Interest Rate Outlook: Closing out 2019

Strong Year for the Markets

After trending down on Tuesday morning, markets reversed course and closed the year on a high note. While they were off their December all-time highs, the S&P 500 and Nasdaq posted their best yearly performances since 2013, rising 28.9% and 35.2%, respectively, while the DJIA had its best year since 2017, rallying 22.3%. Treasury yields closed the year lower with the Fed-sensitive 2-yr note posting its largest 12-month decline since December 2008 while the benchmark 10-yr note fell by the most since December 2014. On the last day of 2019, the yield curve steepened as the 10-yr yield increased to 1.91% while the 2-yr yield declined to 1.56%.

Trade Outlook Improves

On December 13th, President Trump announced that the US had reached a Phase One trade deal with China, tweeting “We have agreed to a very large Phase One Deal with China. They have agreed to many structural changes and massive purchases of Agricultural Products, Energy, and Manufactured Goods, plus much more. The 25% Tariffs will remain as is, with 7 ½% put on much of the remainder….” The tariffs that were previously scheduled to take effect on December 15th were not levied as a result of the latest deal. Additionally, the President agreed to lower tariffs from 15% to 7.5% on approximately $120 billion worth of goods. Concurrently, a senior Chinese administration official stated that China would purchase a total of $200 billion of farm products and other goods from the US over two years.

On Wednesday, China’s central bank announced new stimulus measures to stoke growth in the world’s second largest economy. The People’s Bank of China stated it will reduce the reserve requirement for all banks, essentially freeing up 800 billion yuan ($114.9B) for banks to lend. The decision was widely expected and will take effect on Monday, January 6th.

Fed Funds Futures

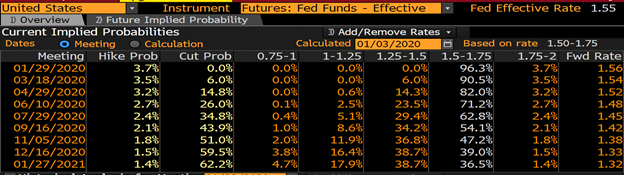

Market expectations for additional easing by the Federal Reserve have continued to soften. Current fed funds futures contracts are pricing in 60% odds of a full rate cut by the end of 2020, while the majority of fed officials expect no change in rates in 2020.

Source: Bloomberg

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.