Interest Rate Outlook: U.S. & China Trade Talks Resume

Chinese President Xi Jinping and U.S. President Donald Trump agreed to resume trade negotiations ahead of the G20 summit last weekend, with the U.S. granting a reprieve on certain Huawei restrictions and on further tariff increases. China agreed to buy additional American agricultural goods in exchange. Stock markets surged on Monday in reaction to the improved tone, sending the S&P 500 to a new record high. Bond markets were less encouraged by the rhetoric, with yields across the curve little changed since the June 19th, 2019, Fed meeting. The 2-year Treasury yield is currently 1.77% and the 10-year Treasury note currently yields 1.99% (yields are of 7/2/2019).

Manufacturing Data

The Institute for Supply Management’s June 2019 measure of U.S. factory activity slipped from 52.1 to 51.7 in May 2019, where readings above 50 indicate expansion. The reading marked the third consecutive month of decelerating manufacturing growth, though the reading wasn’t quite as slow as had been expected by economists. Contractions in European and Japanese manufacturing activity began earlier this year, according to HIS Markit indices. Without a near-term resolution to trade disputes, U.S. manufacturing activity appears likely to follow.

Fed Rate Outlook

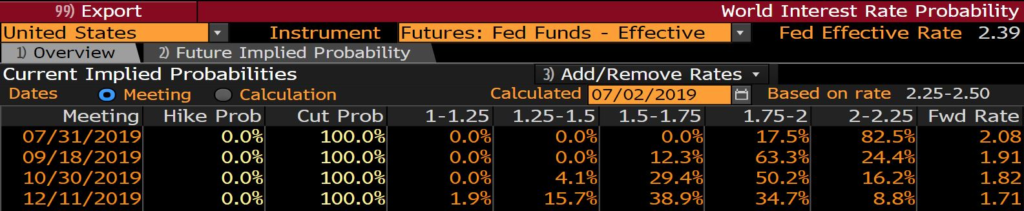

Federal Reserve Chairman Jerome Powell said in his press conference after the June 19th FOMC meeting that “the case for somewhat more accommodative policy has strengthened.” The “dot plot” of FOMC members’ expectations on overnight rate policy showed most members supporting cuts this year, and the post-meeting press release left the door wide open for a cut later this month. Despite equity indices that remain near record highs, new economic readings have done nothing to weaken the case for a July cut. Futures market assumptions are little changed in the past two weeks, with contracts still assuming a 25 basis point cut this month and another 50 basis points of rate reductions priced in by February 2020.

Source: Bloomberg

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.