purchases to stimulate economic activity rather than to help normalize markets.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.