Will There Be a Renaissance in Oil and Gas?

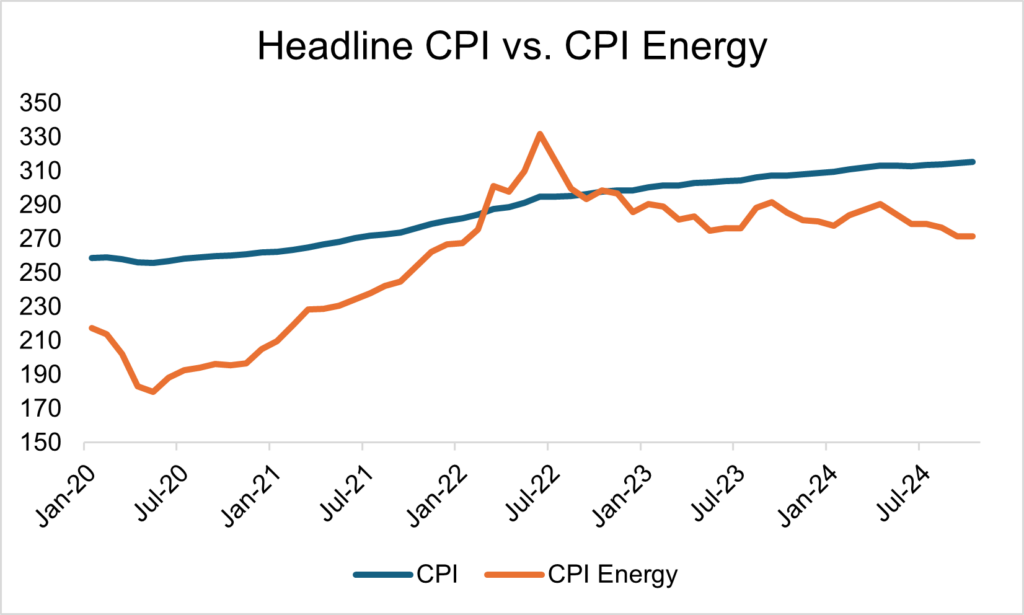

Entering the Presidential election, the greatest concern among voters was the economy[1] in the wake of decades-high inflation experienced under the Biden administration. By some metrics the economy was healthy at the end of President Biden’s tenure, with relatively low unemployment, equities at all-time highs, and the rate of inflation near the Fed’s 2% target. However, sticker shock continues to linger as prices—measured by the Consumer Price Index—were over 20% higher than at the beginning of Biden’s administration. While inflation was primarily driven by pandemic-related supply chain bottlenecks, fiscal stimulus, and near-zero interest rates, a surge in energy prices exacerbated this trend in 2022, following the Russian invasion of Ukraine. With gas prices top of mind during the election cycle, President-Elect Trump touted an ambitious goal to reduce energy prices by 50% within 12 months of his tenure[2]. He planned to do this by reducing regulations that restrict oil and gas extraction, letting American energy manufacturers “drill, baby, drill.”

Exhibit 1: Headline CPI vs. CPI Energy

Source: FRED, Bureau of Labor Statistics

Proposed Policy

Proposed policy under the Trump administration effectively consists of two components: 1) Increase the domestic oil supply, and 2) Scale back incentives for electric vehicles and other forms of low-carbon energy. Plans to increase domestic oil supply include increasing the number of leases to drill on federal lands, lifting restrictions on LNG exports, resuming the Keystone Pipeline, and replenishing the Strategic Petroleum Reserve. Meanwhile, President-Elect Trump has promised to repeal tax incentives from the Inflation Reduction Act, including the $7,500 tax credit for electric vehicles as well as tax credits for solar energy and energy-efficient appliances. If successful, this would increase the cost of investing in alternative energy sources; thereby strengthening the viability of fossil fuels as a more affordable energy source. Additionally, the US may once again exit the Paris Climate Accord, the multinational agreement to reduce carbon emissions by 2050. Combined, these actions look to double down on investment in traditional fuel sources and lean into the United States’ energy independence, with the intent of lowering Americans’ gas bills.

Will Prices Plummet?

