Tariff Pause Brings the Market Some Relief

Yesterday, President Trump announced via Truth Social that he would be suspending reciprocal tariffs on nearly all countries for a 90-day period – marking a significant de-escalation in U.S. tariff policy. While not entirely clear from the President’s post, the indication is that countries previously in line to face tariffs above 10% will now be subject to the 10% baseline rate only. Existing tariffs on automobiles, steel, and aluminum were unaffected.

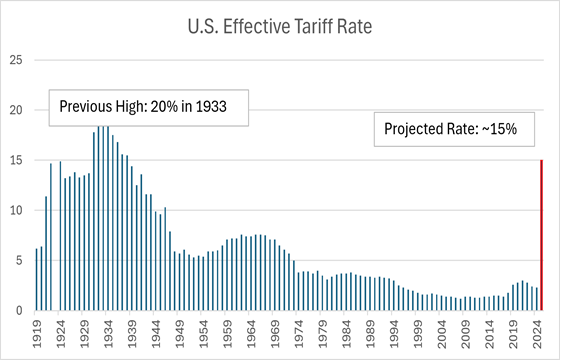

Source: U.S. International Trade Commission, Bloomberg

The notable exception to this new development is China, which the President simultaneously announced is set to face a 125% tariff rate, effective immediately. This comes after a week of ongoing escalations between the U.S. and China, with each country retaliating to the other’s prior tariff announcements with an ever-higher rate. As things stand, China is set to implement tariffs of 84% on U.S. imports beginning today.

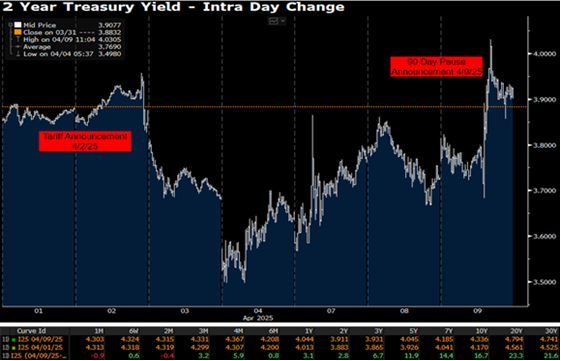

Despite the China news, the overwhelming sentiment in financial markets following the announcement was one of relief. The S&P posted a nearly 10% gain on the day (essentially all of which came following the announcement) and the Nasdaq rose 12%, its biggest one-day rally since 2001. The move took equity markets from near bear market territory to less than 5% below their level prior to the April 2nd announcement. The dollar also rallied and short rates rose sharply as the market priced out the probability of near-term Fed action.

The situation remains fluid, as countries react to the White House’s actions. The EU, for instance, announced today that it would suspend tariffs it was set to implement on a subset of $23B in U.S. imports.

It remains to be seen how negotiations between the U.S. and such a wide breadth of nations will go. Additionally, the implementation of a 10% universal tariff alone constitutes a seismic shift in the global trading order. Estimates suggest that the new effective tariff rate will be in the range of 15-20%, still the highest level since the 1930s. In short, while yesterday provided some relief, it is far from the end of the story.

Source: Bloomberg

Takeaways For Cash Investors

Fed – Yesterday’s rally eases the pressure on the Fed to cut rates in the near term, allowing it to maintain its status quo bias. Futures contracts for the Fed’s next meeting in May went from pricing in a 60% chance of a cut to 25%. The market is still pricing in 3-4 cuts this year.

Rates – Bond sold off following the announcement, with majority of the action happening in the short-to-middle portion of the curve. The two-year Treasury rate rose 20 basis points to 3.90% by the end of the day, while the 10-year increased 4 basis points to 4.33%. Following a lower-than-expected CPI report this morning rates declined marginally, the 2-year falling to 3.81%.

Credit – Credit spreads tightened, with the OAS on the Bloomberg 1-3 Corporate Index declining by 4 bps to 83 bps. Spreads remain relatively contained, below levels seen as recently as October 2023.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.