Interest Rate Outlook: Markets Stumble as Yield Curve Inverts

Co-authored by: Carter Bourassa

On Wednesday, August 14th, 2019, the yield curve inverted when the 10-year Treasury note fell below the yield of the 2-year note. Equity markets dipped in reaction, with the three major indexes all suffering losses of more than 2.9%. Yield curve inversions are among the more reliable recession indicators; Credit Suisse reports that recessions follow, on average, 22 months after a yield curve inversion. The last such 2-10 inversion occurred in 2007. Adding to the stress in fixed income markets, the 30-year US bond yield dropped 15 bps to close the day at an all-time low of 2.02%, then fell further to 1.97% in early trading on Thursday and sits at 2.05% as of this morning. The inversion comes as the US-China trade dispute continues to escalate despite the White House delaying an estimated $300 billion in tariffs on Chinese-made electronics and toys.

Unrelenting Trade War

On Tuesday, August 13th, 2019, President Trump announced the delay of tariffs on electronics including laptops, smartphones, and gaming consoles, pushing the implementation of the tariffs back to December 15th from September 1st. Apple, among other electronics manufacturers, rallied on the news, as the delay is intended to prevent a rise in electronics prices during the holiday shopping season. China was unmoved, and halted purchases of US agricultural goods while allowing the value of the Yuan to drop, a move the Trump administration deemed “currency manipulation.” In China’s view, the now-delayed 10% tariff constituted a breach of the agreement reached during the G-20 summit. Chinese officials indicated retaliation is imminent, but the next developments remain unclear.

Fed Rate Outlook

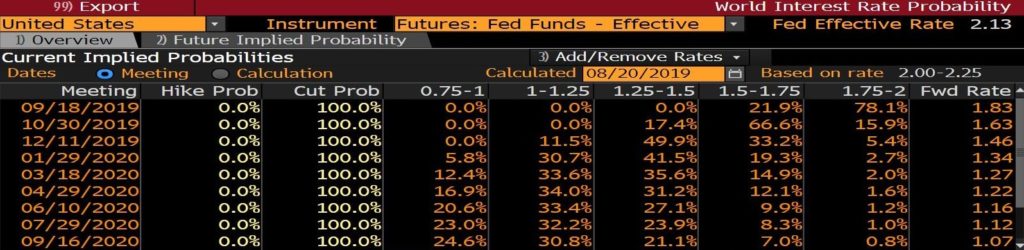

The FOMC convenes again on monetary policy on September 17-18 and the market-implied probability of an additional rate cut at the meeting has increased since the July 31 cut. As of writing, futures implied a 78% chance of a 25 bp cut and a 22% chance of a 50 bp cut.

Source: Bloomberg

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.