October Mid-Month Portfolio Update

Labor Market Remains Solid but Data Could be Noisy Ahead

The September employment report was solid overall but with hurricanes Helene and Milton hitting the Southeast of the United States, labor statistics could be noisy ahead.

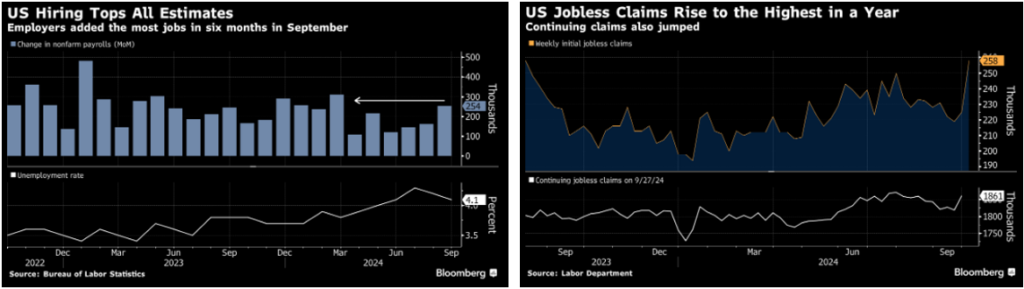

September Employment Report:

- For the first time in 3 months, headline nonfarm payrolls came in higher than expected at 254,000 vs. consensus of 150,000, led by job gains in leisure and health care. This was the largest monthly increase in 6 months.

- The prior two reports were upwardly revised by 72,000 jobs. This marks the first time since March that the two prior reports received positive revisions.

- The unemployment rate fell for the second consecutive month, dropping to 4.1% from 4.2%, and on an un-rounded basis, (4.051%) it was close to reaching 4%. This was the first back-to-back decline in the rate in over a year.

- The number of people being laid off declined in September by 95,000.

- The 3-month moving average of job gains rose to 186,000, up from the August reading of 140,000.

Looking ahead, the October jobs report (which will be released on November 1st) will incorporate layoffs in the manufacturing and management sectors (via. auto maker Stellantis), Boeing’s striking factory workers and the recent hurricanes’ impacts. Overall, it is expected to be a weak report with estimates showing nonfarm payrolls coming in at 110,000. We have seen the first indication of the hurricanes’ effects from the weekly Initial Jobless Claims report for the week of October 5th, which spiked to the highest level since August of 2023.

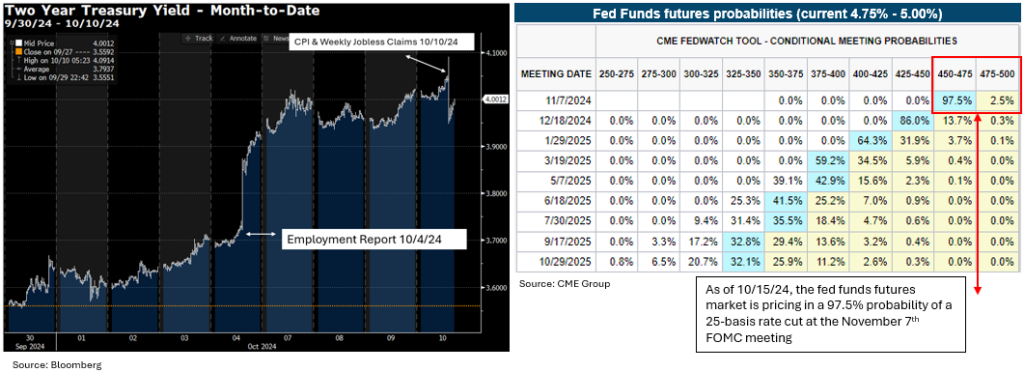

Yields Rose Due to Increased Probability of Smaller Rate Cuts

Strong US data culminating with a solid labor market report led to one of the largest weekly increases in the 2-year yield since mid-2022. Following the jobs report, the 2-year yield rose 21 basis points and by mid-month closed at 3.95%. This re-pricing of Treasury yields also saw expectations of rate cuts being reduced with the possibility of a 50-basis point rate cut at the November meeting being taken off the table. As of 10/15/24, the fed funds futures market is pricing in a 97.5% probability of a 25-basis point rate cut at the November 7th FOMC meeting. At one point last week, the market was pricing in close to a 15% probability of no rate cut but those odds have since come down to only 2.5%.

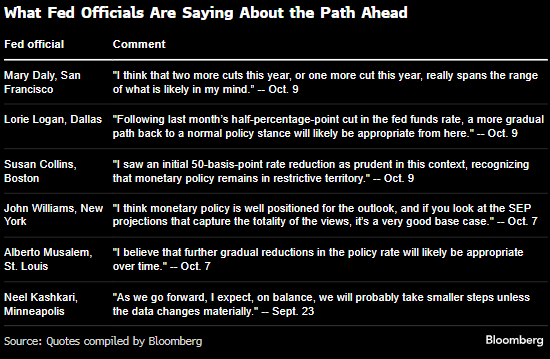

FOMC Minutes Show Push Back on a 50 Basis Point Cut

The minutes from the September FOMC meeting showed there was a preference among some members to cut rates at a more gradual pace, saying: “Some participants observed that they would have preferred a 25-basis-point reduction of the target range at this meeting, and a few others indicated that they could have supported such a decision,”. You may recall that there was one lone dissenter, Fed Governor Michelle Bowman, who wanted a more “measured” pace of cuts.

Recently, there have been some notable quotes from Fed Presidents supporting a slower pace, such as Atlanta Fed President Bostic who said he’s “totally comfortable with skipping a meeting if the data suggests that’s appropriate.” Below are some additional recent Fed commentary.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.