January 2025 Mid-Month Market Update

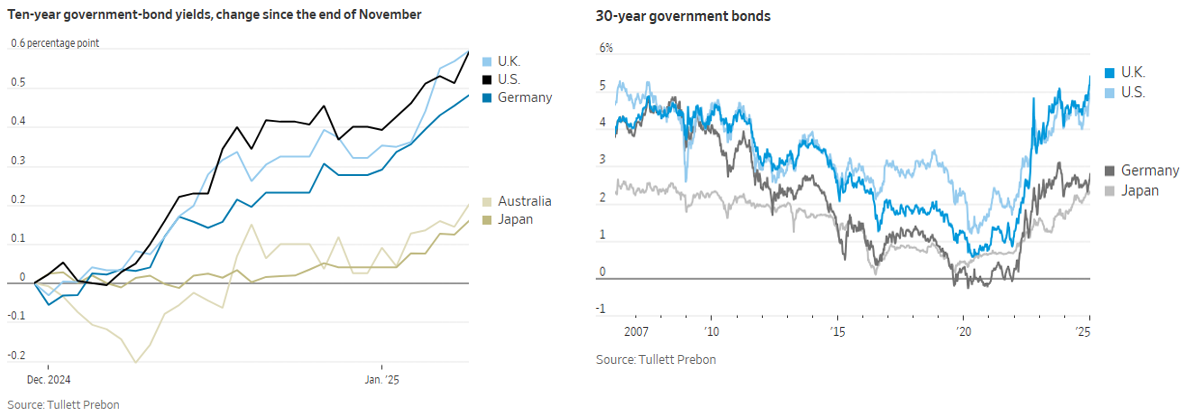

Government Bond Yields Rise Globally

The rise in U.S. treasury yields has continued into the new year, primarily driven by 3 factors:

- Solid economic data

- Sticky inflation

- Deficit concerns and increasing borrowing

A string of solid U.S. releases has continued, with both the ISM Manufacturing & Services reports coming in better than expected, the December nonfarm payrolls beating expectations by nearly 100,000, and the unemployment rate falling to 4.1%. Inflation has remained stubbornly above the Fed’s 2% target and expectations are for price pressures to remain elevated in 2025. In addition, U.S. GDP growth has been much stronger than expected and has contributed to higher yields for both the 10-and 30-year Treasuries.

Larger deficits lead to increased government borrowing and higher bond issuance. This is not only a concern here in the U.S., but many other countries also expect increased deficits. For example, the U.K. saw their 30-year yield rise to 5.4% – the highest level since 1998 – as a result of increased bond issuance to fund budget deficits.

Source: Tullett Prebon

Fed Officials Signal a Pause

Over the past few weeks, several Fed officials have conveyed a cautious tone on rate cuts for 2025. In addition, the minutes from the December FOMC meeting highlighted that almost all participants have judged that the upside risks to inflation have increased, reinforcing recent Fed speeches in which members saw it appropriate to slow the pace of easing. Below is some recent Fed commentary in 2025:

- Richmond Fed President Barkin: “I think there is more upside risk than downside risk…. So I put myself in the camp of wanting to stay restricted for longer.”

- Fed Governor Cook: “We can afford to proceed more cautiously with further cuts”, but it is still “appropriate to move the policy rate toward a more neutral stance.”

- Philadelphia Fed President Harker: “I think it’s appropriate for us to take a bit of a pause right now and see how things shake out, … We can stay where we are for a little bit — probably not long.” Policymakers need to “let the data play out.”

- St. Louis Fed President Musalem: “Going forward, rate reductions have to be gradual – and more gradual than I thought in September.”

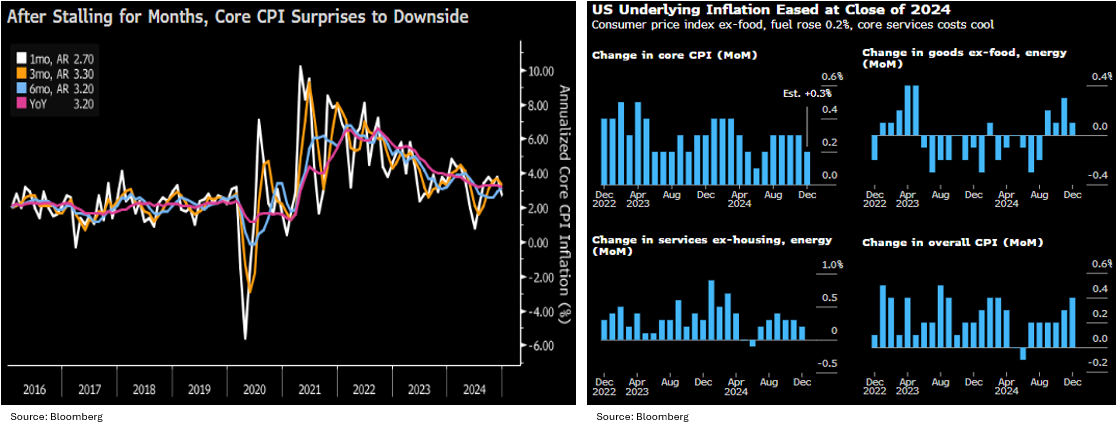

Core Inflation’s First Decline in 6 Months

Stickier than expected inflation has been the prevailing theme for the past several months. However, the December Consumer Price Index (CPI) report was a welcome relief with monthly Core-CPI coming in lower than expectations at +0.2%, the first decline in 6 months. The monthly headline reading rose +0.4% with energy prices accounting for more than 40% of the increase. The year-over-year reading is still showing some stickiness with headline CPI rising from +2.7% to +2.9% while Core-CPI declined for the first time since July, falling from +3.3% to +3.2%. Looking ahead, while the December reading helped cool fears of a potential reacceleration of inflation, economists are still cautious as many of the Trump administration’s proposed policies are broadly inflationary. After the release, the fed funds futures market is still forecasting just one 25 basis point rate cut by the Fed for all of 2025.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.