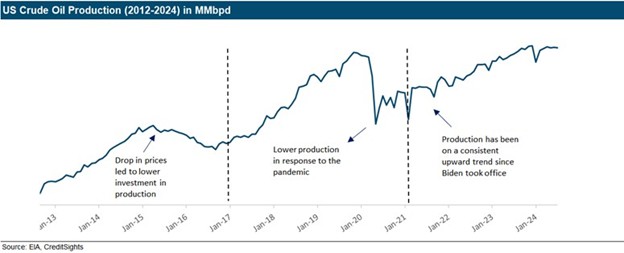

While increased supply may put downward pressure on energy prices, the general consensus is that the president-elect’s proposals are unlikely to have a significant impact on energy prices in the near future. The main reason is that energy prices are primarily shaped by global economic conditions, namely global demand, which are beyond the control of any one administration. Additionally, major changes in energy prices have generally been linked to exogenous shocks such as the global pandemic and Russia-Ukraine conflict. Regarding output, historical data suggests oil production has little-to-no correlation with who’s in office.[3] Furthermore, an oversupply of oil would likely reduce the expected return on added output and could even create losses on new drilling. As a result, producers are unlikely to flood the market without sufficient demand.

Exhibit 2: US Crude Oil Production 2012-2014

Source: EIA, CreditSights

Where the new administration may have the most influence on energy supply is by increasing the amount of drilling on federal lands, but the potential short-term impact is dubious. The timeline for getting a lease approved to first production can take anywhere from three to four years for onshore drilling and up to eight years for offshore drilling.[4] While increasing the number of permits may promote activity, any new investments will not likely bear fruit until the end of the Trump administration or beyond.

Moreover, technology has been a more important factor in boosting oil production in the last decade than expanding drilling operations. This is largely attributed to the “shale revolution”, which combined fracking with horizontal drilling and significantly improved the efficiency of oil production. While activity levels are 50% below 2014 levels, the total US supply has increased 50% over that period. Furthermore, the cost of drilling has decreased 34% and completion times are 23% lower over the same period.[5] In other words, the US has been able to simultaneously reduce its oil rig count and produce a record amount of oil at lower cost. While more permits on federal lands may bring energy prices down, it is unclear if this activity will offset other variables that drive prices such as technology and global demand.

While risks to oil prices are skewed to the downside, it is worth noting that the proposed 25% tariffs on Canada, which comprised over 50% of oil imports to the US,[6] and speculated sanctions on Iran, introduce upside risk to commodity prices.

Credit Implications

Because a new wave of supply is improbable in the near future, the proposed policies will likely have a minimal impact in the short-term. Longer-term, oil and gas producers may benefit from deregulation and headwinds to businesses who focus on low-carbon energy. The deregulation benefits will likely be more impactful for smaller businesses in the sector, for whom the costs are more burdensome, whereas larger oil and gas companies may only see a modest benefit. Meanwhile, the repealing of tax credits for renewable energy and other low-carbon businesses may make it more expensive to develop these alternative sources, which could disincentivize additional investment. Disruptions to additional low-carbon investment may raise long-term demand for oil and gas as they maintain their cost advantage—both to producers and the consumer—for longer than previously anticipated. Overall, we believe the proposed legislation under President-Elect Trump leans positive for the oil and gas industry in the medium- to long-term.

Less support for renewables does have some drawbacks for integrated oil companies, however, as it may increase their energy transition risk by introducing greater uncertainty into the development of their own low-carbon businesses. While these companies primarily produce fossil fuels, they are also investing billions into carbon capture, hydrogen, biogas, and other alternative fuels, many of which are subsidized through tax incentives. Without them, it may be difficult to justify greater investment into these businesses, which already offer lower returns than fossil fuels. Fluctuations in fiscal support across Democrat and Republican administrations further complicate allocation decisions, obscuring forecasts for future energy demand. It’s perhaps for these reasons that Exxon Mobil’s CEO is in favor of staying in the Paris agreement.[7] Although Exxon’s stance may seem paradoxical, the associated uncertainty may lead to suboptimal investment in renewable energy businesses. This, in turn, may have long-term credit quality ramifications should energy companies’ competitive edge fall short of renewables-focused competitors. As a result, cash investors, especially those who incorporate ESG considerations into their investment policy, should pay attention to any changes in the capex allocation of oil and gas producers.

[1] https://www.pewresearch.org/politics/2024/09/09/issues-and-the-2024-election/

[2] https://www.npr.org/2024/11/13/nx-s1-5181963/trump-promises-more-drilling-in-the-u-s-to-boost-fossil-fuel-production

[3] Credit Sights – Energy Policy at a Crossroads: Trump vs. Harris

[4] JP Morgan – Refresher on Federal Lands

[5] JP Morgan – Oil Americana

[6] https://www.eia.gov/tools/faqs/faq.php?id=727&t=6

[7] https://www.wsj.com/business/energy-oil/exxon-says-trump-should-keep-u-s-in-paris-climate-pact-3d8de471

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.