AFP Liquidity Survey Indicates Separately Managed Accounts (SMAs) May Make a Comeback

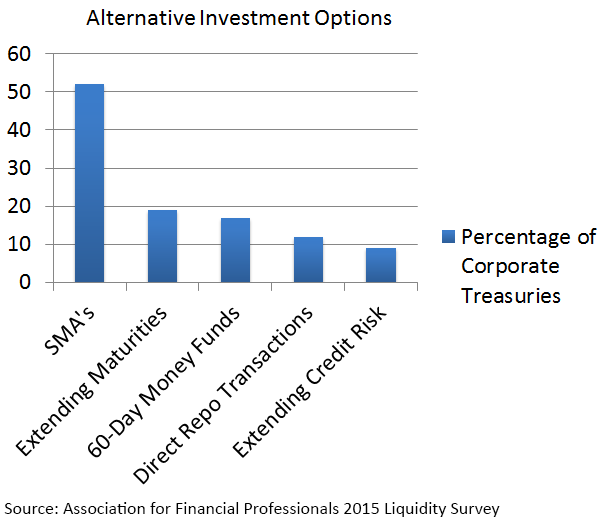

Among the most interesting statistics in the 2015 AFP Liquidity Survey from the Association for Financial Professionals (AFP) is that 52 percent of corporate treasurers are considering use of separately managed accounts (SMAs) as a response to the 2016 reforms that will change the nature of institutional money market funds.

That finding may come as a surprise if, like many people, you tend to believe that the world of cash investments revolves around two limited choices: bank deposits and money market funds. However, you may also be surprised to learn that for much of the last half century, maintaining portfolios of directly purchased securities in separately managed accounts was a common way of managing corporate cash.

That finding may come as a surprise if, like many people, you tend to believe that the world of cash investments revolves around two limited choices: bank deposits and money market funds. However, you may also be surprised to learn that for much of the last half century, maintaining portfolios of directly purchased securities in separately managed accounts was a common way of managing corporate cash.

While bank deposits were always a mainstay for corporate cash, the use of money market funds is a relatively recent phenomenon. It wasn’t until the 1990s that money market funds surpassed 10 percent of liquid corporate cash balances overall. Once they took hold, they grew in popularity to a peak in 2008, when they accounted for 37 percent of holdings. Problems associated with the financial crisis that year lessened their appeal in subsequent years, but money funds currently still account for more than 20 percent of corporate cash balances.

Why, then, are we now in this “back to the future moment,” with corporate treasurers suddenly considering separately managed accounts as an alternative investment option?

Under SEC rules that go into effect in October 2016, institutional money market funds will “break the buck” when they adopt floating net asset values, creating potential risk to principal. At the same time, liquidity gates and redemption fees in times of stress may potentially affect liquidity. When the AFP survey questioned corporate treasurers about how they would respond to those changes, 52 percent said they would consider separately managed accounts as an alternative to money funds.

There are challenges in managing direct purchases, because they require hands-on investment and accounting expertise, risk and credit monitoring, and liquidity management. The good news is that managing separate accounts is far from a lost art, and opting to employ separately managed liquidity accounts maintained by an advisory firm with depth in fund research and counterparty risk management can help to effectively address those issues.

DOWNLOAD 2015 AFP LIQUIDITY SURVEY

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.