Negative Rates, Do They Work?

Introduction

The President of the ECB, Mario Draghi, recently performed an about-face on the direction of interest rates. After having previously announced plans to begin raising interest rates out of the negative range, Draghi altered course significantly, stating that rates will likely remain negative until at least 2021. Negative rates, initially intended to act as a short-term boost to stimulate growth and raise inflation rates, are now in their fifth year since being initially implemented in June of 2014. So far, the policy has not proven to be successful in achieving its initially stated goals and has instead seemed to leave the Eurozone dependent on its continuation. With rates already in the negative range, little cushion remains to ease monetary policy further in the event of a crisis. Given current events, such as Brexit, trade tensions between China and the U.S., and increasingly strained relations in the Middle East to name a few, it is not impossible that the situation could escalate to a point at which the Eurozone would run out of monetary ammo.

The lower bound for interest rates was once thought to be defined as zero. Often referred to as the liquidity trap, the lower bound is thought to signify the point at which no monetary injections in the economy would prove effective, as individuals and institutions would rather hold the money than lend it out. While the U.S. held firm to this stance, other central banks including those in Switzerland, Sweden, Japan, and throughout the euro area challenged the notion. As global growth weakens and concerns of a recession reignite in the U.S., more and more policy officials have been revisiting the possible implications of lowering rates to the negative range. In this blog, we discuss how negative interest rate policy works in theory vs. in practice, and apply these findings to the current situation in the U.S.

Negative Rates in Theory

In February of this year, the San Francisco Fed’s Vasco Curdia weighed the case for negative interest rates. He wondered whether negative interest rates could have helped the U.S. in recovering from the Great Recession, and if so, by how much.

By definition, a negative deposit rate requires savers to pay to hold deposits with the bank rather than receiving interest in return, as is the case under normal conditions. In theory, an individual or institution would not accept a negative return on deposits. In practice, however, the outcome is less certain. There are benefits to depositing cash outside of earning a return, including the security of holding cash with a bank. How much such benefits are worth leads us to better understand how much depositors are willing to pay to receive them.

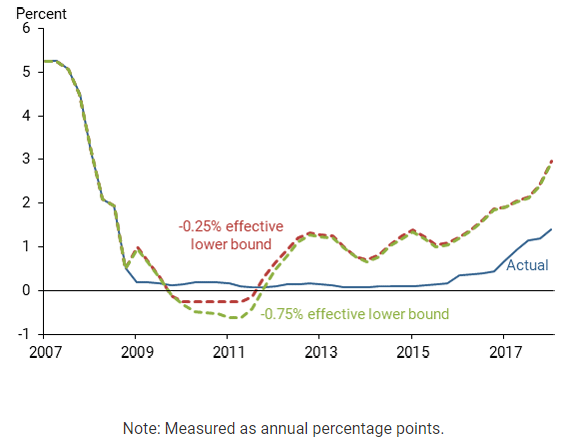

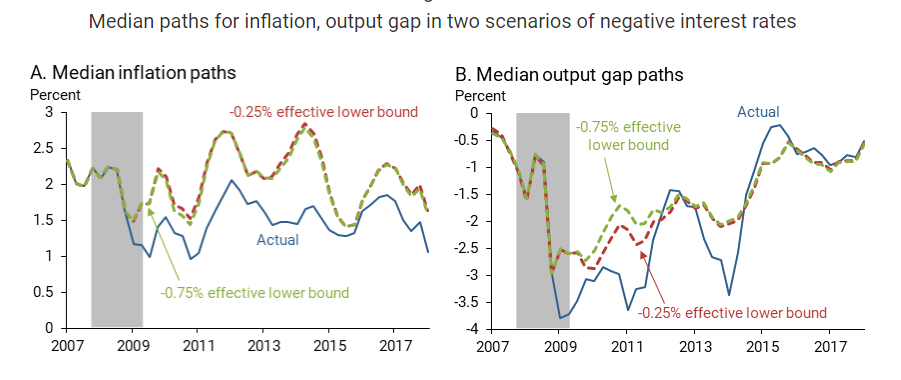

Curdia created a model that would estimate the underlying conditions in the U.S. economy since the financial crisis and then simulated a scenario in which the Fed Funds rate would fall below zero. Data for core personal consumption expenditures price inflation, real GDP growth and the effective federal funds rate from 1987 to the first quarter of 2018 forms the foundation of the estimation and simulations. Based on the model, and as seen in Figure 1, negative rates of -0.25% and -0.75% would have been constrained for a much shorter amount of time than the actual interest rate was, implying that negative rates stimulate the economy more effectively than rates constrained by the lower bound of zero. Based on the same model, Figure 2 demonstrates that negative rates would have raised inflation levels and would have steadied the trend of the output gap between 2010 and 2015.

