February 2025 Mid-Month Market Update

Mixed Data Keeping the Fed on Hold

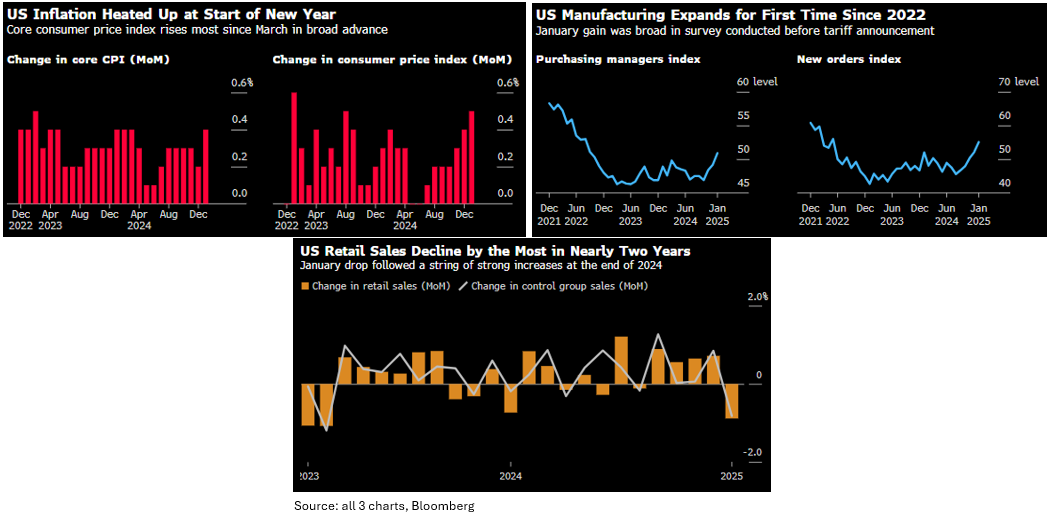

Fed Chair Powell recently said he wants “to see inflation behaving in a way that builds confidence that we are really making progress.” Unfortunately, the January Consumer Price Index (CPI) did not build any confidence that inflation is decelerating, coming in much higher than expectations. Overall, data releases this month have been mixed, and when taken in conjunction with continued tariff news dominating the headlines, it points to a Fed that is in no rush to cut anytime soon with the fed funds futures market pricing in only one rate cut for 2025. Here is a summary of recent data releases:

- Labor Market: The January employment report was mixed with nonfarm payrolls coming in lower than expectations at +143,000. However, there were +100,000 in upward revisions to the prior two readings which brought the 3-month average to a very solid 237,000 jobs created. Surprisingly, the unemployment rate fell back to 4.0%, the lowest since May of 2024.

- Inflation: CPI in January surprised to the upside with headline CPI spiking +0.5%, which was the largest monthly reading since August 2023 and core-CPI rising +0.4% which is the highest reading since March 2024. There are concerns that inflation appears to be stuck above the Fed’s 2.0% target with headline yearly CPI rising back to a 3-handle (3.0%) and the 3-month annualized pace rising to +4.5%.

- Manufacturing: The ISM Manufacturing Index came in at a stronger-than-expected 50.9, which is the first reading above 50 since October 2022. Readings below 50 signal contraction while readings above 50 signal expansion. However, there were some inflationary concerns from the report, with the prices paid index component rising to its highest level since May 2024.

- Retail Sales: Although headline retail sales were expected to decline in January, the -0.9% reading was much lower than anticipated, however, there were solid upward revisions to December’s release. Part of the decline for January is being attributed to consumers pulling back after a strong holiday shopping season. One positive was eating & drinking establishments, which rose +0.9% and is typically the first thing consumers will pull back on if feeling under pressure.

