A New Era of Term Debt Financing for Early-Stage Companies: Flexibility Expands as Hidden Costs Arise

Financing projects and growth through debt has long been a staple of modern corporate economics. However, debt for companies with little credit history, a relative lack of fungible assets, negative cash flow and little to no revenue for the foreseeable future have historically presented an untenable risk for many traditional banks. Fortunately for these organizations, a thriving and growing market broadly known as venture debt exists, consisting of venture banks, public/private funds, and specialty finance companies that are willing and eager to lend into this space.

For the past 14 years, Capital Advisors Group has worked with earlier-stage companies across industries that do not qualify for large commercial bank debt financing facilities. Following the credit crisis of 2008 – 2009, we observed a dramatic shift in debt financing. As investors with cash sat on the sidelines sought return, some found that early-stage debt financing provided ample opportunity, and lenders began to crowd into the market. These new lenders were able to fill a unique space, targeting newly commercial or near-commercial stage companies and providing larger and more flexible terms than those available from the legacy venture debt players. New structures began to emerge, some with no equity component and deals sizes that ranged from $20 million to over $100 million. These lenders were lending against the commercial viability of the products the borrowers were, or soon would be. offering.

This development has dramatically increased the competitive landscape for early-stage lending over the past seven years. Competition to win good deals is fierce, forcing many traditional lenders to stretch the boundaries of their appetite for risk and expand the parameters of their lending structures. Generally, this competition has made borrowing for earlier-stage companies far more attractive than it once may have been.

Increased Competition

Prior to the increase in competition, the emerging private debt market in the early 2000s provided few options for lender and/or borrower maneuverability. Term sheets would generally focus on maturity; interest only period, interest rate and warrants. These were the primary driving forces behind every lender’s return on investment. But as the diversity of debt funds expanded, so too did the flexibility and variety of repayment options. Now terms such as “payment in – kind” (or PIK) interest, “variable maturity,” “full bullet,” “revenue share,” etc. might appear alongside the usual rate and equity kicker language. Each of these new terms can affect the ultimate value of a financing in many ways, but very often they can push out the repayment of the loan, giving the company longer availability and greater flexibility of the financing.

To track the changes in the debt market caused by this new competition, Capital Advisors Group maintains a database of terms and conditions for deals it has completed dating back to 2003.

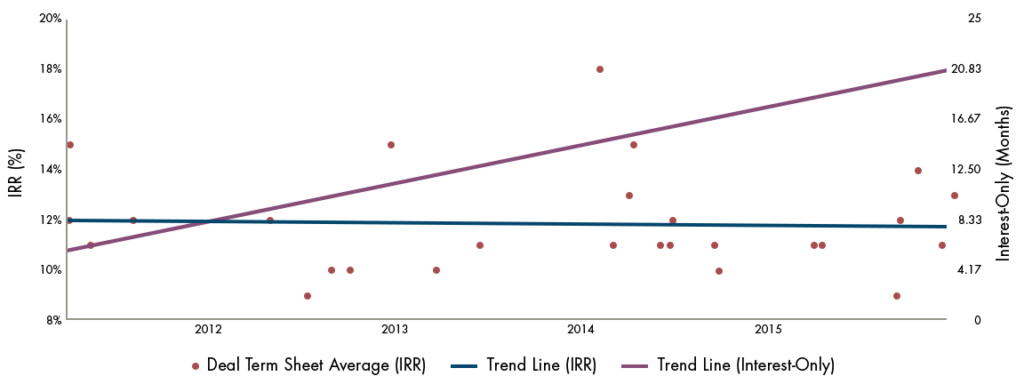

Figure 1*

For example, since 2012, interest-only periods have dramatically increased (Figure 1). We often see milestone-driven, interest-only extensions that can take these periods of cash flexibility well beyond two years.

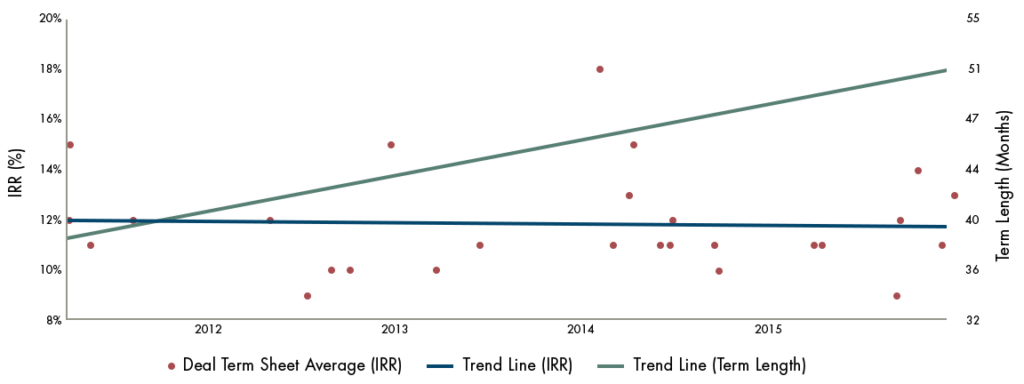

Figure 2*

Figure 2 also illustrates growth in the length of terms offered during the same period.