Figure 1

Source: Federal Reserve Bank of San Francisco, How Much Could Negative Rates Have Helped the Recovery?, Vasco Cúrdia, February 4, 2019

Figure 2

Source: Federal Reserve Bank of San Francisco, How Much Could Negative Rates Have Helped the Recovery?, Vasco Cúrdia, February 4, 2019

The conclusions of the model are not exact. The model assumes, for example, that the effects on the economy from interest rate changes are unchanged for a negative rate. In reality, a negative interest rate might lead individuals to save less and search for alternative sources of return, which would in turn lead to less stimulation than the model suggests.

The St. Louis Fed also put together a model in order to analyze the hypothetical impact of negative interest rates on the economy. Reinbold and Wen theorized that if there is a cost to hoarding cash, then individuals and institutions would pay to hold their cash at banks and at central banks. Researchers Dong and Wen created a model using costs of holding cash to illustrate the implementation of negative rates and its effect. They came to a similar conclusion that in a situation in which aggregate demand for investment and consumption is weak, central banks should implement negatives rates, given its potential to reduce the cost of borrowing and lead to an increase in investment spending.

Negative Rates in Practice

In 2014, the ECB dropped the rate on bank deposits held overnight to -0.1% to counteract dangerously low levels of inflation, essentially charging commercial banks for keeping money at the ECB.

Negative rates have had numerous consequences, one being that investing in real estate became more profitable than holding cash, leading to a fear of overbuilding and housing bubbles. Additionally, ECB officials have expressed concerns about the impact of negative rates on regional banks’ profitability, as interest income and margins on loans weaken. The most concerning repercussion, however, may be the ongoing reliance on negative rates as a stabilizer and the potentially constraining effect this could have on the ECBs ability to enact further stimulus. Given current global conditions, the ability to do so is imperative.

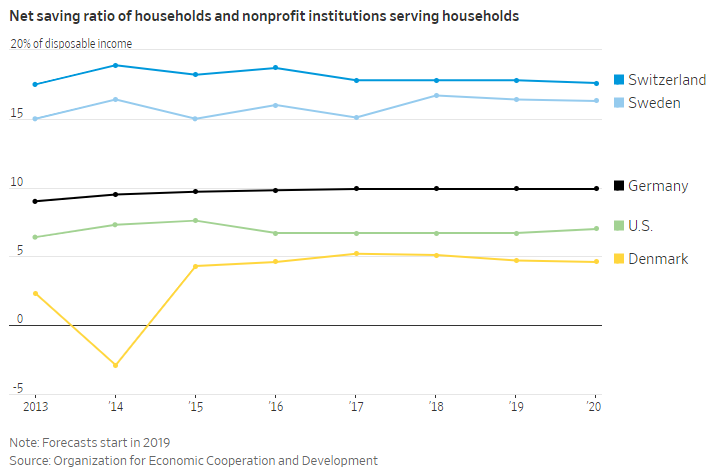

In theory, negative rates would have lowered the savings rate by encouraging spending and investment. However, Figure 3 demonstrates that the policy has had a seemingly negligible impact on aggregate savings rates across Europe.

Figure 3

Source: The Wall Street Journal, Negative Rates, Designed as a Short-Term Jolt, Have Become an Addiction, Brian Blackstone, May 20, 2019

Conclusion

How effective the measures have been in raising levels of inflation and stimulating economic growth is highly debated. As recently as December, the ECB slashed the forecast for annual GDP growth to 1.1% from 1.7%. Similarly, while the OECD cut projections in U.S. and China by only 0.1% each to 2.6% and 6.2%, respectively, the OECD cut their forecast for the Eurozone noticeably from 1.8% to 1.0%. Ultimately, knowledge of the impact of negative rates is constrained by the inability to know the counterfactual. There is no full-proof way of knowing what the Eurozone (and its periphery) economies would look like if rates had bottomed out at 0%.

The FOMC will meet this week for their regular policy meeting to discuss how best to move forward, given trade tensions and hiring slowdowns among other signs of economic weakness within the U.S. and abroad. However Fed officials choose to act, they would be wise to weigh heavily the current economic environment in the Eurozone and consider what implications this might have for the U.S. as it deals with chronically lower interest rates.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.