Interest Rate Outlook: Fed Maintains “Wait-and-See” Stance

Overview

The FOMC concluded its two-day meeting on Wednesday, May 1st and, as expected, kept the fed funds target range unchanged at 2.25-2.50%. Echoing its comments in March, the Fed expressed comfort with their current “wait and see” approach to monetary policy. The equity markets declined slightly as Fed Chair Powell attributed the weakness in core inflation to transitory factors, suggesting a more hawkish stance, and on the fixed income front, the 2-yr Treasury yield increased by 4 bps to close at 2.31%.

Declines in Core Inflation are “Transient”

In the statement following the meeting, the Fed noted that economic activity “rose at a solid rate” following a slowdown in growth earlier this year. During the press conference following the statement, Chair Powell said “I see us on a good path” but also acknowledged that inflation, both overall and core, “have declined and are running below” the Fed’s 2% target. He attributed this to “transient” factors but stated that “we of course will be watching very carefully to see that that is the case.” Regarding the recent weak reading of the ISM Manufacturing index in which April activity fell to its slowest pace since October 2016, Powell said that FOMC members “see that reading as, it’s still a positive reading and consistent with what we expect from the manufacturing sector, which is moderate or perhaps modest growth.”

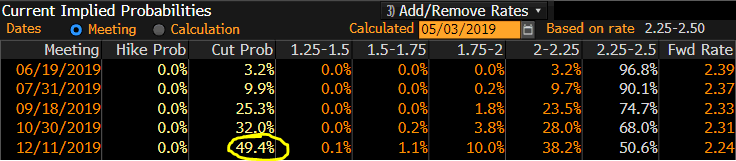

Fed Funds Futures

The Fed’s communication suggests that an insurance cut in rates is not on the near-term horizon. Nevertheless, fed funds futures are still pricing in about a 50% chance of a cut by the end of the year and an almost 80% chance of a cut in 2020. In contrast, 63% of the respondents to the April/May CNBC Fed Survey forecast a rate hike in 2020, and some also believe that a hike is possible this year.

Source: Bloomberg

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.