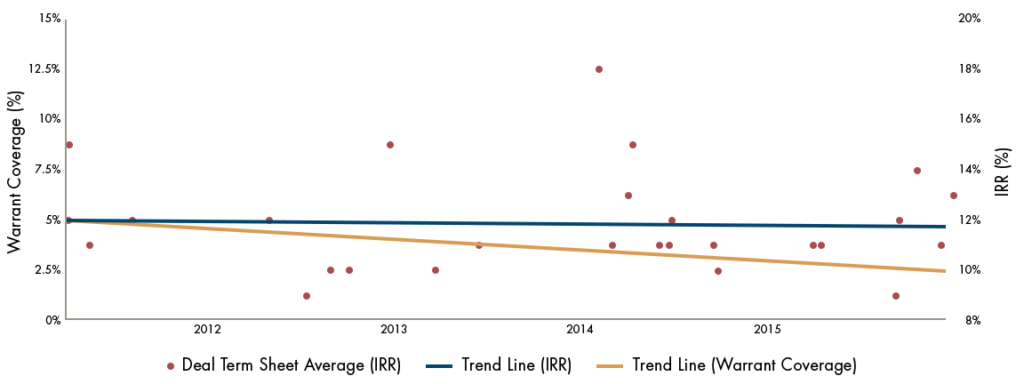

Another benefit of competition in the space can be seen in the downward trend in warrants (Figure 3), as these equity components are increasingly being replaced with one-time predictable cash-outs in the form of success fees. Success fees typically provide the borrower with more clarity on the exact “cost” of the loan throughout the term, unlike a warrant, where the value can be at times obfuscated by private company status and public market volatility.

Figure 3*

Finally, competition has led to a trend of longer I/O periods. Coupled with a drop in interest rates and warrants, this lengthening would lower the overall internal rates of return over the I/O period, all else being equal. However, as can be seen in Figures 1, 2, and 3, IRRs have remained relatively static between 2011 to 2016. The cause of this stagnation relates to how companies pay for such increases in flexibility.

New Hidden Costs

While increased competition has resulted in a net benefit to the borrower, lenders still have internal return targets to meet as well as the growing need to somehow hedge against these longer and more flexible terms.

One hedging method is a general abandonment of fixed interest rate financings. Just a few years ago, having a float – to – fixed interest rate was fairly standard across the industry. However, fixed rate loans are now more difficult to come by. In every term sheet, there is a section detailing the rate at which the loan will accrue interest, and that rate is now typically tied to short-term benchmark rates such as LIBOR or the WSJ Prime rate, which is published daily in the Wall Street Journal. These benchmarks are directly affected by the Fed funds rate, the rate which the Fed advises banks charge each other in the Federal Reserve System. The Fed effectively creates a floor, slightly above which exist the WSJ Prime rate and LIBOR (i.e. Fed funds rate + marginal spread = LIBOR, etc). Therefore, with borrowing rates now commonly indexed to either LIBOR or WSJ Prime, they are inherently dictated by the Fed funds rate, which at the moment in mid-2017, looks poised to continue to rise over the coming years. As a

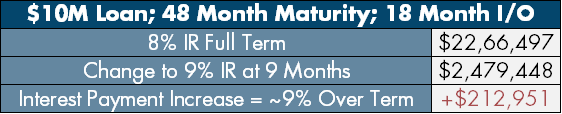

result, while all-in cost calculations on loans presented to borrowers today are based on static interest rates, a gradual increase in the Fed funds rate will float those formerly fixed or stable IRRs. Figure 4 illustrates the interest payment implications using an example of a $10M loan with a 48 month maturity and an 18 month Interest-Only period.

Figure 4*

Conclusion

We believe burgeoning competition has ultimately benefited borrowers in the private debt industry as a whole. However, the competition is not without its drawbacks. A higher repayment over the term of the loan is just one of the potential issues which have arisen as large (and small) debt players have crowded in to the market. Now, more than ever, it is crucial for borrowers to know their options and the potential implications of their decisions as the look to get the best deal for their company.

*All examples are intended for illustrative purposes only. Capital Advisors Group internal data is based on more than 96 completed and incomplete deals.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.