Source: Bloomberg

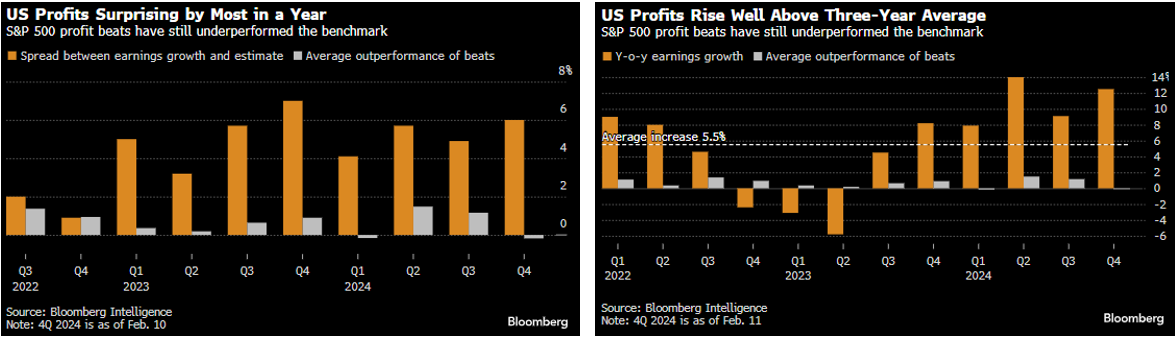

Healthy Earnings Season Surprise

Approximately three-quarters of S&P 500 companies have reported, and U.S. companies are having one of their best earnings seasons in years. Earnings-per-share are on pace to increase +12.5% vs expectations of +7.0% and well above the average of +5.5% going back to the first quarter of 2022. The consumer is leading the way, with consumer discretionary earnings growth rising over +30% with retail companies like Yum! Brands, Ralph Lauren, and Disney topping estimates. However, some market participants are citing the reason for the surprise outperformance is that many analysts cut their estimates ahead of earnings season. Looking ahead, companies will be focused on the impact tariffs will have on profit margins.

Source: Bloomberg

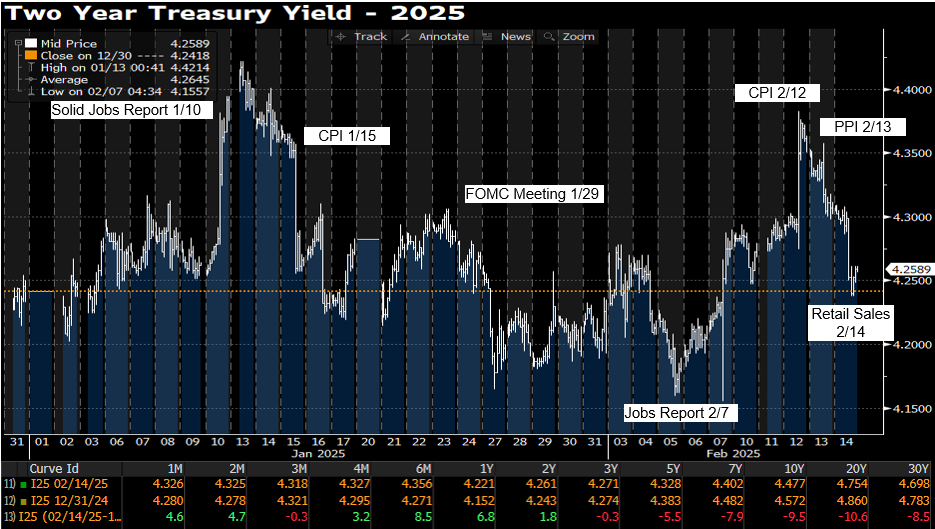

Yields Mixed to Start the Year

Front-end yields have increased to start the year as expectations for rate cuts by the Fed have been pushed out while long-end yields have declined on concerns that a trade war could impact future growth. The chart below highlights the 2-year treasury yield and some of the key economic releases so far in 2025 that have driven yield changes. After peaking at 4.42% in early January following a solid December period jobs report, the 2-year yield steadily declined to a low of 4.15% after a disappointing January period jobs report, then spiked to 4.38% after January CPI surprised to the upside and declined back to almost unchanged for the year after a disappointing January retail sales report. Away from data, markets will be focused on delayed tariffs and geopolitical events as Mexico and Canada tariffs are delayed to early March, the analysis of reciprocal tariffs delayed to April, and negotiations for ending the Russia/Ukraine war are underway.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.