Interest Rate Outlook: Bond Market Liquidity Normalizing

Economic Shutdown

We are only just seeing initial readings on the state of the post-COVID 19 economy and much will unfold in the months ahead. Data released in early April reflects the dismal reality of the large-scale shutdown of the US economic growth engine. Jobless claims have surged to record levels, with more than 22 million Americans filing first-time claims since the COVID-induced lockdown began in March. In a stunning statistic, the number of jobs lost in just the last month exceed the 21.5 million that were created in the 11 years since the most recent economy recovery began in 2009. Monthly housing starts plunged in March by the most since 1984, while Philadelphia-area manufacturing activity sank by the most since 1980 in early April. Industrial production in March dropped by the most since 1946. Despite the disheartening implications for so many individuals, occasional bright spots may be found amidst the broadly negative economic news. For example, while new building activity plunged horribly in March (most notably by 42.5% in the Northeast), applications for building permits remained 5% higher than a year earlier.

Bond Market Liquidity

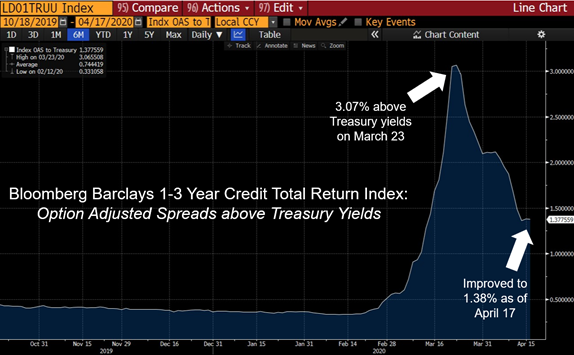

Short-term bond market conditions continued to normalize throughout the first half of April. Large liquidations from investment-grade fixed income mutual funds and ETFs drove credit spreads dramatically higher in mid-March, but the tsunami of shareholder redemptions from such funds has since subsided. With bond market supply and demand now much more closely aligned, credit spreads in high-quality, short-term issuers have recovered more than half of the ground that was lost in mid-March.

Source: Bloomberg

Fed Funds Futures

The Fed’s facilities to provide liquidity to various parts of the economy now exceed $2.3 trillion in total support. Given the breadth and depth of the pandemic fall-out impacting the US and global economies alongside the rapid ballooning of the Fed’s balance sheet, futures markets suggest no possibility that the Fed could lift overnight rate targets from the zero percent lower bound this year.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.