Earnings Credit Rate is Slow to Respond in Rising Rate Environment

The Earnings Credit Rate (ECR) has been a successful tool used by banks to lure corporate depositors during the low interest rate environment, but shouldn’t be expected to keep pace with rising interest rates. Banks offer ECRs to offset bank transactional fees for non-interest bearing deposits accounts, effectively acting as a conduit to hard interest. ECR’s infancy began with Regulation Q, which prohibited banks from paying interest on transactional business accounts. This led to banks offering “soft dollar” credits on non-interest bearing accounts to offset banking services. During the financial crisis, with money fund yields close to zero, deposit accounts that offered ECRs were attractive to many corporate treasurers.

With the Federal Reserve embarking on interest rate increases, will ECRs keep pace? At what point will the opportunity cost catch up, and when will merely covering banking fees no longer be enough? Will higher rates entice assets out of deposits into higher yield instruments?

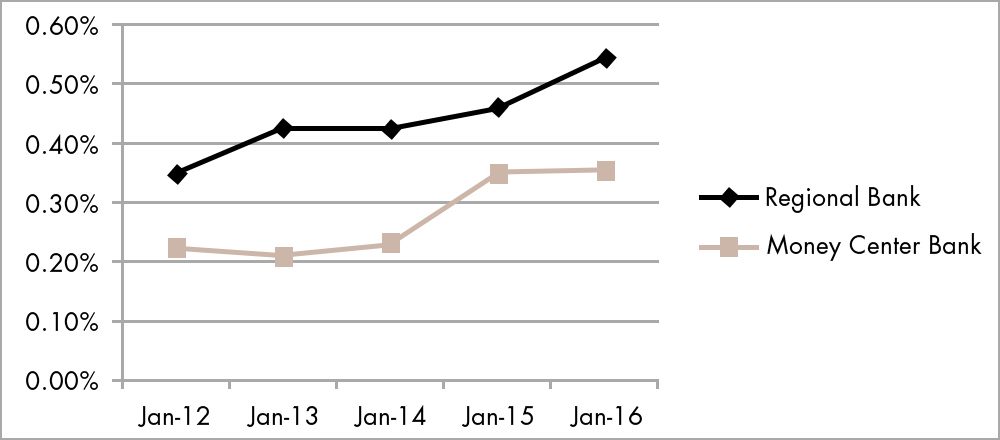

Although ECR data is not widely available, anecdotal evidence presented by Bridget Meyer, CTP, in her AFP blog, Earnings Credit Rate: Predicting the Cloudy Future of ECR, seems to indicate that ECR has increased since the Fed started hiking rates in December 2015, although the increases have not been the same for everyone. The blog post suggests that banks tend to sweeten their ECR deals to lure new clients with significant operational balances. Regional banks also tend to be more willing to pay up than SIBs thanks to Basel III-related profitability structures. For example, in Graph 1, regional banks were offering ECRs of 0.50% compared with 0.35% for money center banks.

Graph 1: ECR History* – Regional Banks vs. Money Center Banks

Source: Bridget Meyer, CTP, Earnings Credit Rate: Predicting the Cloudy Future of ECR

Source: Bridget Meyer, CTP, Earnings Credit Rate: Predicting the Cloudy Future of ECR

*Based on Redbridge’s BankScore™ of Global Rates & Fees

Since December 2015, the Federal Reserve has raised the short-term rates three times at 0.25% each for a total of 0.75%, and is poised to do so again two more times this year. Short-term market rates rose in response, although bank rates have yet to see meaningful increases. The opportunity costs of overnight bank deposits have become more evident.

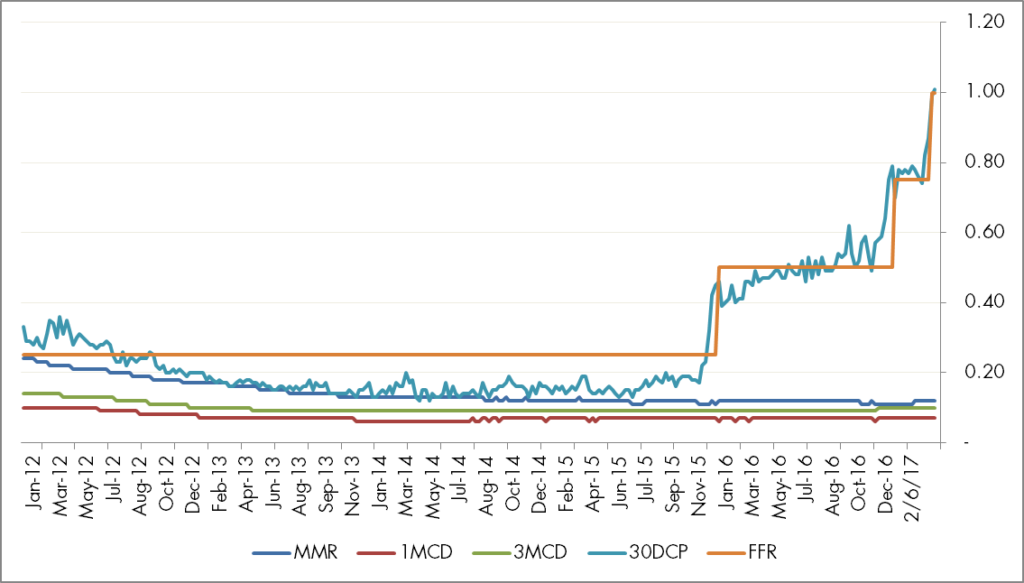

Graph 2: Comparative Short-term Interest Rates

Source: FDIC’s weekly national rates and Bloomberg

Source: FDIC’s weekly national rates and Bloomberg

Graph 2 provides a snapshot of short-term rates for the last five years. The top range of the fed funds rate (FFR) moved up from 0.25% in December 2015 to 1.00% in March 2017. The 30-day dealer-placed A1/P1-rated commercial paper (30DCP) index rate rose from 0.16% to 1.01%, closely matching the Fed’s rate increases.

By contrast, national average deposit rates published by the FDIC hardly budged. Among jumbo deposits (greater than $100,000), money market rate (MMR) rose only 0.01% to 0.12% since December 2015. The one-month certificate of deposit rate (1MCD) stood unchanged at 0.07% and the three-month CD rate (3MCD) rose 0.01% to 0.10%.

Some depositors may see ECR increases, but few, if any, are expected to receive the full benefit of the 0.75% increase. With the Fed poised for two more rate hikes this year and perhaps three more in 2018, the opportunity costs of deposits versus market rates may grow even larger.

Note: This post is an excerpt from our white paper, Revisiting Bank Deposits as a Liquidity Solution.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.