Interest Rate Outlook: Ongoing U.S. and China Trade War Takes a Toll

The fallout from the ongoing U.S. and China trade war continues to impact both countries and may be contributing to global weakness. Chinese economic growth fell to 6.2% in the second quarter, the lowest level since record-keeping began in March of 1992, as the value of the country’s exports to the U.S. dropped by 8.2% during the same period. On the flip side, U.S. exports to China plummeted by 31.4% in the month of May 2019. In his semi-annual Congressional testimony on July 10th, 2019, Federal Reserve Chair Jerome Powell noted that domestic “growth in business investment seems to have slowed” and “may reflect concerns about trade tensions and slower growth in the global economy.”

Labor Market Remains a Bright Spot

Fears that the robust U.S. labor market may finally be cooling were calmed with the release of the June 2019 Employment Report. The economy added 224,000 jobs to non-farm payrolls and job creation has averaged 172,000 per month in the first half of 2019. The unemployment rate rose from 3.6% to 3.7% but remained near a 50-year low, and average hourly earnings were up by 3.1% year-over-year.

Fed Rate Outlook

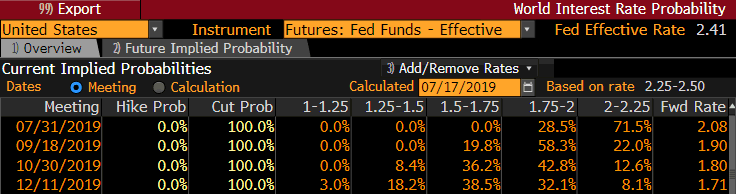

The FOMC meeting minutes from their June 2019 meeting were released on July 10th,2019, and they revealed that members felt that rate cuts could be warranted if global economic uncertainty continues. Chair Powell signaled to Congress last week that the central bank is ready to cut the overnight lending rate at its next FOMC meeting on July 30th and 31st, 2019, despite healthy labor data. Powell said that “It appears that uncertainties around trade tensions and concerns about the strength of the global economy continue to weigh on the U.S. economic outlook.” As to the magnitude of possible Fed action later this month, the Powell was noncommittal in response to a question regarding the odds of a 50 basis point rate decrease. The market-implied probability for a cut of that size has faded, especially after St. Louis Fed President James Bullard, the lone voter in favor of a cut at the June 2019 meeting, said such a move was unnecessary at this time. Futures imply a 72% probability of a 25 basis point cut and a 28% probability of a 50 basis point cut.

Source: Bloomberg

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.