Interest Rate Outlook: Monetary Policy Report

Monetary Policy Report

In its semi-annual report to Congress submitted earlier this week, the FOMC stated that “The U.S. economy continued to grow moderately last year and the labor market strengthened further. With these gains, the current expansion entered its 11th year, becoming the longest on record.” The report noted that inflation remains below the Fed’s long-run objective of 2%, which in part allowed it to conduct three interest rate cuts last year. The Fed also made particular note of the state of the manufacturing sector, stating that “After increasing solidly in 2017 and 2018, manufacturing output turned down last year. This decline raised fears among some observers that the weakness could spread and potentially lead to an economy-wide recession. In general, a decline in manufacturing similar to that in 2019 would not be large enough to initiate a major downturn for the economy.” Additionally, the report pointed out China as a risk, stating “Because of the size of the Chinese economy, significant distress in China could spill over to U.S. and global markets through a retrenchment of risk appetite, U.S. dollar appreciation and declines in trade and commodity prices.”

Powell Testimony

Fed Chair Jerome Powell noted that while the domestic economy remains on solid footing, spillover effects from the Coronavirus could affect the outlook. In his testimony before the House Financial Services Committee, he noted “We will be watching this carefully. The question for us really is what will be the effects on the U.S. economy? Will they be persistent? Will they be material? That’s really the question,” going on to say, “There’s no way to be confident about anyone’s assessment, and there are a range of assessments.”

Fed Funds Futures

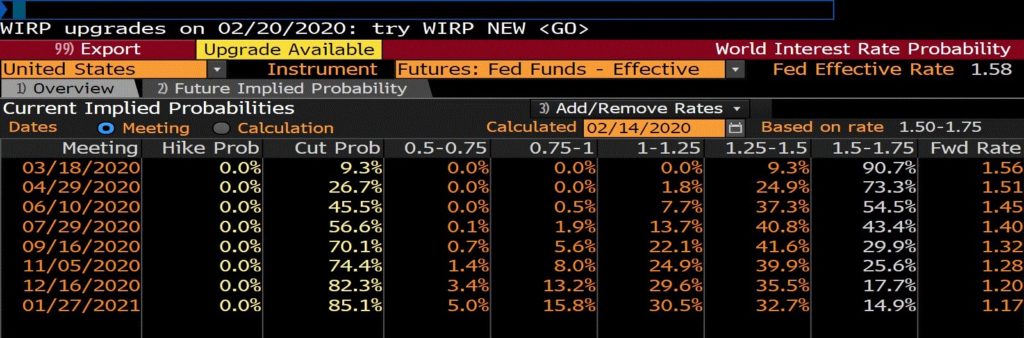

The current consensus within the Federal Reserve is that the overnight lending rate will remain unchanged throughout 2020. The markets hold a somewhat different view, however, with fed funds futures contracts pricing in a 25 basis point reduction in the rate by September and greater than 50% odds of a second cut by the December timeframe. This sentiment is largely unchanged from two weeks ago.

Source: Bloomberg

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.